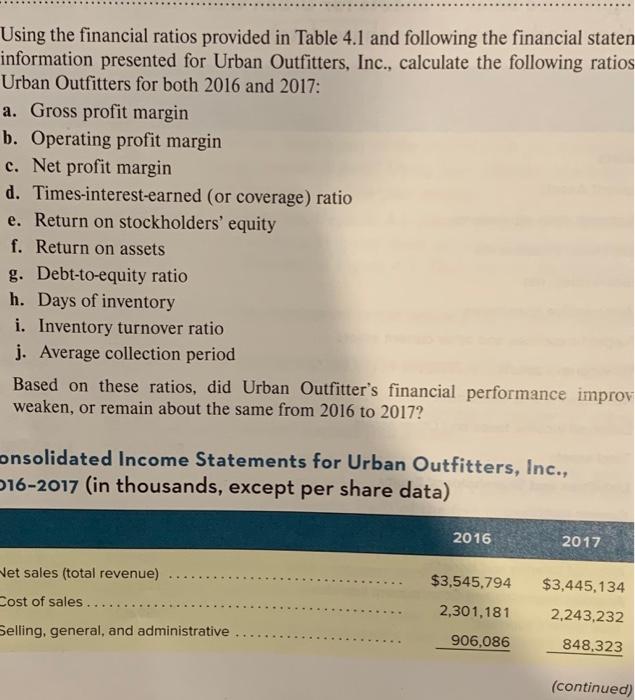

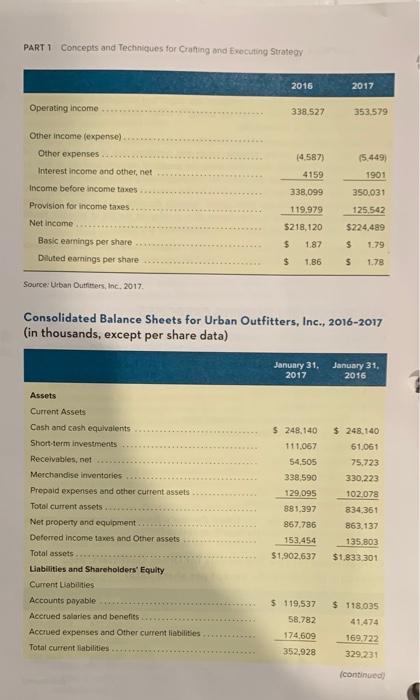

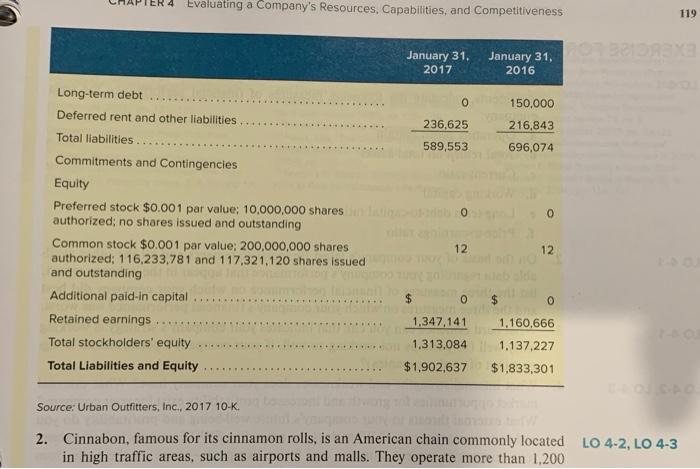

Using the financial ratios provided in Table 4.1 and following the financial staten information presented for Urban Outfitters, Inc., calculate the following ratios Urban Outfitters for both 2016 and 2017: a. Gross profit margin b. Operating profit margin c. Net profit margin d. Times-interest-earned (or coverage) ratio e. Return on stockholders' equity f. Return on assets g. Debt-to-equity ratio h. Days of inventory i. Inventory turnover ratio j. Average collection period Based on these ratios, did Urban Outfitter's financial performance improv weaken, or remain about the same from 2016 to 2017? onsolidated Income Statements for Urban Outfitters, Inc., 16-2017 (in thousands, except per share data) 2016 2017 et sales (total revenue) $3,545,794 $3,445,134 Cost of sales... 2,301,181 2.243.232 Selling, general, and administrative 906,086 848,323 (continued) PART 1 Concepts and Techniques for Crating and Executing Strategy 2016 2017 Operating income 338,527 353,579 Other income lexpense) (4.587) Other expenses Interest income and other, net 15.449) 4159 1901 Income before income taxes 338,099 350.031 Provision for income taxes 119.979 125,542 Net Income $218,120 $224,489 $ 1.87 $ 1:79 Basic earnings per share Diluted earnings per share $ 1.86 $ 178 Source: Urban Outfitters, Inc. 2017 Consolidated Balance Sheets for Urban Outfitters, Inc., 2016-2017 (in thousands, except per share data) January 31. 2017 January 31, 2016 Current Assets Cash and cash equivalents $ 248,140 $ 248.140 Short-term investments 111.067 61.061 Receivables, net 54,505 75,723 Merchandise inventories 338,590 330.223 Prepaid expenses and other current assets 129,095 102.078 Total current assets 881.397 834,361 857.786 863.137 Net property and equipment Deferred income taxes and Other assets 153.454 135 803 Total assets $1,902,637 $1.833 301 Liabilities and Shareholders' Equity Current Liabilities Accounts payable $ 119.537 $ 118.035 58.782 Accrued salaries and benefits Accrued expenses and Other current liabilities 41,474 174,609 169.722 Total current liabilities 352,928 329.231 continued 4 Evaluating a Company's Resources. Capabilities, and Competitiveness 119 RE January 31. 2017 January 31, 2016 Long-term debt 0 150,000 Deferred rent and other liabilities 236,625 216,843 Total liabilities 589,553 696,074 Commitments and Contingencies Equity Preferred stock $0.001 par value: 10,000,000 shareste authorized; no shares issued and outstanding 0 12 12 Common stock $0.001 par value: 200,000,000 shares authorized: 116,233,781 and 117,321,120 shares issued and outstanding Additional paid in capital 0 Retained earnings 1,347,141 1,160,666 Total stockholders' equity 1.313,084 1.137,227 Total Liabilities and Equity $1,902,637 + $1,833,301 Source: Urban Outfitters, Inc., 2017 10-K. 2. Cinnabon, famous for its cinnamon rolls, is an American chain commonly located LO 4-2, LO 4-3 in high traffic areas, such as airports and malls. They operate more than 1,200