Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer entire question a and b with steps shown Data table Delos's prior loan agreement of 680 million for six years at 8.624% per

please answer entire question a and b with steps shown

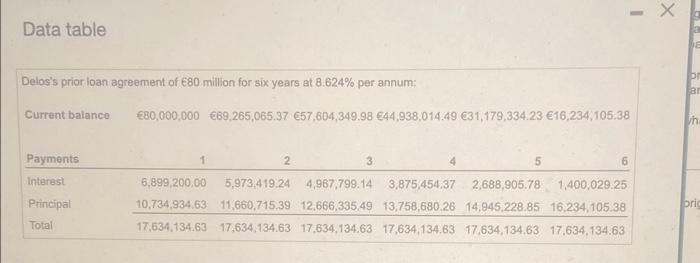

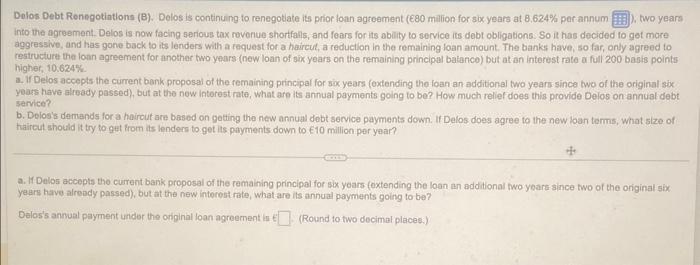

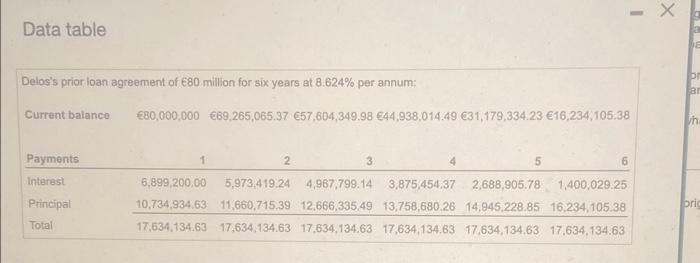

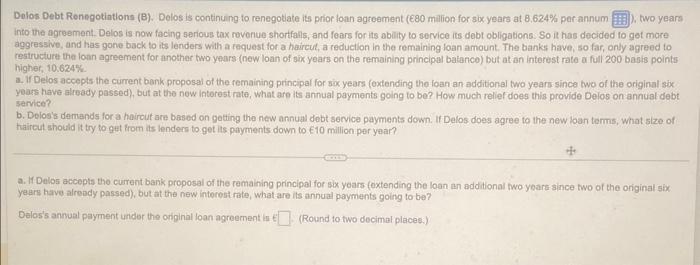

Data table Delos's prior loan agreement of 680 million for six years at 8.624% per annum: Current balance 80,000,00069,265,065.3757,604,349.9844,938,014.49631,179,334.2316,234,105.38 Dolos Debt Renegotintions (B). Delos is continuing to renegotate its prior loan agreement (E80 milion for six years at 8,624% per annum into the agreement. Delos is now facing serious tax revenue shortfalls, and fears for its ability to service its debt obligations. So it has decided fo got more aggresshe, and has gone back to its lenders with a request for a haircut, a reduction in the remaining foan amount. The banks have, so far, only agreed to restructurt the foan agreement for another two years (new loan of six years on the ramaining principal bakanco) but at an interest rate a full 200 basis points higher, 10.624% a. If Delos accepts the current bank proposal of the remaining principal for six years (oxtending the loan an additional two yearis since two of the original six. yeats have already passed), but at the now interest rate, what are its annual payments going to be? How much relief does this provide Delos on annual debt service? b. Delos's demands for a haircut are based on getting the new annual debt service payments down. If Delos does agree to the new loan terms, what size of haireut should it try to get from its lenders to get its payments down to 610 million per year? a. If Delos accepts tho current bark proposal of the remaining principal for six yoars (oxtending the loan an additional two yeare since two of the original six. years have already passed), but at the new interest rate, what are ils annuai payments going to be? Delos's annual payment undor the original loan agreement ini (Round to two decimat places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started