Answered step by step

Verified Expert Solution

Question

1 Approved Answer

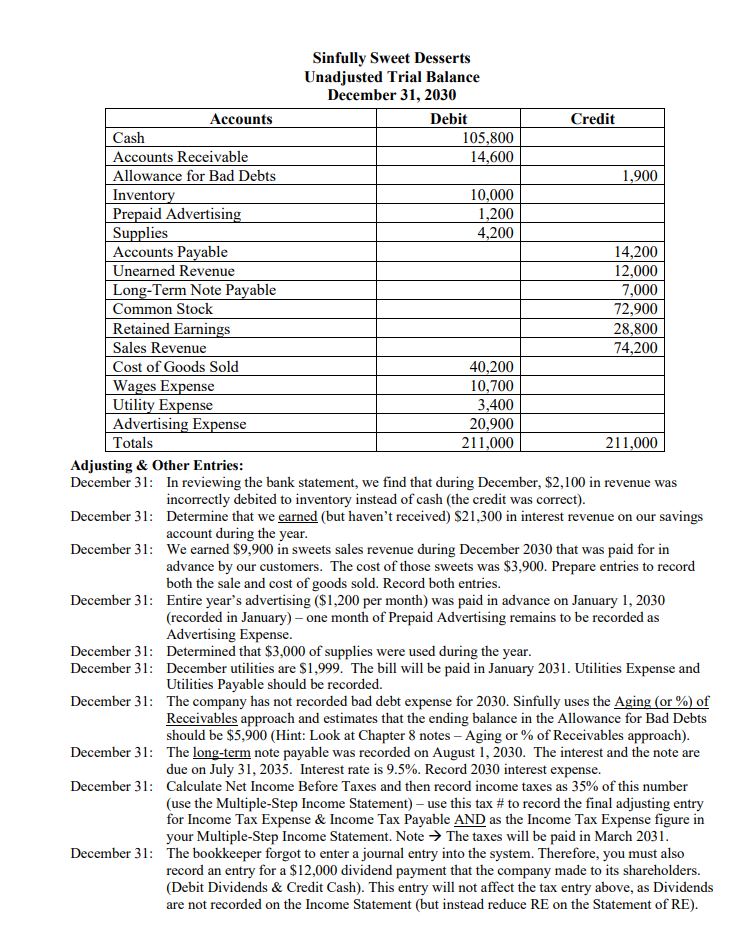

Please answer everything! Sinfully Sweet Desserts Unadjusted Trial Balance December 31, 2030 Adjusting & Other Entries: December 31: In reviewing the bank statement, we find

Please answer everything!

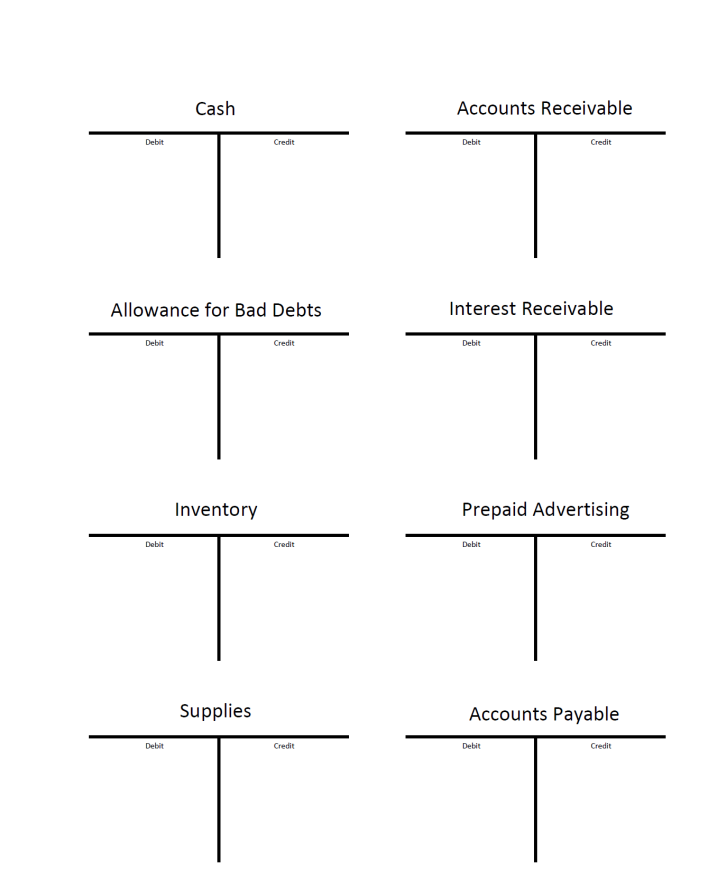

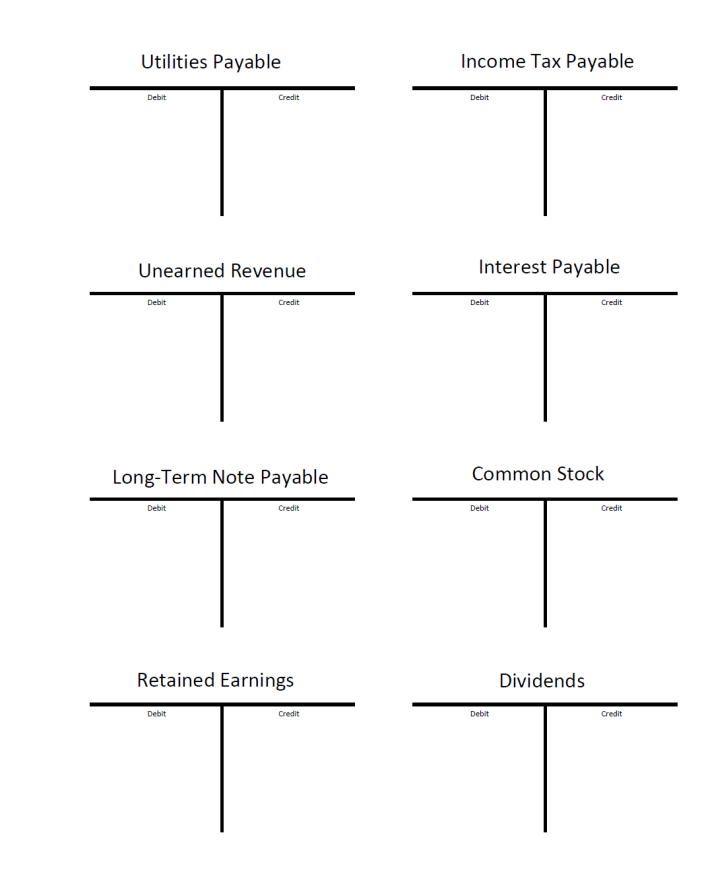

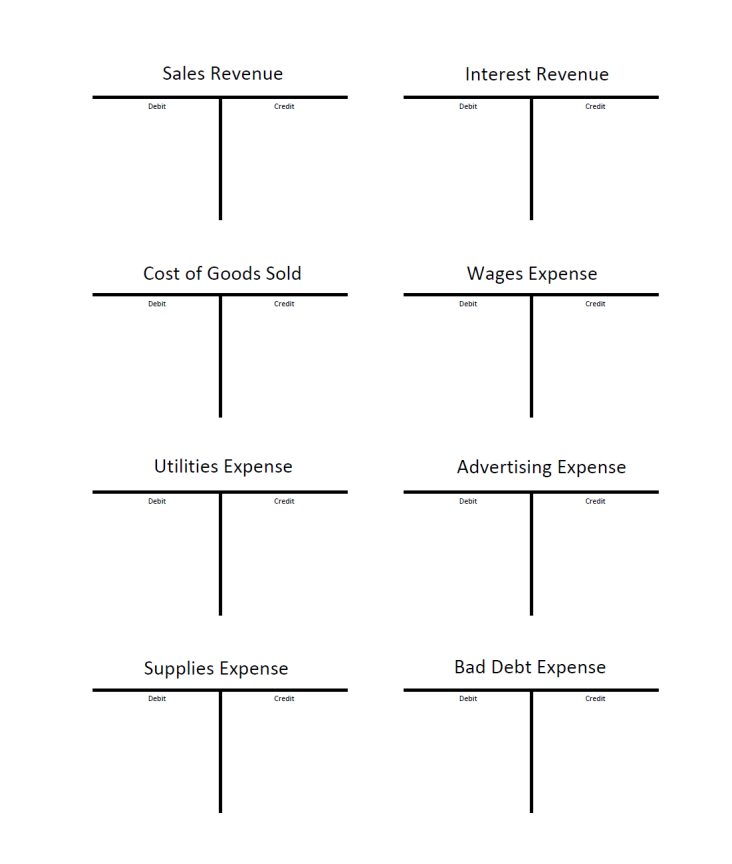

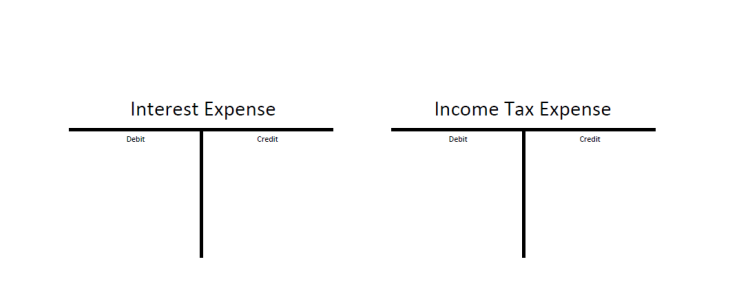

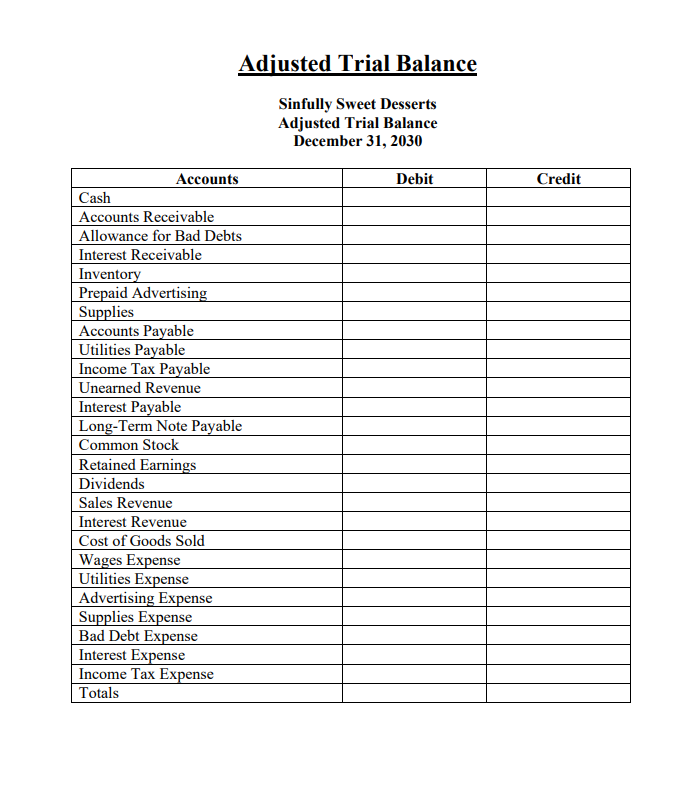

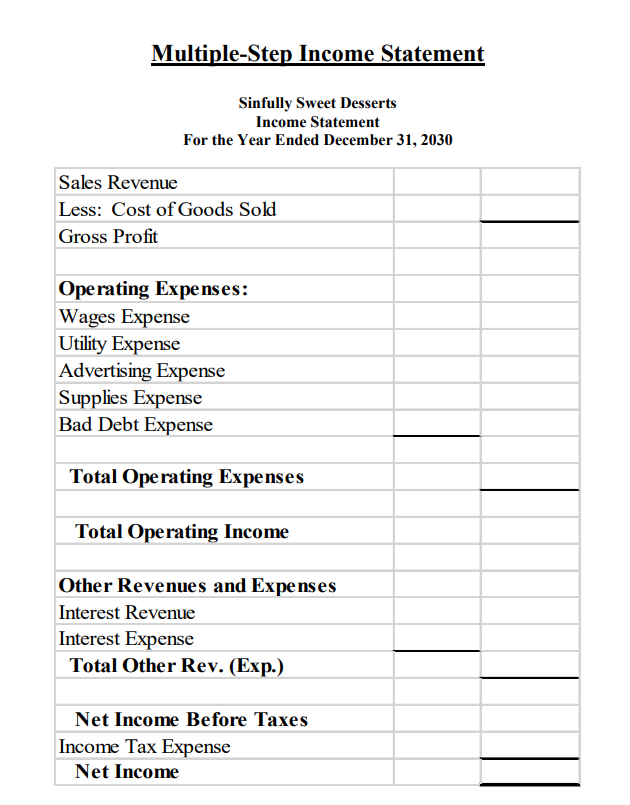

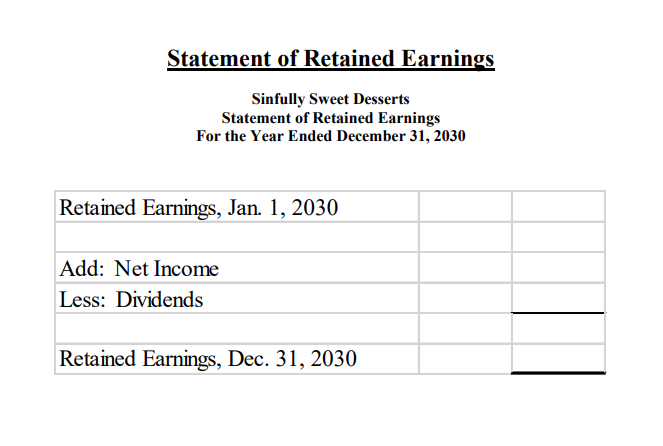

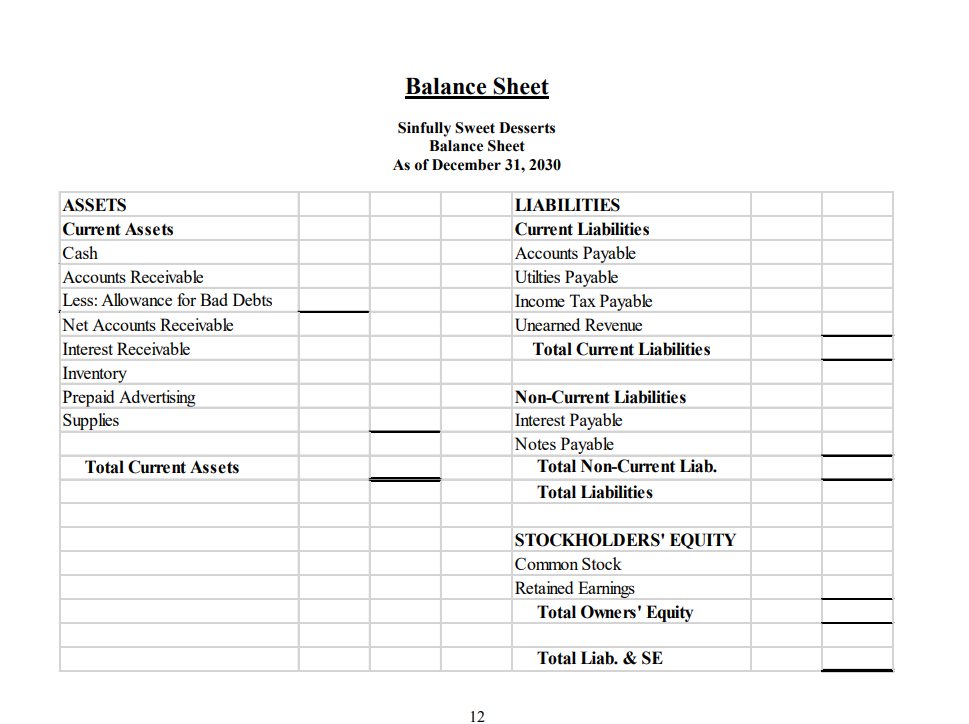

Sinfully Sweet Desserts Unadjusted Trial Balance December 31, 2030 Adjusting \& Other Entries: December 31: In reviewing the bank statement, we find that during December, $2,100 in revenue was incorrectly debited to inventory instead of cash (the credit was correct). December 31: Determine that we earned (but haven't received) \$21,300 in interest revenue on our savings account during the year. December 31: We earned $9,900 in sweets sales revenue during December 2030 that was paid for in advance by our customers. The cost of those sweets was $3,900. Prepare entries to record both the sale and cost of goods sold. Record both entries. December 31: Entire year's advertising ( $1,200 per month) was paid in advance on January 1, 2030 (recorded in January) - one month of Prepaid Advertising remains to be recorded as Advertising Expense. December 31: Determined that $3,000 of supplies were used during the year. December 31: December utilities are $1,999. The bill will be paid in January 2031. Utilities Expense and Utilities Payable should be recorded. December 31: The company has not recorded bad debt expense for 2030. Sinfully uses the Aging (or \%) of Receivables approach and estimates that the ending balance in the Allowance for Bad Debts should be $5,900 (Hint: Look at Chapter 8 notes - Aging or \% of Receivables approach). December 31: The long-term note payable was recorded on August 1, 2030. The interest and the note are due on July 31,2035 . Interest rate is 9.5%. Record 2030 interest expense. December 31: Calculate Net Income Before Taxes and then record income taxes as 35% of this number (use the Multiple-Step Income Statement) - use this tax \# to record the final adjusting entry for Income Tax Expense \& Income Tax Payable AND as the Income Tax Expense figure in your Multiple-Step Income Statement. Note The taxes will be paid in March 2031. December 31: The bookkeeper forgot to enter a journal entry into the system. Therefore, you must also record an entry for a $12,000 dividend payment that the company made to its shareholders. (Debit Dividends \& Credit Cash). This entry will not affect the tax entry above, as Dividends are not recorded on the Income Statement (but instead reduce RE on the Statement of RE). Allowance for Bad Debts \begin{tabular}{l|l} \hline Debit & \end{tabular} Accounts Receivable \begin{tabular}{l|l} \hline Deblt & Credit \end{tabular} \begin{tabular}{c|c} \multicolumn{2}{c}{ Interest Receivable } \\ \hline Debit & \\ & \end{tabular} \begin{tabular}{c|c} \multicolumn{2}{c}{ Prepaid Advertising } \\ \hline Deblt & \\ & \\ & \end{tabular} Accounts Payable \begin{tabular}{c|c} \hline Debit & \\ & \end{tabular} \begin{tabular}{l|l} \multicolumn{2}{c}{ Utilities Payable } \\ \hline Debit & \\ & \end{tabular} \begin{tabular}{c|c} \multicolumn{2}{c}{ Income Tax Payable } \\ \hline & \\ & \end{tabular} \begin{tabular}{c|c} \multicolumn{2}{c}{ Unearned Revenue } \\ \hline Debit & \\ & \end{tabular} \begin{tabular}{c|c} \multicolumn{2}{c}{ Interest Payable } \\ \hline Debit & \\ & \end{tabular} \begin{tabular}{c|c} Long-Term Note Payable \\ \hline Debit & \\ & \end{tabular} \begin{tabular}{l|l} \multicolumn{2}{c}{ Common Stock } \\ \hline & \\ & \end{tabular} \begin{tabular}{c|c} \multicolumn{2}{c}{ Retained Earnings } \\ \hline Debit & \\ & \end{tabular} \begin{tabular}{l|l} \multicolumn{2}{c}{ Dividends } \\ \hline Debit & \\ & \end{tabular} Sales Revenue \begin{tabular}{l|c} \hline Debit & Credit \\ \hline \end{tabular} \begin{tabular}{l|l} Cost of Goods Sold \\ \hline Debolt & \\ & \end{tabular} Utilities Expense Debit Credit \begin{tabular}{l|c} \hline Debit & Credit \\ \hline \end{tabular} Supplies Expense Debit Credit Interest Revenue \begin{tabular}{l|l} \hline Dobit & \end{tabular} \begin{tabular}{c|c} \multicolumn{2}{c}{ Wages Expense } \\ \hline & \end{tabular} Advertising Expense \begin{tabular}{l|l} \hline Dobir & \end{tabular} \begin{tabular}{c|c} \multicolumn{3}{c}{ Bad Debt Expense } \\ \hline & \end{tabular} Adjusted Trial Balance Sinfully Sweet Desserts Adjusted Trial Balance December 31, 2030 Multiple-Step Income Statement Sinfully Sweet Desserts Income Statement Statement of Retained Earnings Sinfully Sweet Desserts Statement of Retained Earnings For the Year Ended December 31, 2030 Balance Sheet Sinfully Sweet Desserts Balance Sheet As of December 31, 2030Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started