PLEASE ANSWER I REALLY NEED HELP Graph the value of your portfolio as a function of the relevant stock price. Show ALL your work and use EXCEL for graphs (please display the formulas used once you're done) For each graph, graph for stock prices between 50 and 80 with 50 data points ( Ex 50.5, 51, 51.5, 52 etc). Assume today is the last day for exercising your options.

3) Short a call at 75, long a put at 75, and long one share of the stock.

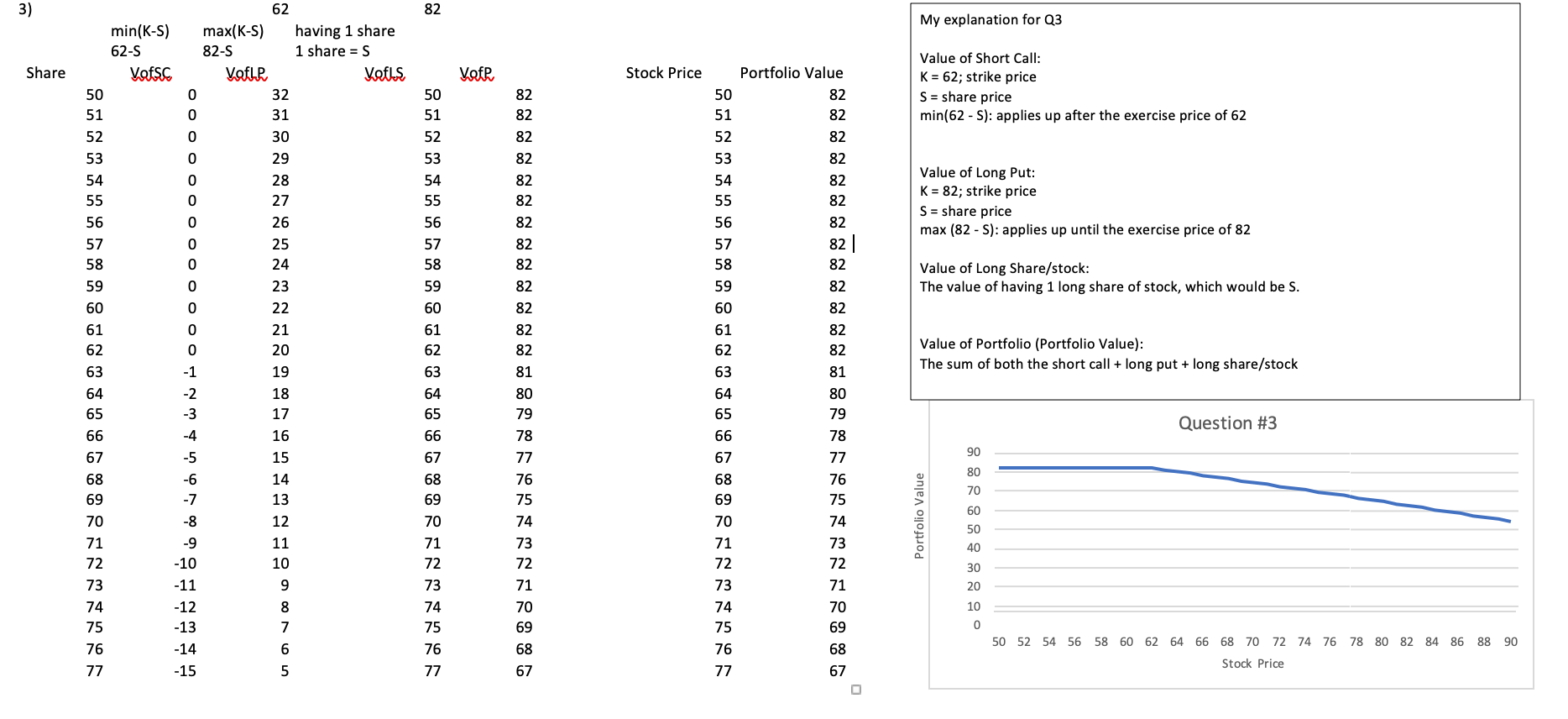

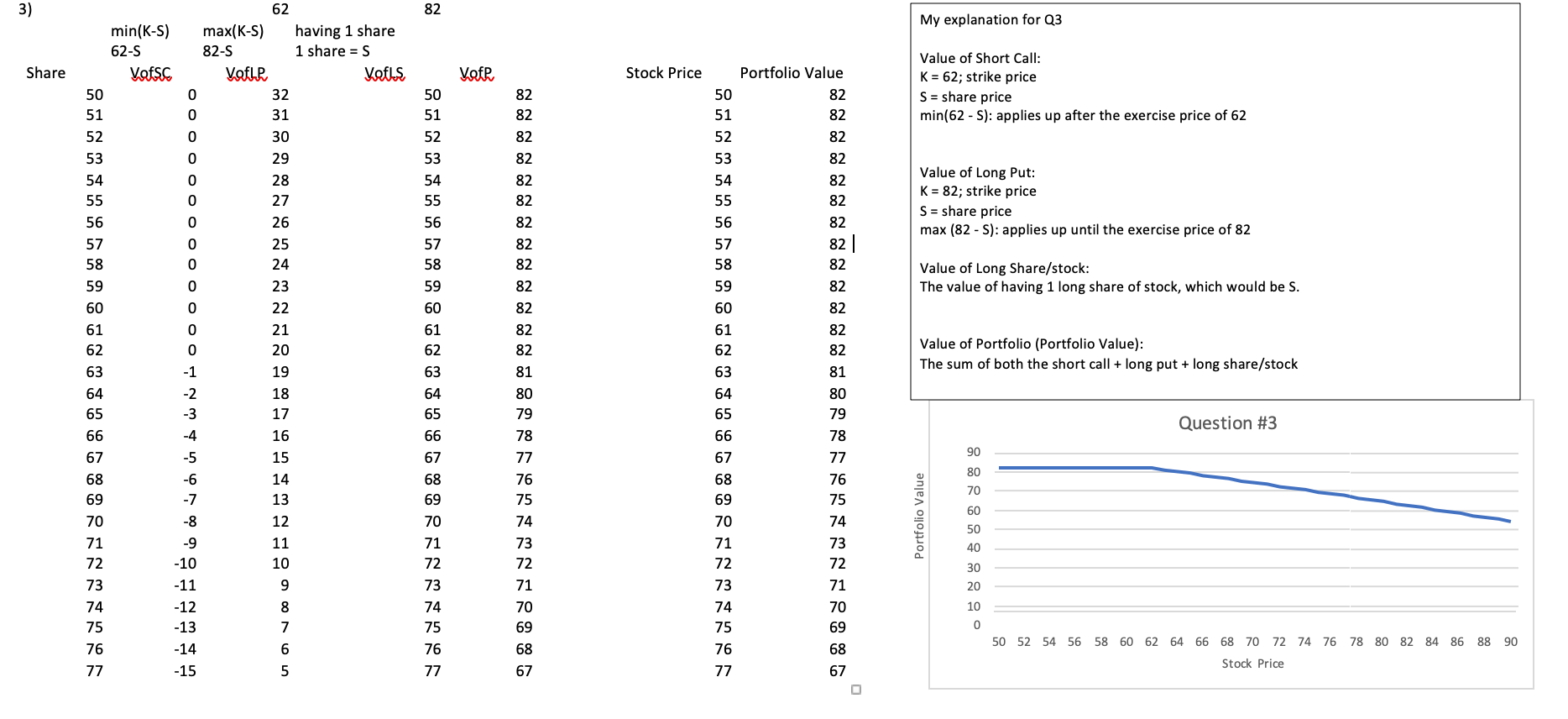

EXAMPLE ON WHAT IT SHOULD LOOK LIKE WHEN COMPLETED 3) You are short a call at 62, and long a put at 82, and long one share of the stock.

3) 82 My explanation for Q3 Share Vote Stock Price Value of Short Call: K = 62; strike price S = share price min(62 -S): applies up after the exercise price of 62 82 82 82 82 82 82 82 82 Value of Long Put: K = 82; strike price S = share price max (82 - S): applies up until the exercise price of 82 55 56 57 58 59 60 61 62 Value of Long Share/stock: The value of having 1 long share of stock, which would be s. 62 min(K-s) max(K-5) having 1 share 62-S 82-5 1 share = 5 Vafsc Vofle Kefls 0 0 52 0 53 o 29 54 0 28 55 0 27 56 0 26 57 0 25 58 0 24 59 O 23 60 0 22 61 0 21 62 0 20 63 -1 19 64 18 65 17 66 16 67 15 68 14 69 -7 13 70 -8 12 71 11 72 -10 10 73 -11 74 -12 75 -13 -14 -15 82 Portfolio Value 50 82 51 82 52 82 53 82 54 82 55 82 56 82 57 58 59 60 82 61 82 62 82 63 81 64 65 66 78 67 68 69 70 71 73 72 72 73 71 74 70 75 69 Value of Portfolio (Portfolio Value): The sum of both the short call + long put + long share/stock Question #3 82 82 81 80 79 78 77 76 75 74 73 72 71 70 65 66 67 68 69 70 71 72 73 74 75 Portfolio Value 79 79 79 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 82 84 86 88 90 Stock Price 3) 82 My explanation for Q3 Share Vote Stock Price Value of Short Call: K = 62; strike price S = share price min(62 -S): applies up after the exercise price of 62 82 82 82 82 82 82 82 82 Value of Long Put: K = 82; strike price S = share price max (82 - S): applies up until the exercise price of 82 55 56 57 58 59 60 61 62 Value of Long Share/stock: The value of having 1 long share of stock, which would be s. 62 min(K-s) max(K-5) having 1 share 62-S 82-5 1 share = 5 Vafsc Vofle Kefls 0 0 52 0 53 o 29 54 0 28 55 0 27 56 0 26 57 0 25 58 0 24 59 O 23 60 0 22 61 0 21 62 0 20 63 -1 19 64 18 65 17 66 16 67 15 68 14 69 -7 13 70 -8 12 71 11 72 -10 10 73 -11 74 -12 75 -13 -14 -15 82 Portfolio Value 50 82 51 82 52 82 53 82 54 82 55 82 56 82 57 58 59 60 82 61 82 62 82 63 81 64 65 66 78 67 68 69 70 71 73 72 72 73 71 74 70 75 69 Value of Portfolio (Portfolio Value): The sum of both the short call + long put + long share/stock Question #3 82 82 81 80 79 78 77 76 75 74 73 72 71 70 65 66 67 68 69 70 71 72 73 74 75 Portfolio Value 79 79 79 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 82 84 86 88 90 Stock Price