please answer, i submitted this a week ago and no answer

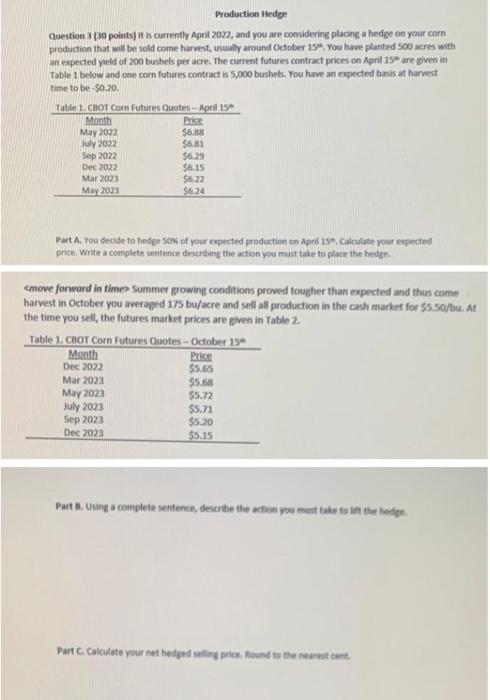

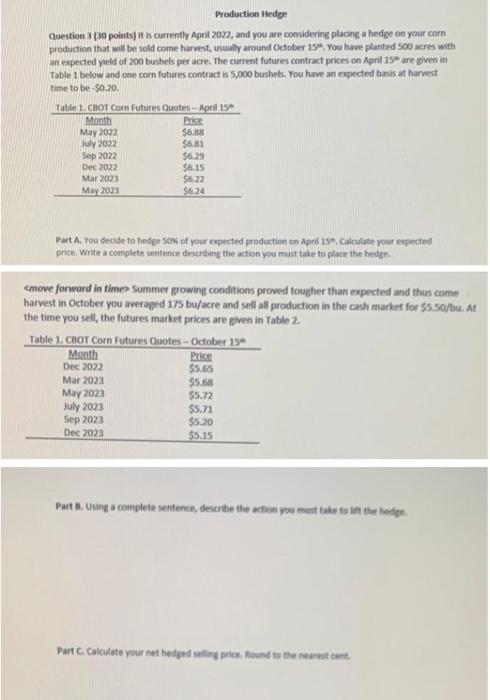

Production Hedge Question 3 (30 points) it is currently Apnit 2022, and you are considering placing a hedge on your corn production that will be sold come harvest, usually around October 15. You have planted 500 acres with an expected yeld of 200 bushels per acre. The current futures contract prices on April 15* are given in Table 1 below and one coen futures contract is 5,000 busherk. You have an expected basis at harvest time to be 5020. \begin{tabular}{|cc} Table 1. CBot Corn futures Quotes-April 15* \\ \hline Month & Price \\ May 2022 & $6.28 \\ July 2022 & $6.81 \\ Sep 2022 & 56.29 \\ Dec 2022 & 56.15 \\ Mar 2023 & 56.22 \\ May 2023 & 56.24 \\ \hline \end{tabular} Part A. You decide to hedge sin of your expected production on April 15". Calculate your expected price. Write a complete sentence describing the action you must take to place the hedge. emove forward in times Summer growing conditions proved tougher than expected and thus come harvest in October you averaged 175 bu/acre and sell all production in the carh market for 55.50/bu. At the time you sell, the futures market prices are given in Table 2. \begin{tabular}{cc} Table 1. Clot Corn Futures Quotes - October 15a \\ \hline Month & Price \\ Dec 2022 & $5.65 \\ Mar 2023 & $5.68 \\ May 2023 & $5.72 \\ luly 2023 & $5.71 \\ Sep 2023 & $5.20 \\ Dec 2023 & $5.15 \\ \hline \end{tabular} Part B. Uung a complete sentence, describe the action you must taie to int the hedge. Part Ci Calculate your net hedged selling price. Round to the nearest cent. Part B. Using a complete sentence, describe the action you must take to lift the hedge. Part C. Calculate your net hedged selling price. Round to the nearest cent. Production Hedge Question 3 (30 points) it is currently Apnit 2022, and you are considering placing a hedge on your corn production that will be sold come harvest, usually around October 15. You have planted 500 acres with an expected yeld of 200 bushels per acre. The current futures contract prices on April 15* are given in Table 1 below and one coen futures contract is 5,000 busherk. You have an expected basis at harvest time to be 5020. \begin{tabular}{|cc} Table 1. CBot Corn futures Quotes-April 15* \\ \hline Month & Price \\ May 2022 & $6.28 \\ July 2022 & $6.81 \\ Sep 2022 & 56.29 \\ Dec 2022 & 56.15 \\ Mar 2023 & 56.22 \\ May 2023 & 56.24 \\ \hline \end{tabular} Part A. You decide to hedge sin of your expected production on April 15". Calculate your expected price. Write a complete sentence describing the action you must take to place the hedge. emove forward in times Summer growing conditions proved tougher than expected and thus come harvest in October you averaged 175 bu/acre and sell all production in the carh market for 55.50/bu. At the time you sell, the futures market prices are given in Table 2. \begin{tabular}{cc} Table 1. Clot Corn Futures Quotes - October 15a \\ \hline Month & Price \\ Dec 2022 & $5.65 \\ Mar 2023 & $5.68 \\ May 2023 & $5.72 \\ luly 2023 & $5.71 \\ Sep 2023 & $5.20 \\ Dec 2023 & $5.15 \\ \hline \end{tabular} Part B. Uung a complete sentence, describe the action you must taie to int the hedge. Part Ci Calculate your net hedged selling price. Round to the nearest cent. Part B. Using a complete sentence, describe the action you must take to lift the hedge. Part C. Calculate your net hedged selling price. Round to the nearest cent