Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer in Excel Format Damien's Frisbee Company is considering launching a new factory to build a new product: the Super Frisbee 3000. It would

Please answer in Excel Format

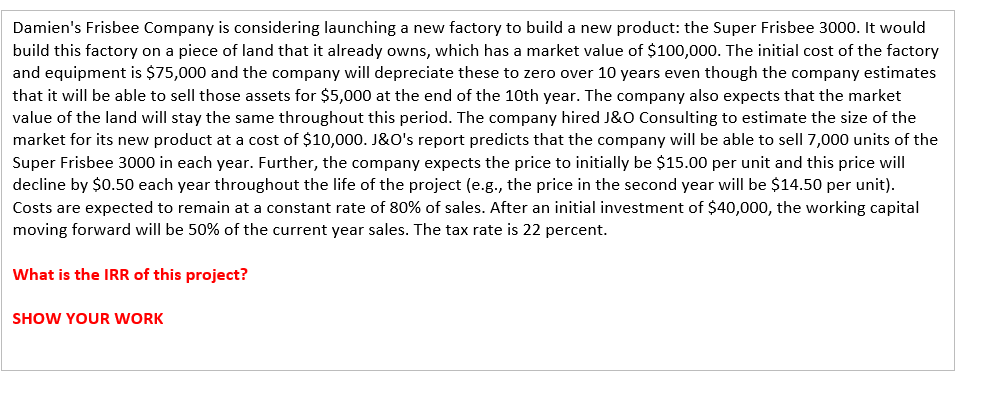

Damien's Frisbee Company is considering launching a new factory to build a new product: the Super Frisbee 3000. It would build this factory on a piece of land that it already owns, which has a market value of $100,000. The initial cost of the factory and equipment is $75,000 and the company will depreciate these to zero over 10 years even though the company estimates that it will be able to sell those assets for $5,000 at the end of the 10th year. The company also expects that the market value of the land will stay the same throughout this period. The company hired J&O Consulting to estimate the size of the market for its new product at a cost of $10,000.J&O's report predicts that the company will be able to sell 7,000 units of the Super Frisbee 3000 in each year. Further, the company expects the price to initially be $15.00 per unit and this price will decline by $0.50 each year throughout the life of the project (e.g., the price in the second year will be $14.50 per unit). Costs are expected to remain at a constant rate of 80% of sales. After an initial investment of $40,000, the working capital moving forward will be 50% of the current year sales. The tax rate is 22 percent. What is the IRR of this project? SHOW YOUR WORKStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started