Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer in Excel format with proper labels, detailed formulas, and explanations for a great rating. Thank you! 13. Edgar Wall is considering the purchase

Please answer in Excel format with proper labels, detailed formulas, and explanations for a great rating. Thank you!

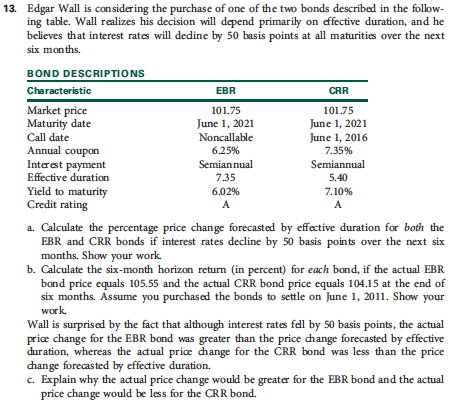

13. Edgar Wall is considering the purchase of one of the two bonds described in the follow- ing table. Wall realizes his decision will depend primarily on effective duration, and he believes that interest rates will dedine by 50 basis points at all maturities over the next six months. BOND DESCRIPTIONS Characteristic EBR CRR Market price 101.75 101.75 June 1, 2021 June 1, 2021 Maturity date June 1, 2016 Call date Annual coupon 6.25% 7.35% Interest payment Semiannual Semiannual Effective duration 7.35 5.40 7.10% Yield to maturity 6.02% Credit rating a. Calculate the percentage price change forecasted by effective duration for both the EBR and CRR bonds if interest rates decline by 50 basis points over the next six months. Show your work. b. Calculate the six-month horizon return (in percent) for each bond, if the actual EBR bond price equals 105.55 and the actual CRR bond price equals 104.15 at the end of six months. Assume you purchased the bonds to settle on June 1, 2011. Show your work Wall is surprised by the fact that although interest rates fell by 50 basis points, the actual price change for the EBR bond was greater than the price change forecasted by effective duration, whereas the actual price change for the CRR bond was less than the price change forecasted by effective duration. c. Explain why the actual price change would be greater for the EBR bond and the actual price change would be less for the CRR bondStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started