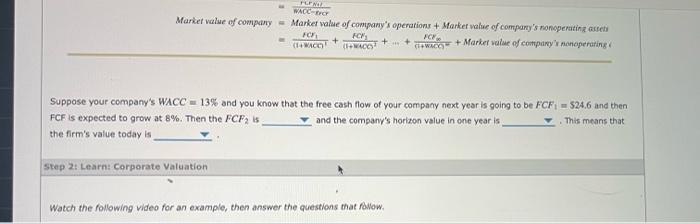

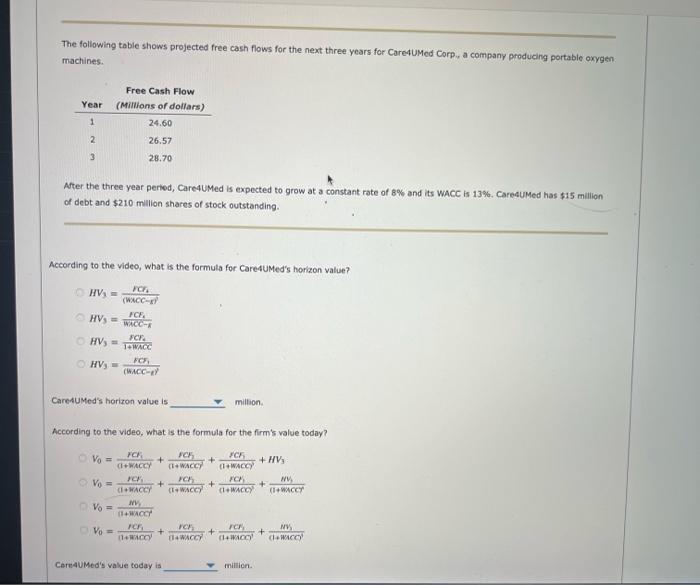

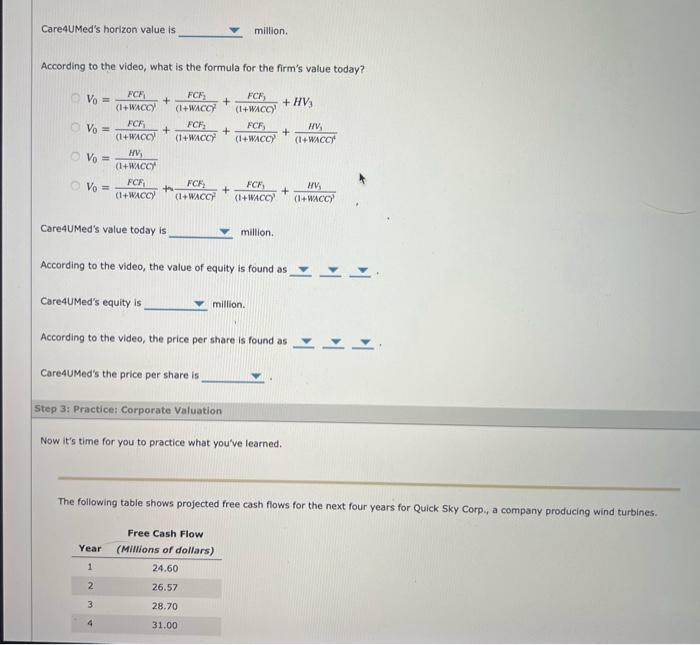

Suppose your company's WACC =13% and you know that the free cash flow of your company next year is going to be FCF, =524.6 and then FCF is expected to grow at 8%. Then the FCF2 is and the company's horizon value in one year is . This means that the firm's value today is step 2: Learn: Corporate Valuation Wotch the following video for an example, then answer the questions that folow. The folliowing table shows projected free cash flows for the next three years for Care4uMed Corp., a company producing portable oxygen machines. Ater the three year peried, Care4UMed is expected to grow at a constant rate of 8% and its WaCC is 13%. Care4uMed has $15 million of debt and $210 million shares of stock outstanding. According to the video, what is the formula for Care4uMed's horizon value? HV3=(WC4)2HC4HV3=WCCCxFCE2HV3=1+1ACC2xC2HV3=(WACC)2HC1 CareAumed's horizon value is milison. According to the video, what is the formula for the firm's value today? Cereaumed's value today is millich. Care4uMed's horizon value is million. According to the video, what is the formula for the firm's value today? V0=(1+WACCCFCF1+(1+WCCC2FCF2+(1+WCCC1FCF1+HV3V0=(1+WACCFCF1+(1+WACC2FCF2+(1+WACC)2FCF3+(1+WACC)2HV3V0=(1+WACC2HV3V0=(1+WACCC2FCF1+(1+WACC2FCF2+(1+WACC)2FCF1+(1+WACCC2HV3 Care4UMed's value today is million. According to the video, the value of equity is found as Care4uMed's equity is million. According to the video, the price per share is found as Care4uMed's the price per share is Step 3: Practice: Corporate Valuation Now it's time for you to practice what you've learned. The following table shows projected free cash flows for the next four years for Quick Sky Corp, a company producing wind turbines. Suppose your company's WACC =13% and you know that the free cash flow of your company next year is going to be FCF, =524.6 and then FCF is expected to grow at 8%. Then the FCF2 is and the company's horizon value in one year is . This means that the firm's value today is step 2: Learn: Corporate Valuation Wotch the following video for an example, then answer the questions that folow. The folliowing table shows projected free cash flows for the next three years for Care4uMed Corp., a company producing portable oxygen machines. Ater the three year peried, Care4UMed is expected to grow at a constant rate of 8% and its WaCC is 13%. Care4uMed has $15 million of debt and $210 million shares of stock outstanding. According to the video, what is the formula for Care4uMed's horizon value? HV3=(WC4)2HC4HV3=WCCCxFCE2HV3=1+1ACC2xC2HV3=(WACC)2HC1 CareAumed's horizon value is milison. According to the video, what is the formula for the firm's value today? Cereaumed's value today is millich. Care4uMed's horizon value is million. According to the video, what is the formula for the firm's value today? V0=(1+WACCCFCF1+(1+WCCC2FCF2+(1+WCCC1FCF1+HV3V0=(1+WACCFCF1+(1+WACC2FCF2+(1+WACC)2FCF3+(1+WACC)2HV3V0=(1+WACC2HV3V0=(1+WACCC2FCF1+(1+WACC2FCF2+(1+WACC)2FCF1+(1+WACCC2HV3 Care4UMed's value today is million. According to the video, the value of equity is found as Care4uMed's equity is million. According to the video, the price per share is found as Care4uMed's the price per share is Step 3: Practice: Corporate Valuation Now it's time for you to practice what you've learned. The following table shows projected free cash flows for the next four years for Quick Sky Corp, a company producing wind turbines