Answered step by step

Verified Expert Solution

Question

1 Approved Answer

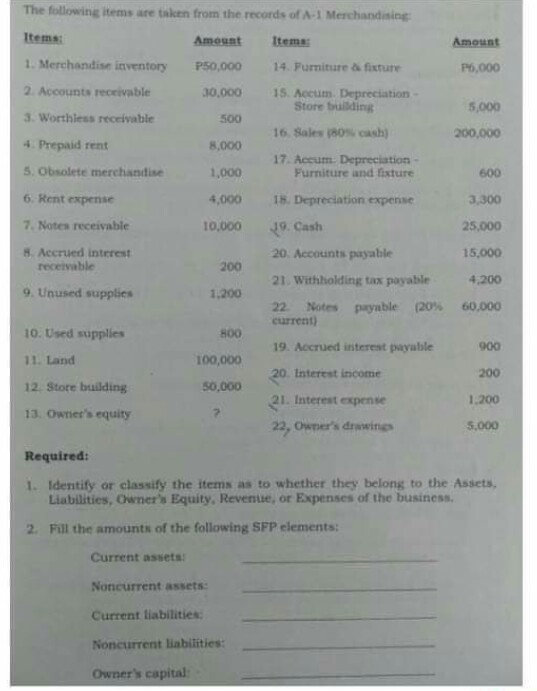

please answer number 2. with solutions please. thank you so much please answer 1-4 please please. thank you 19. Cash The following items are taken

please answer number 2. with solutions please. thank you so much

please answer 1-4 please please. thank you

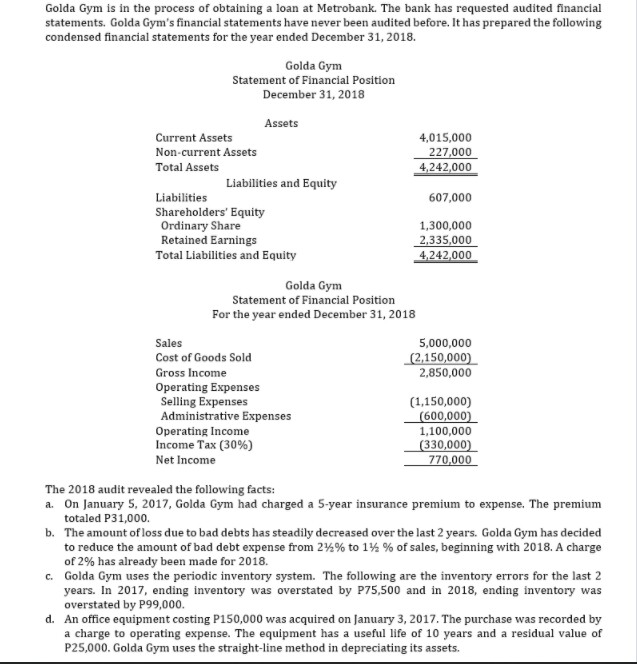

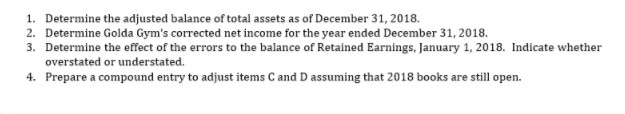

19. Cash The following items are taken from the records of A-1 Merchandising Items: Amount Items: Amount 1. Merchandise inventory P50,000 14. Purniture & fixture P6,000 2. Accounts receivable 30,000 15. Accum. Depreciation Store building 5,000 3. Worthiess receivable 500 16. Sales Ocash) 200.000 4. Prepaid rent 8,000 17. Accum. Depreciation - 5. Obsolete merchandise 1,000 Furniture and fixture 500 6. Rent expense 4,000 15. Depreciation expense 3.300 7. Notes receivable 10,000 25.000 # Accrued interest 20. Accounts payable 15.000 receivable 21. Withholding tax payable 4,200 9. Unused supplies 1.200 22 Notes payable (20% 60,000 current) 10. Used supplies H00 19. Accrued interest payable 900 11. Land 100,000 20. Interest income 200 12 Store building 50,000 21. Interest expense 1.200 13. Owner's equity 2 22, Owner's dwing 5.000 Required: 1. Identify or classify the items as to whether they belong to the Assets Liabilities, Owner's Equity, Revenue, or Expenses of the business 2. Fill the amounts of the following SFP clements: 200 Current assets Noncurrent assets: Current liabilities: Noncurrent limbilities: Owner's capital Golda Gym is in the process of obtaining a loan at Metrobank. The bank has requested audited financial statements. Golda Gym's financial statements have never been audited before. It has prepared the following condensed financial statements for the year ended December 31, 2018. Golda Gym Statement of Financial Position December 31, 2018 4,015,000 227,000 4,242,000 Assets Current Assets Non-current Assets Total Assets Liabilities and Equity Liabilities Shareholders' Equity Ordinary Share Retained Earnings Total Liabilities and Equity 607,000 1,300,000 2,335,000 4,242,000 Golda Gym Statement of Financial Position For the year ended December 31, 2018 Sales 5,000,000 Cost of Goods Sold (2,150,000) Gross Income 2,850,000 Operating Expenses Selling Expenses (1,150,000) Administrative Expenses (600,000) Operating Income 1,100,000 Income Tax (30%) (330,000) Net Income 770,000 The 2018 audit revealed the following facts: a. On January 5, 2017, Golda Gym had charged a 5-year insurance premium to expense. The premium totaled P31,000. b. The amount of loss due to bad debts has steadily decreased over the last 2 years. Golda Gym has decided to reduce the amount of bad debt expense from 24% to 1% % of sales, beginning with 2018. A charge of 2% has already been made for 2018. c. Golda Gym uses the periodic inventory system. The following are the inventory errors for the last 2 years. In 2017, ending inventory was overstated by P75,500 and in 2018, ending inventory was overstated by P99,000. d. An office equipment costing P150,000 was acquired on January 3, 2017. The purchase was recorded by a charge to operating expense. The equipment has a useful life of 10 years and a residual value of P25,000. Golda Gym uses the straight-line method in depreciating its assets. 1. Determine the adjusted balance of total assets as of December 31, 2018. 2. Determine Golda Gym's corrected net income for the year ended December 31, 2018. 3. Determine the effect of the errors to the balance of Retained Earnings, January 1, 2018. Indicate whether overstated or understated. 4. Prepare a compound entry to adjust items C and D assuming that 2018 books are still openStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started