Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer number one and 2 please show me step by step instruction on how to complete questions. please show and tell me when calculator

Please answer number one and 2 please show me step by step instruction on how to complete questions. please show and tell me when calculator is used thank you

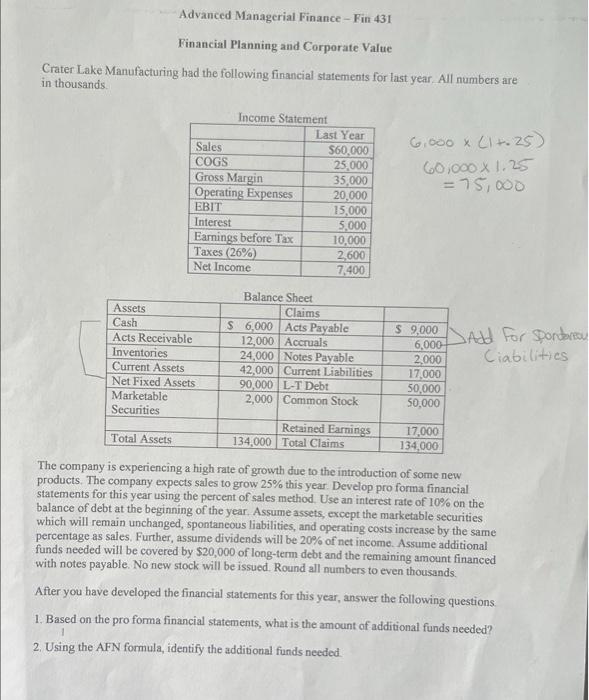

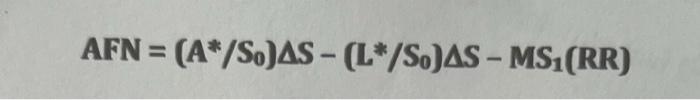

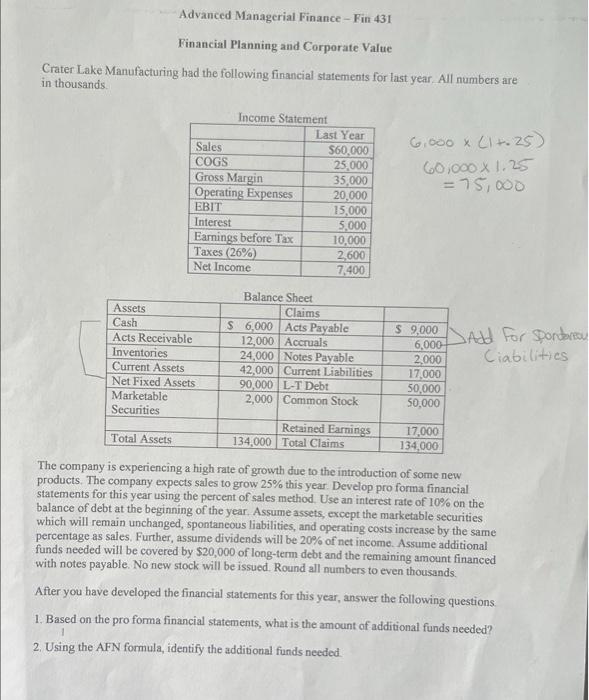

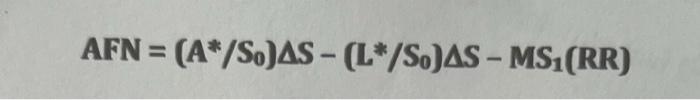

Advanced Managerial Finance - Fin 431 Financial Planning and Corporate Value Crater Lake Manufacturing had the following financial statements for last year. All numbers are in thousands. 6,000(1+.25)60,0001.25=75,000 The company is experiencing a high rate of growth due to the introduction of some new products. The company expects sales to grow 25% this year. Develop pro forma financial statements for this year using the percent of sales method. Use an interest rate of 10% on the balance of debt at the beginning of the year. Assume assets, except the marketable securities which will remain unchanged, spontaneous liabilities, and operating costs increase by the same percentage as sales. Further, assume dividends will be 20% of net income. Assume additional funds needed will be covered by $20,000 of long-term debt and the remaining amount financed with notes payable. No new stock will be issued. Round all numbers to even thousands. After you have developed the financial statements for this year, answer the following questions. 1. Based on the pro forma financial statements, what is the amount of additional funds needed? 2. Using the AFN formula, identify the additional funds needed. AFN=(A/S0)S(L/S0)SMS1(RR)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started