Answered step by step

Verified Expert Solution

Question

1 Approved Answer

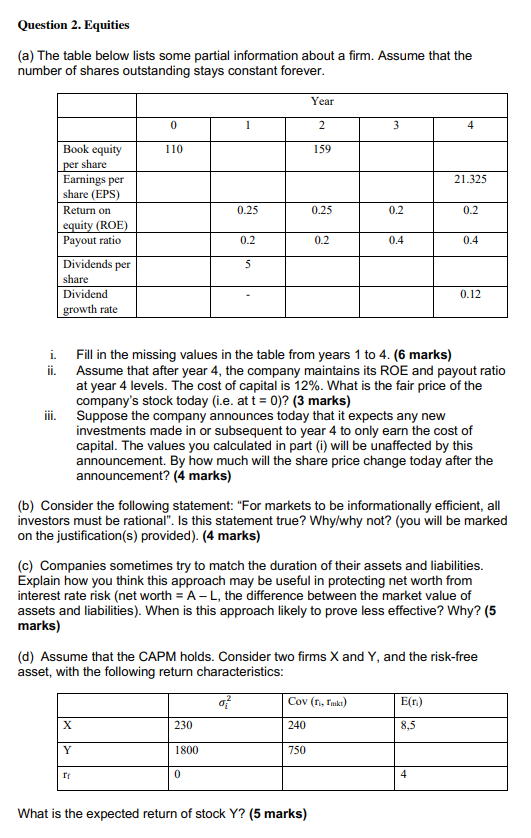

Please answer only a) and b) Question 2. Equities (a) The table below lists some partial information about a firm. Assume that the number of

Please answer only a) and b)

Question 2. Equities (a) The table below lists some partial information about a firm. Assume that the number of shares outstanding stays constant forever. Year 0 2 3 Book equity 110 159 per share 21.325 0.25 0.25 0.2 0.2 0.2 0.2 0.4 0.4 Earnings per share (EPS) Return on equity (ROE) Payout ratio Dividends per share Dividend growth rate 5 0.12 i Fill in the missing values in the table from years 1 to 4. (6 marks) ii. Assume that after year 4, the company maintains its ROE and payout ratio at year 4 levels. The cost of capital is 12%. What is the fair price of the company's stock today (i.e. at t = 0)? (3 marks) Suppose the company announces today that it expects any new investments made in or subsequent to year 4 to only earn the cost of capital. The values you calculated in part (i) will be unaffected by this announcement. By how much will the share price change today after the announcement? (4 marks) (b) Consider the following statement: "For markets to be informationally efficient, all investors must be rational". Is this statement true? Why/why not? (you will be marked on the justification(s) provided). (4 marks) (c) Companies sometimes try to match the duration of their assets and liabilities. Explain how you think this approach may be useful in protecting net worth from interest rate risk (net worth = A-L, the difference between the market value of assets and liabilities). When is this approach likely to prove less effective? Why? (5 marks) (d) Assume that the CAPM holds. Consider two firms X and Y, and the risk-free asset, with the following return characteristics: Cov (r, rinki) Er) X 230 240 8,5 Y 1800 750 If 0 4 What is the expected return of stock Y? (5 marks) Question 2. Equities (a) The table below lists some partial information about a firm. Assume that the number of shares outstanding stays constant forever. Year 0 2 3 Book equity 110 159 per share 21.325 0.25 0.25 0.2 0.2 0.2 0.2 0.4 0.4 Earnings per share (EPS) Return on equity (ROE) Payout ratio Dividends per share Dividend growth rate 5 0.12 i Fill in the missing values in the table from years 1 to 4. (6 marks) ii. Assume that after year 4, the company maintains its ROE and payout ratio at year 4 levels. The cost of capital is 12%. What is the fair price of the company's stock today (i.e. at t = 0)? (3 marks) Suppose the company announces today that it expects any new investments made in or subsequent to year 4 to only earn the cost of capital. The values you calculated in part (i) will be unaffected by this announcement. By how much will the share price change today after the announcement? (4 marks) (b) Consider the following statement: "For markets to be informationally efficient, all investors must be rational". Is this statement true? Why/why not? (you will be marked on the justification(s) provided). (4 marks) (c) Companies sometimes try to match the duration of their assets and liabilities. Explain how you think this approach may be useful in protecting net worth from interest rate risk (net worth = A-L, the difference between the market value of assets and liabilities). When is this approach likely to prove less effective? Why? (5 marks) (d) Assume that the CAPM holds. Consider two firms X and Y, and the risk-free asset, with the following return characteristics: Cov (r, rinki) Er) X 230 240 8,5 Y 1800 750 If 0 4 What is the expected return of stock YStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started