Please write all your steps regarding each calculation. Also, refer to the formula sheet; if any formula is used, please label it. Anyways thank you, and I will rate it after completion.

Please write all your steps regarding each calculation. Also, refer to the formula sheet; if any formula is used, please label it. Anyways thank you, and I will rate it after completion.

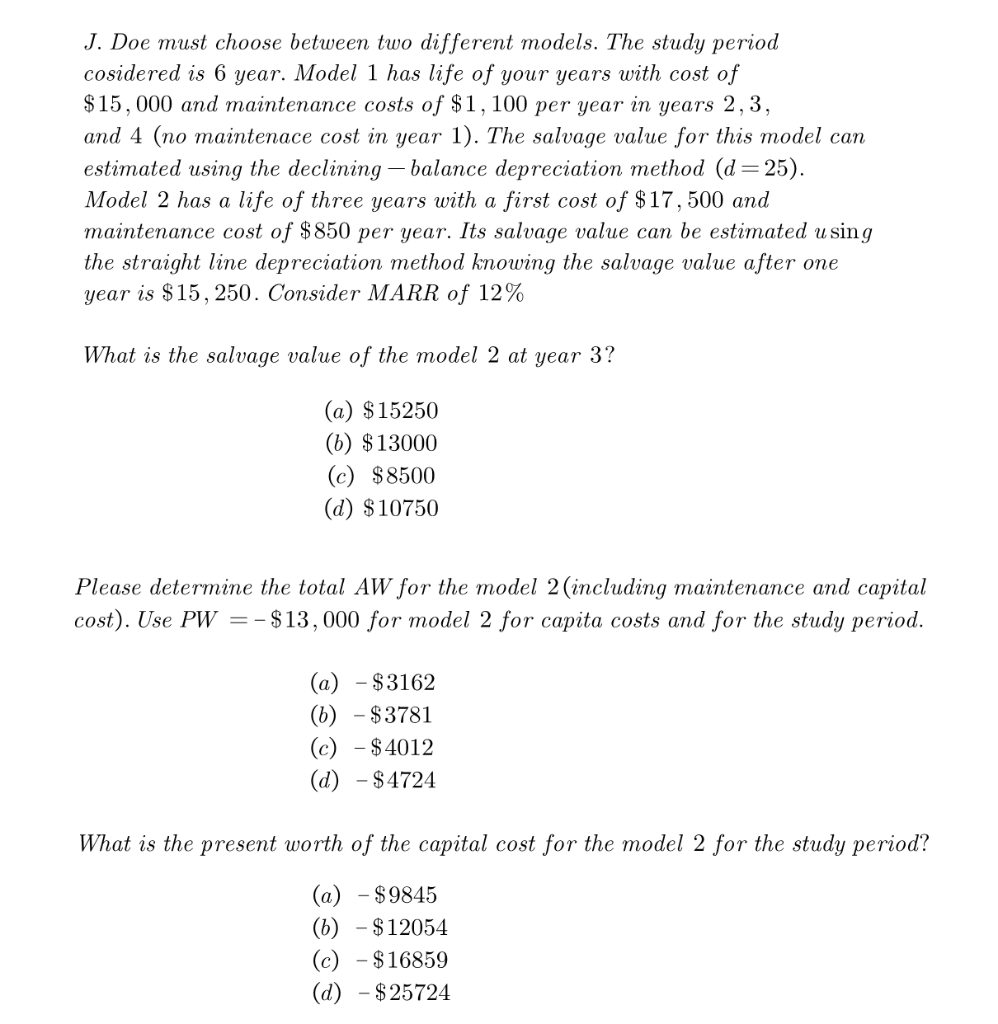

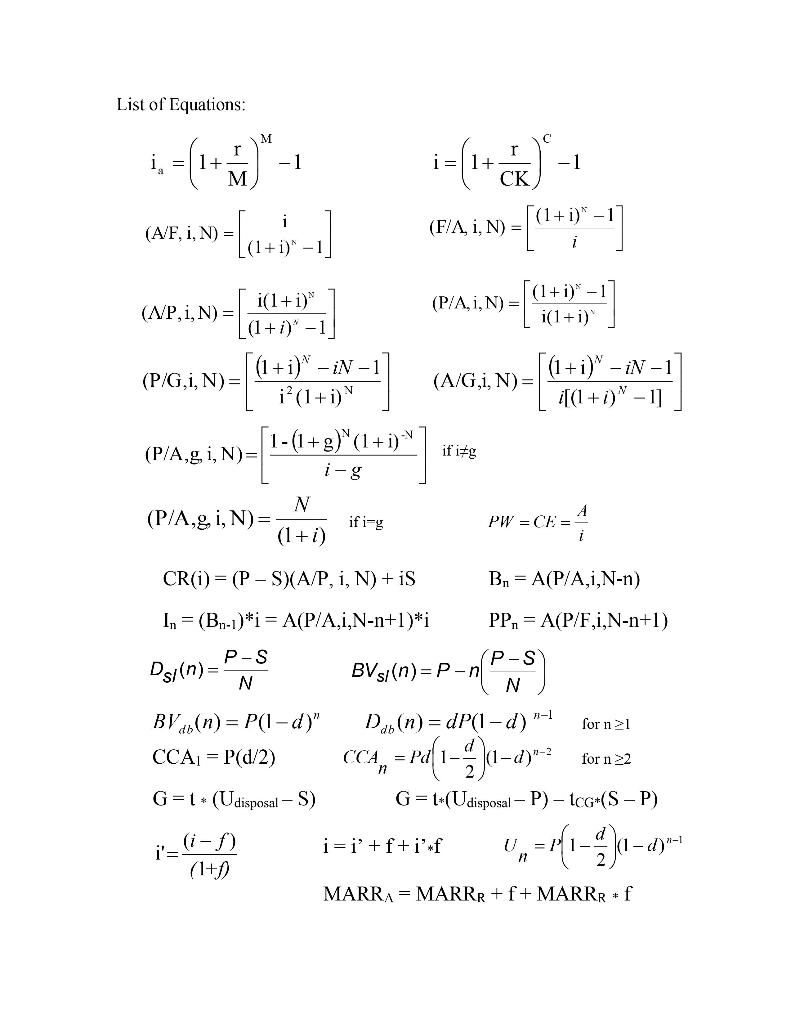

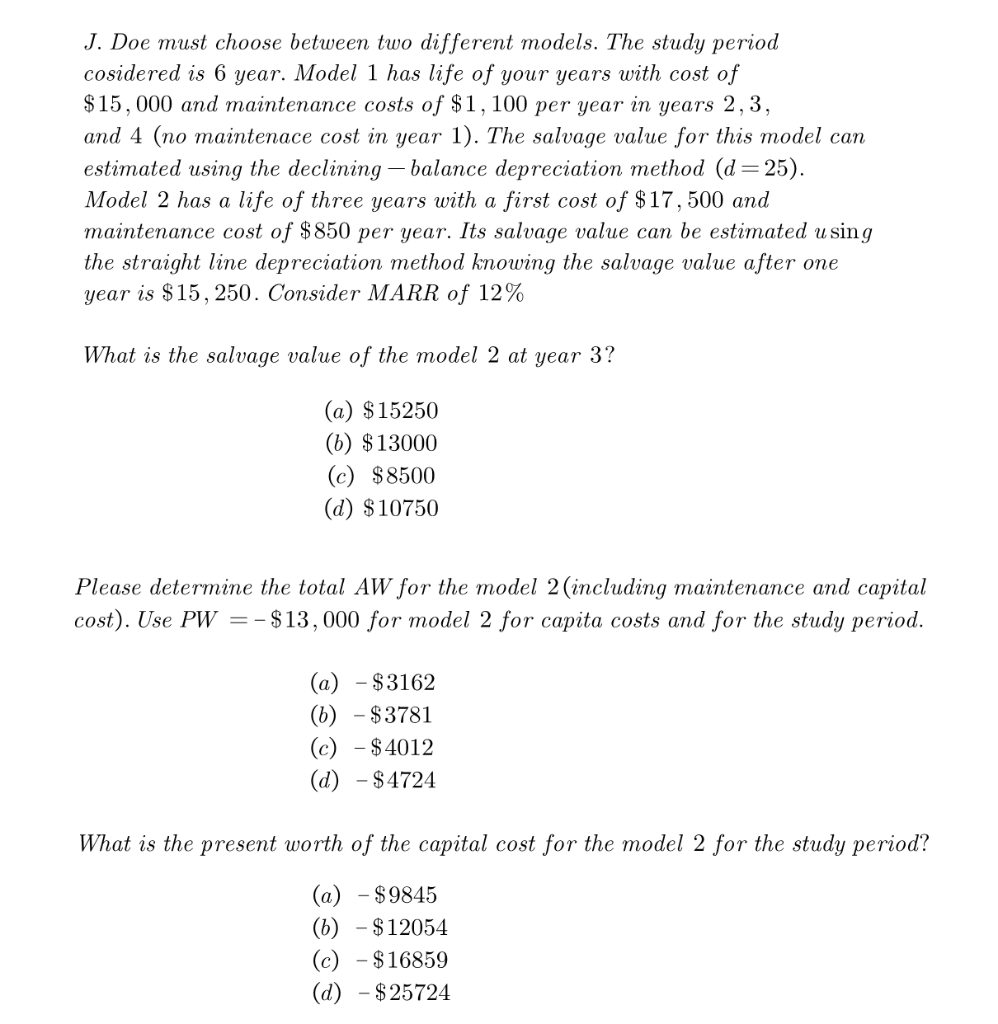

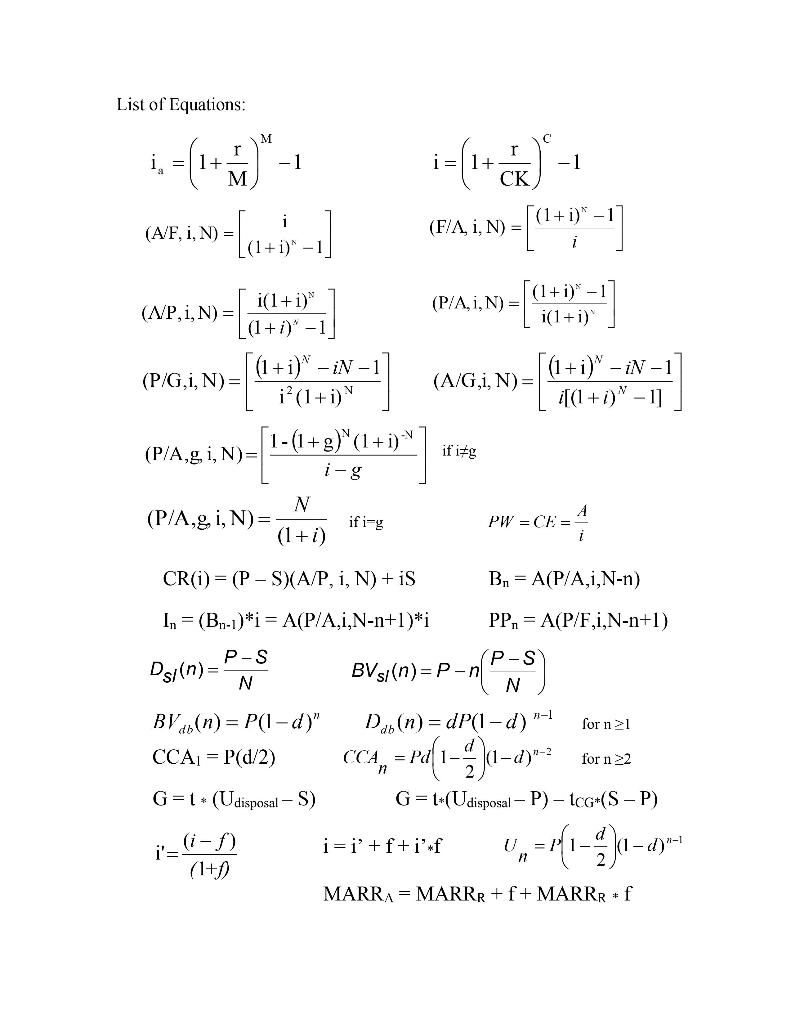

J. Doe must choose between two different models. The study period cosidered is 6 year. Model 1 has life of your years with cost of $15,000 and maintenance costs of $1,100 per year in years 2,3, and 4 (no maintenace cost in year 1). The salvage value for this model can estimated using the declining - balance depreciation method (d=25). Model 2 has a life of three years with a first cost of $ 17,500 and maintenance cost of $850 per year. Its salvage value can be estimated using the straight line depreciation method knowing the salvage value after one year is $15, 250. Consider MARR of 12% What is the salvage value of the model 2 at year 3? (a) $15250 (6) $13000 (c) $8500 (d) $10750 Please determine the total AW for the model 2 (including maintenance and capital cost). Use PW =-$13,000 for model 2 for capita costs and for the study period. (a) - $3162 (6) - $3781 (c) - $ 4012 (d) - $4724 What is the present worth of the capital cost for the model 2 for the study period? (a) - $9845 (6) - $12054 (c) - $16859 (d) - $25724 List of Equations: M r = 1+ -1 . i=11+ - 1 (A/F, i, N) = - [4+:-) (F/A, i, N) = (NP, i, N)= (P/A,1,N) = (1+i) - 1 i(1+i) i(1+i) (1+i) - 1 (1+i)* - iN-1 i? (1+i) (P/G,,N)= [(1+i)" - iN - 1 (A/G,i, N)= i[(1+i)" - 11 1-(1+3) *(1+i) "V (P/A,g, i, N)= if itg N (P/A,g, i, N)= ifiy PW = CE = i (1+i) CR(i)= (P-SXA/P, i, N) + is B, = A(P/A,1,N-n) In = (B1-1) *i = A(P/A,1,N-n+1)*i PP, = A(P/F,1,N-n+1) P-S P-S Ds/(n)= BVs/(n)=P-n N N BV(n)= P(1-4) Dav(n)=dP(1-d)-1 CCA = P(d/2) CC4, - - 1-2) fora for n>2 G=1* (Udisposal - S) G = L*(Udisposal - P) - tcG+(S-P) for n>1 i=i' +f+i'#f (1-d)! (i-1) i'= (1+1 11 MARRA = MARRR + f + MARRR #f J. Doe must choose between two different models. The study period cosidered is 6 year. Model 1 has life of your years with cost of $15,000 and maintenance costs of $1,100 per year in years 2,3, and 4 (no maintenace cost in year 1). The salvage value for this model can estimated using the declining - balance depreciation method (d=25). Model 2 has a life of three years with a first cost of $ 17,500 and maintenance cost of $850 per year. Its salvage value can be estimated using the straight line depreciation method knowing the salvage value after one year is $15, 250. Consider MARR of 12% What is the salvage value of the model 2 at year 3? (a) $15250 (6) $13000 (c) $8500 (d) $10750 Please determine the total AW for the model 2 (including maintenance and capital cost). Use PW =-$13,000 for model 2 for capita costs and for the study period. (a) - $3162 (6) - $3781 (c) - $ 4012 (d) - $4724 What is the present worth of the capital cost for the model 2 for the study period? (a) - $9845 (6) - $12054 (c) - $16859 (d) - $25724 List of Equations: M r = 1+ -1 . i=11+ - 1 (A/F, i, N) = - [4+:-) (F/A, i, N) = (NP, i, N)= (P/A,1,N) = (1+i) - 1 i(1+i) i(1+i) (1+i) - 1 (1+i)* - iN-1 i? (1+i) (P/G,,N)= [(1+i)" - iN - 1 (A/G,i, N)= i[(1+i)" - 11 1-(1+3) *(1+i) "V (P/A,g, i, N)= if itg N (P/A,g, i, N)= ifiy PW = CE = i (1+i) CR(i)= (P-SXA/P, i, N) + is B, = A(P/A,1,N-n) In = (B1-1) *i = A(P/A,1,N-n+1)*i PP, = A(P/F,1,N-n+1) P-S P-S Ds/(n)= BVs/(n)=P-n N N BV(n)= P(1-4) Dav(n)=dP(1-d)-1 CCA = P(d/2) CC4, - - 1-2) fora for n>2 G=1* (Udisposal - S) G = L*(Udisposal - P) - tcG+(S-P) for n>1 i=i' +f+i'#f (1-d)! (i-1) i'= (1+1 11 MARRA = MARRR + f + MARRR #f

Please write all your steps regarding each calculation. Also, refer to the formula sheet; if any formula is used, please label it. Anyways thank you, and I will rate it after completion.

Please write all your steps regarding each calculation. Also, refer to the formula sheet; if any formula is used, please label it. Anyways thank you, and I will rate it after completion.