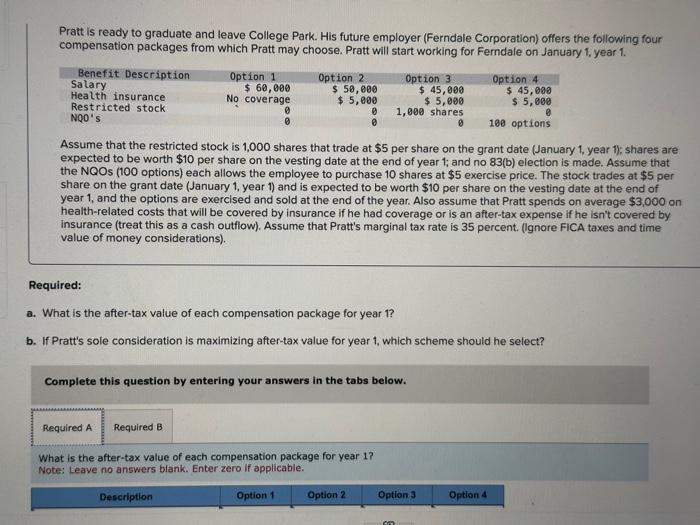

Please answer option. a with the table provided. please fill out Schedule D and Form 8949 for option. c

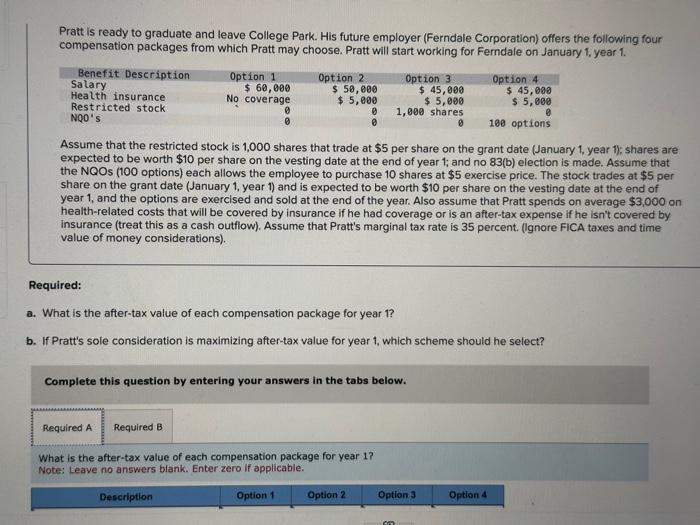

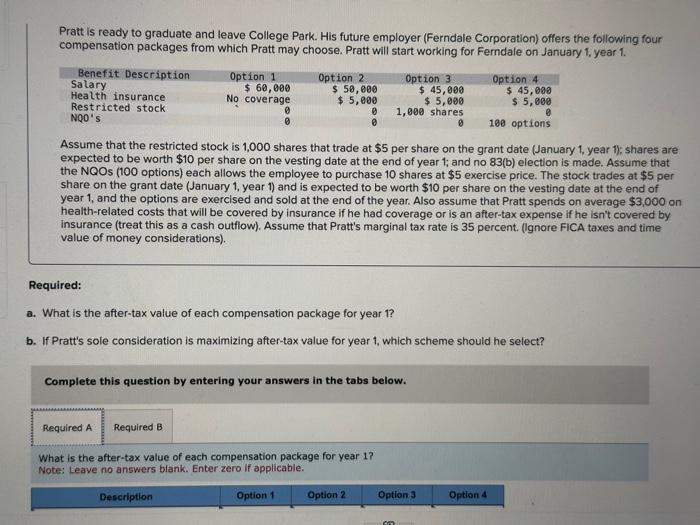

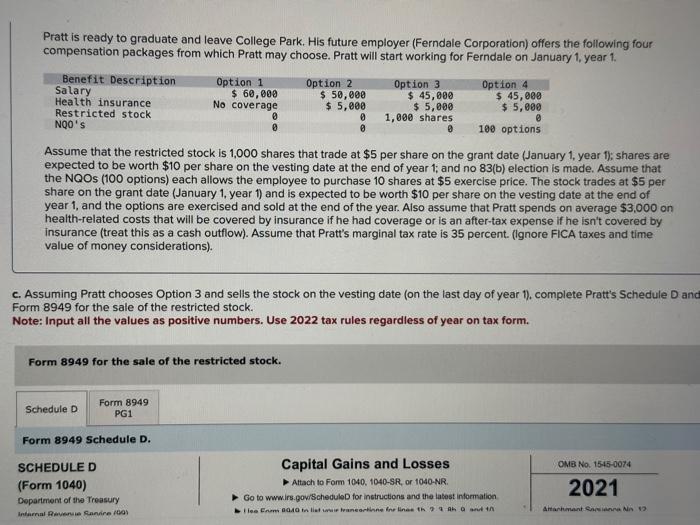

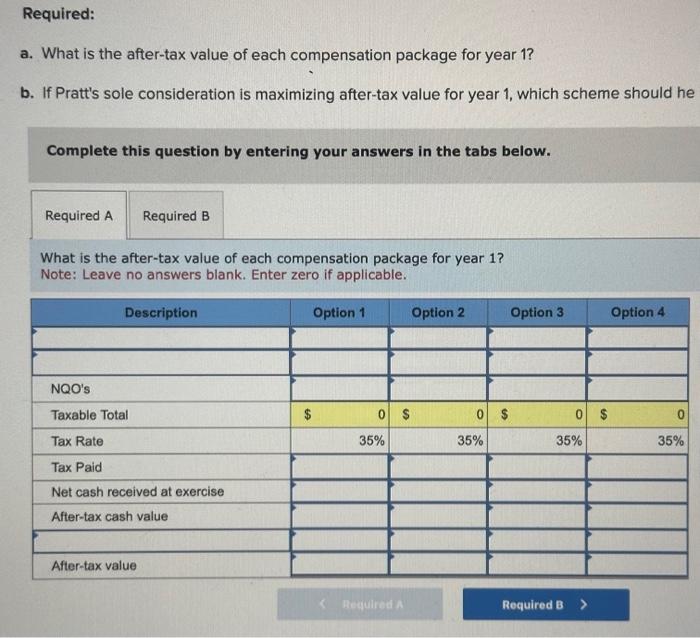

Pratt is ready to graduate and leave College Park. His future employer (Ferndale Corporation) offers the following four compensation packages from which Pratt may choose. Pratt will start working for Ferndale on January 1, year 1. Assume that the restricted stock is 1,000 shares that trade at $5 per share on the grant date (January 1 , year 1 ); shares are expected to be worth $10 per share on the vesting date at the end of year 1 ; and no 83 (b) election is made. Assume that the NQOs (100 options) each allows the employee to purchase 10 shares at $5 exercise price. The stock trades at $5 per share on the grant date (January 1, year 1) and is expected to be worth $10 per share on the vesting date at the end of year 1, and the options are exercised and sold at the end of the year. Also assume that Pratt spends on average $3,000 on health-related costs that will be covered by insurance if he had coverage or is an after-tax expense if he isn't covered by insurance (treat this as a cash outflow). Assume that Pratt's marginal tax rate is 35 percent. (Ignore FiCA taxes and time value of money considerations). Required: a. What is the after-tax value of each compensation package for year 1 ? b. If Pratt's sole consideration is maximizing after-tax value for year 1 , which scheme should he select? Complete this question by entering your answers in the tabs below. What is the after-tax value of each compensation package for year 1 ? Note: Leave no answers blank. Enter zero If applicable. Pratt is ready to graduate and leave College Park. His future employer (Ferndale Corporation) offers the following four compensation packages from which Pratt may choose. Pratt will start working for Ferndale on January 1, year 1. Assume that the restricted stock is 1,000 shares that trade at $5 per share on the grant date (January 1 , year 1); shares are expected to be worth $10 per share on the vesting date at the end of year 1 ; and no 83 (b) election is made. Assume that the NQOs (100 options) each allows the employee to purchase 10 shares at $5 exercise price. The stock trades at $5 per share on the grant date (January 1 , year 1 ) and is expected to be worth $10 per share on the vesting date at the end of year 1 , and the options are exercised and sold at the end of the year. Also assume that Pratt spends on average $3,000 on health-related costs that will be covered by insurance if he had coverage or is an after-tax expense if he isn't covered by insurance (treat this as a cash outflow). Assume that Pratt's marginal tax rate is 35 percent. (Ignore FICA taxes and time value of money considerations). c. Assuming Pratt chooses Option 3 and sells the stock on the vesting date (on the last day of year 1), complete Pratt's Schedule D ani Form 8949 for the sale of the restricted stock. Note: Input all the values as positive numbers. Use 2022 tax rules regardless of year on tax form. Form 8949 for the sale of the restricted stock. Form 8949 Schedule D. SCHEDULE D Capital Gains and Losses (Form 1040) - Attach to Form 1040, 1040-SR, or 1040-NR. Department of the Treasury Intarnal Reveruie Gundire ithos Go to wwwirs.govischeduleD for instructions and the latest information R 4 ala Required: a. What is the after-tax value of each compensation package for year 1 ? b. If Pratt's sole consideration is maximizing after-tax value for year 1 , which scheme should he Complete this question by entering your answers in the tabs below. What is the after-tax value of each compensation package for year 1 ? Note: Leave no answers blank. Enter zero if applicable