Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer part (d), (e) and (f). Question 5 (30 marks) (a) Calculate the payback for Project A and Project B. (2 marks) Year 0

Please answer part (d), (e) and (f).

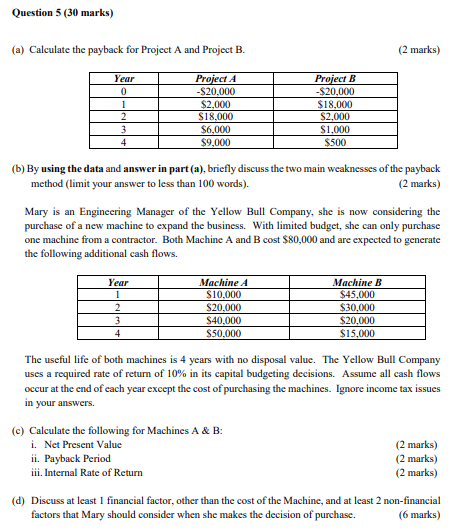

Question 5 (30 marks) (a) Calculate the payback for Project A and Project B. (2 marks) Year 0 1 2 3 4 Project A -$20,000 $2,000 $18,000 $6,000 $9,000 Project B -$20,000 $18,000 $2,000 $1,000 $500 (6) By using the data and answer in part (a), briefly discuss the two main weaknesses of the payback method (limit your answer to less than 100 words). (2 marks) Mary is an Engineering Manager of the Yellow Bull Company, she is now considering the purchase of a new machine to expand the business. With limited budget, she can only purchase one machine from a contractor. Both Machine A and B cost $80,000 and are expected to generate the following additional cash flows. Year 1 2 3 4 Machine A $10,000 $20,000 $40,000 $50,000 Machine B $45,000 $30,000 $20,000 $15,000 The useful life of both machines is 4 years with no disposal value. The Yellow Bull Company uses a required rate of return of 10% in its capital budgeting decisions. Assume all cash flows occur at the end of each year except the cost of purchasing the machines. Ignore income tax issues in your answers. (c) Calculate the following for Machines A & B: i. Net Present Value (2 marks) ii. Payback Period (2 marks) iii. Internal Rate of Return (2 marks) (d) Discuss at least 1 financial factor, other than the cost of the Machine, and at least 2 non-financial factors that Mary should consider when she makes the decision of purchase. (6 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started