Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE ANSWER PARTS A AND B. THANK YOU. On January 1, 2018, Price Company acquired an 80% interest in the common stock of Smith Company

PLEASE ANSWER PARTS A AND B. THANK YOU.

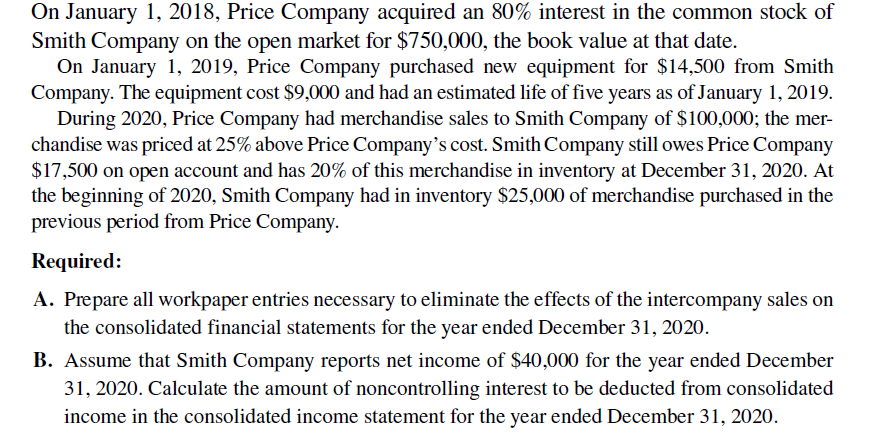

On January 1, 2018, Price Company acquired an 80% interest in the common stock of Smith Company on the open market for $750,000, the book value at that date. On January 1, 2019, Price Company purchased new equipment for $14,500 from Smith Company. The equipment cost $9,000 and had an estimated life of five years as of January 1, 2019. During 2020, Price Company had merchandise sales to Smith Company of $100,000; the merchandise was priced at 25% above Price Company's cost. Smith Company still owes Price Company $17,500 on open account and has 20% of this merchandise in inventory at December 31,2020 . At the beginning of 2020, Smith Company had in inventory $25,000 of merchandise purchased in the previous period from Price Company. Required: A. Prepare all workpaper entries necessary to eliminate the effects of the intercompany sales on the consolidated financial statements for the year ended December 31, 2020. B. Assume that Smith Company reports net income of $40,000 for the year ended December 31,2020 . Calculate the amount of noncontrolling interest to be deducted from consolidated income in the consolidated income statement for the year ended December 31, 2020Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started