Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer parts E & F of this question and please answer asap for a like Question 3 BD and G Company Limited has the

please answer parts E & F of this question and please answer asap for a like

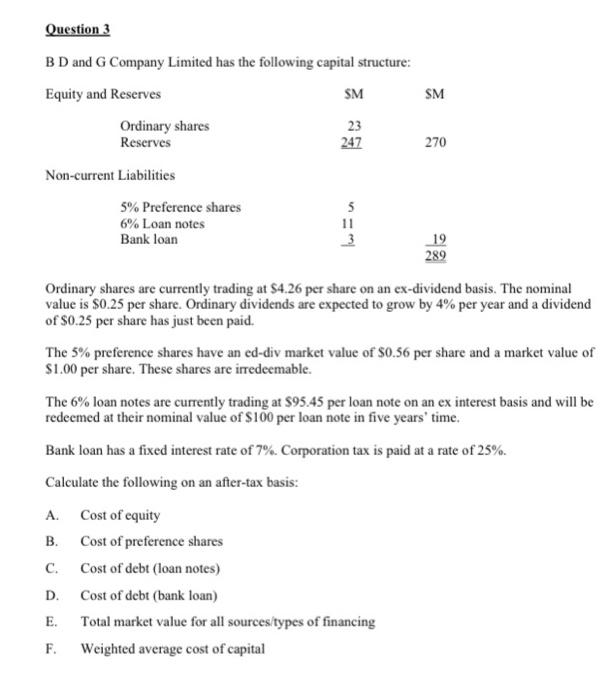

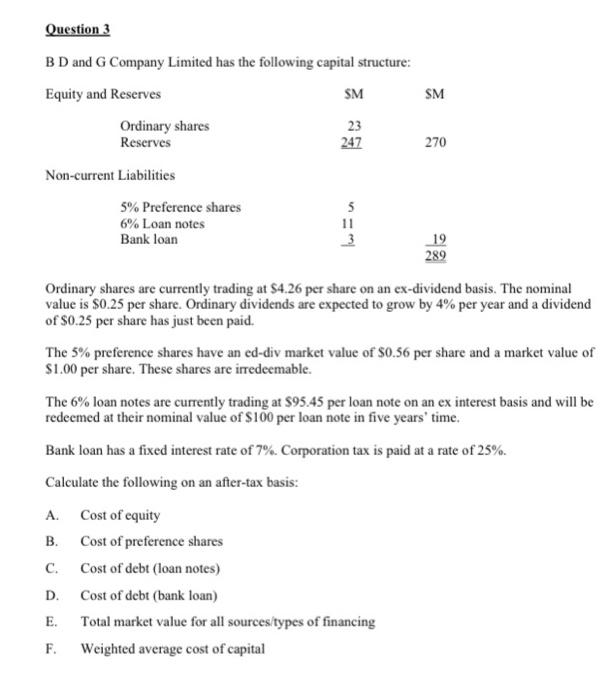

Question 3 BD and G Company Limited has the following capital structure: Equity and Reserves SM SM Ordinary shares Reserves 23 247 270 Non-current Liabilities 5% Preference shares 6% Loan notes Bank loan 5 11 19 289 Ordinary shares are currently trading at $4.26 per share on an ex-dividend basis. The nominal value is $0.25 per share. Ordinary dividends are expected to grow by 4% per year and a dividend of S0.25 per share has just been paid. The 5% preference shares have an ed-div market value of $0.56 per share and a market value of $1.00 per share. These shares are irredeemable. The 6% loan notes are currently trading at $95.45 per loan note on an ex interest basis and will be redeemed at their nominal value of $100 per loan note in five years' time. Bank loan has a fixed interest rate of 7%. Corporation tax is paid at a rate of 25%. Calculate the following on an after-tax basis: A Cost of equity B. Cost of preference shares Cost of debt (loan notes) c. D Cost of debt (bank loan) E. Total market value for all sources/types of financing F. Weighted average cost of capital Question 3 BD and G Company Limited has the following capital structure: Equity and Reserves SM SM Ordinary shares Reserves 23 247 270 Non-current Liabilities 5% Preference shares 6% Loan notes Bank loan 5 11 19 289 Ordinary shares are currently trading at $4.26 per share on an ex-dividend basis. The nominal value is $0.25 per share. Ordinary dividends are expected to grow by 4% per year and a dividend of S0.25 per share has just been paid. The 5% preference shares have an ed-div market value of $0.56 per share and a market value of $1.00 per share. These shares are irredeemable. The 6% loan notes are currently trading at $95.45 per loan note on an ex interest basis and will be redeemed at their nominal value of $100 per loan note in five years' time. Bank loan has a fixed interest rate of 7%. Corporation tax is paid at a rate of 25%. Calculate the following on an after-tax basis: A Cost of equity B. Cost of preference shares Cost of debt (loan notes) c. D Cost of debt (bank loan) E. Total market value for all sources/types of financing F. Weighted average cost of capital

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started