Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer Problem 10 only 0 0 file:///C/Users/Jaskaran%20Sachdeva/Downloads/Donald-E.-Kieso-et-al.-Intermediate-Accounting.-2-Wiley-2016.pdf a + - 0 x 392 of 221 | Cunilenls 2 - + Q E fil to

Please answer Problem 10 only

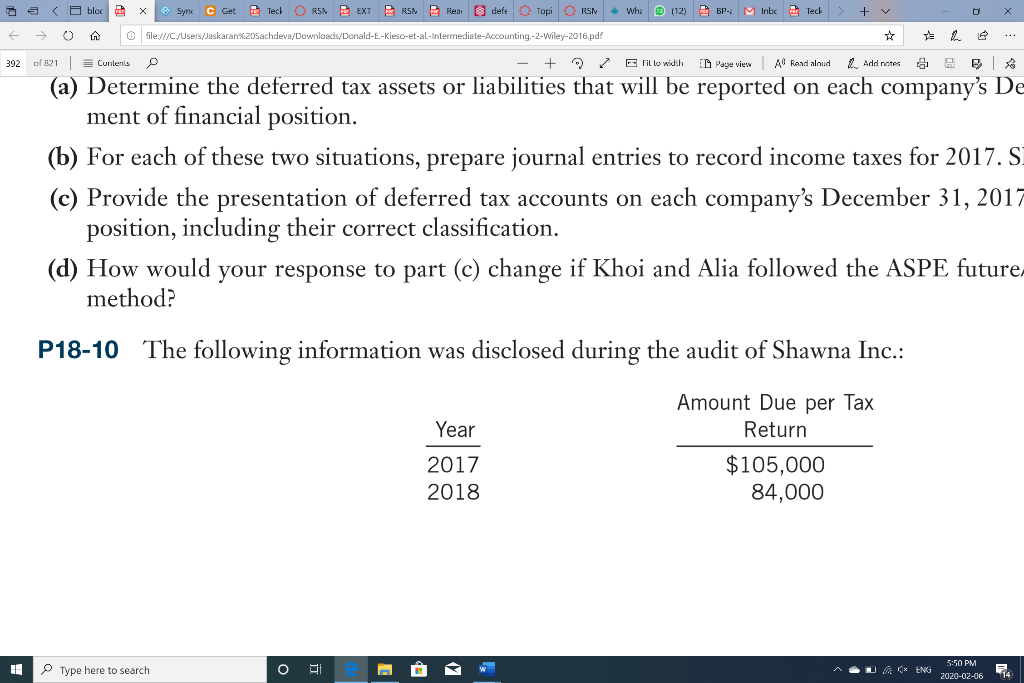

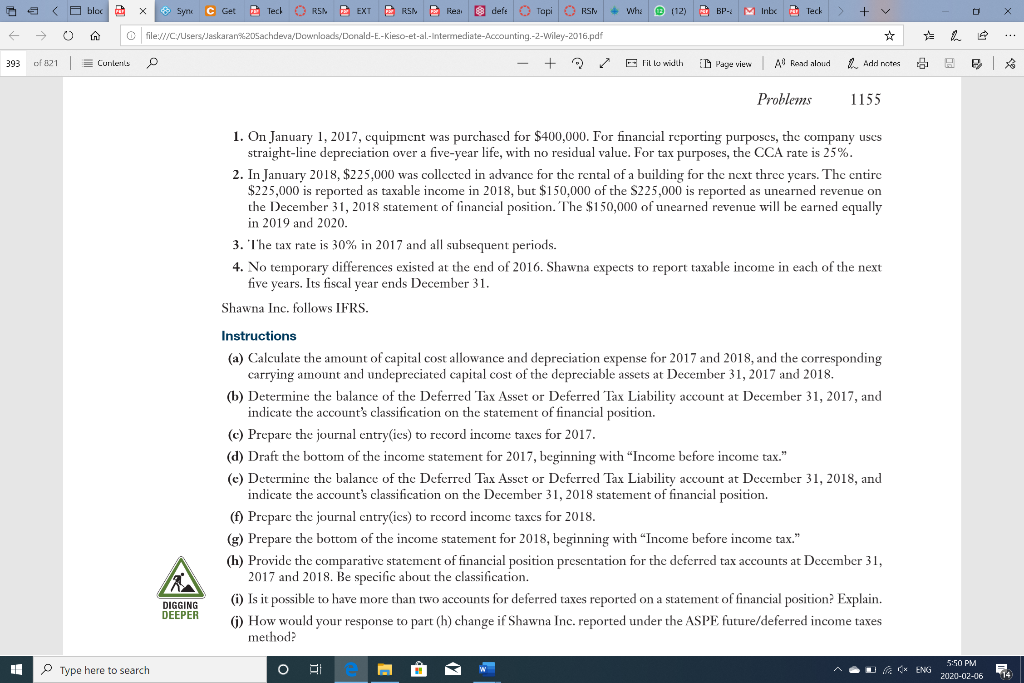

0 0 file:///C/Users/Jaskaran%20Sachdeva/Downloads/Donald-E.-Kieso-et-al.-Intermediate-Accounting.-2-Wiley-2016.pdf a + - 0 x 392 of 221 | Cunilenls 2 - + Q E fil to width Page View All Raad aloud Add notes % (a) Determine the deferred tax assets or liabilities that will be reported on each company's De ment of financial position. (b) For each of these two situations, prepare journal entries to record income taxes for 2017. S (c) Provide the presentation of deferred tax accounts on each company's December 31, 2017 position, including their correct classification. (d) How would your response to part (c) change if Khoi and Alia followed the ASPE future- method? P18-10 The following information was disclosed during the audit of Shawna Inc.: Year 2017 2018 Amount Due per Tax Return $105,000 84,000 $105.000 Type here to search A . (* ENG 5:50 PM 2020-02-06 14 + Wh (12) BP- M Inbc Teck > + - 0 X 393 a + - 0 x 392 of 221 | Cunilenls 2 - + Q E fil to width Page View All Raad aloud Add notes % (a) Determine the deferred tax assets or liabilities that will be reported on each company's De ment of financial position. (b) For each of these two situations, prepare journal entries to record income taxes for 2017. S (c) Provide the presentation of deferred tax accounts on each company's December 31, 2017 position, including their correct classification. (d) How would your response to part (c) change if Khoi and Alia followed the ASPE future- method? P18-10 The following information was disclosed during the audit of Shawna Inc.: Year 2017 2018 Amount Due per Tax Return $105,000 84,000 $105.000 Type here to search A . (* ENG 5:50 PM 2020-02-06 14 + Wh (12) BP- M Inbc Teck > + - 0 X 393 aStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started