Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer question 18 to 24. Thank you. Questions 18-24 relate to Mark Cannan Mark Cannan is updating research reports on two well-established consumer companies

Please answer question 18 to 24. Thank you.

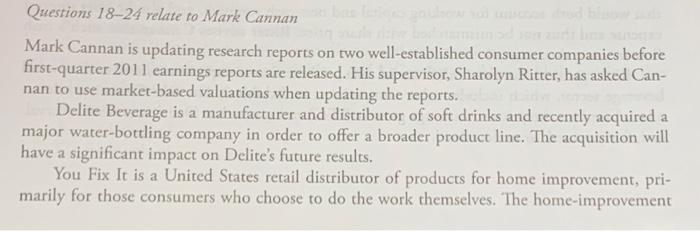

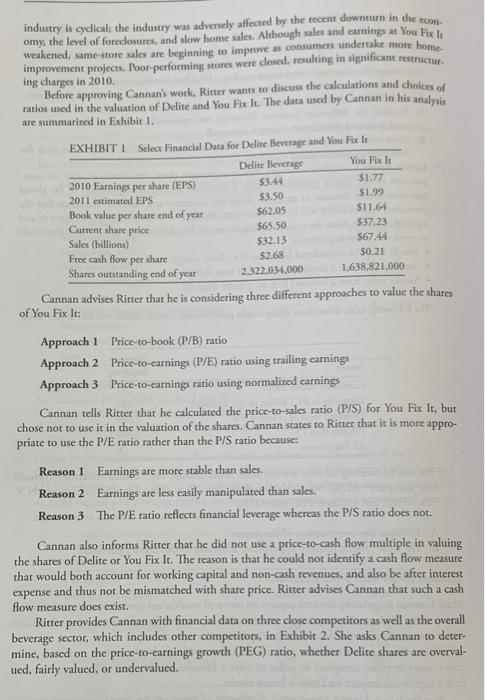

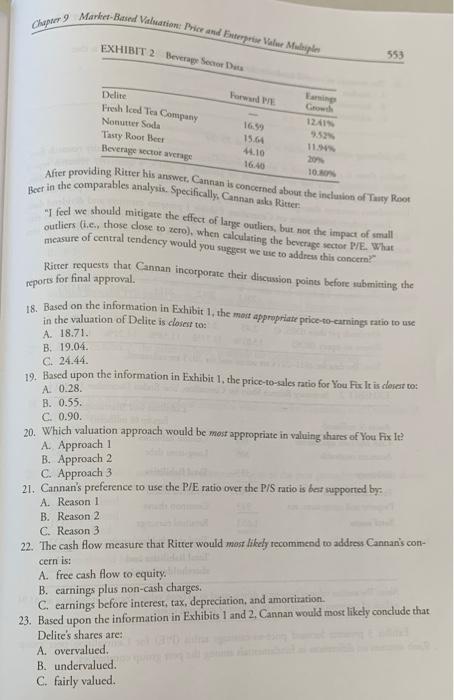

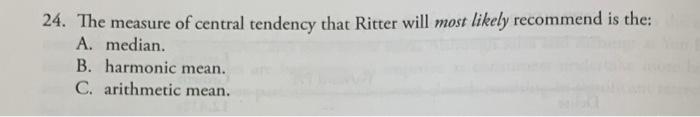

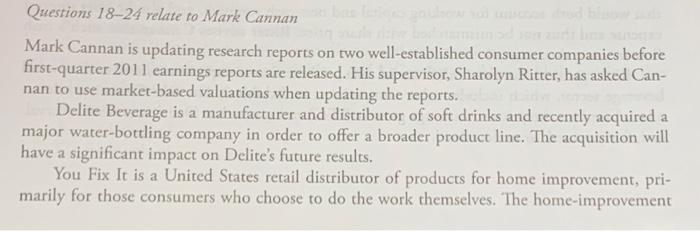

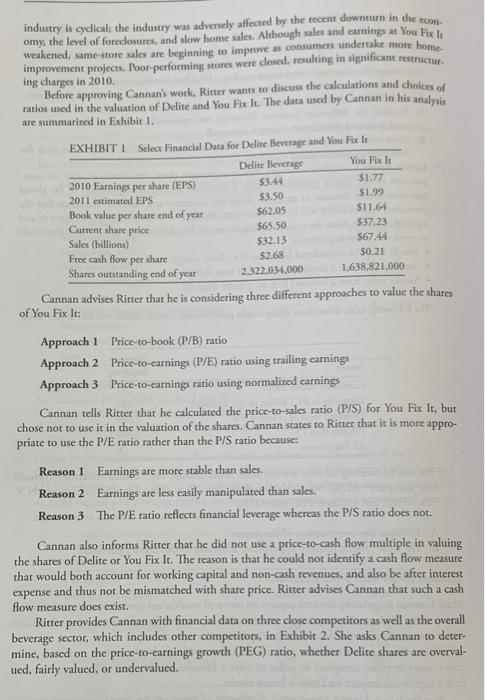

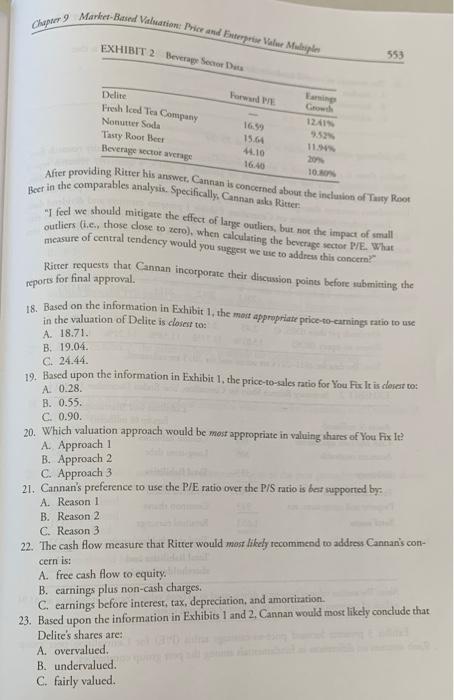

Questions 18-24 relate to Mark Cannan Mark Cannan is updating research reports on two well-established consumer companies before first-quarter 2011 earnings reports are released. His supervisor, Sharolyn Ritter, has asked Can- nan to use market-based valuations when updating the reports. Delite Beverage is a manufacturer and distributor of soft drinks and recently acquired a major water-bottling company in order to offer a broader product line. The acquisition will have a significant impact on Delite's future results. You Fix It is a United States retail distributor of products for home improvement, pri- marily for those consumers who choose to do the work themselves. The home-improvement industry is cyclicals the industry was adversely affected by the recent downturn in the con omy, the level of foreclosures, and slow home sales. Although sales and earnings ar You Fix Le weakened, same-store sales are beginning to improve as consumers undertake more home improvement projects. Poor performing stores were closed, resulting in significant restructur. ing charges in 2010. Before approving Cannan's work, Ritter wants to discuss the calculations and choices of ratios used in the valuation of Delite and You Fix It. The data used by Cannan in his analysis are summarized in Exhibit 1. EXHIBIT 1 Select Financial Data for Delite Beverage and You Fix le Delite Beverage You Fix It 2010 Earnings per share (EPS) $3.44 $1.77 2011 estimated EPS $3.50 $1.99 Book value per share end of year $62.05 $11.64 Current share price $65.50 $37.23 Sales (billions) $32.13 $67.44 Free cash flow per share $0.21 Shares outstanding end of year 2.322.034.000 1,638,821,000 Cannan advises Ritter that he is considering three different approaches to value the shares of You Fix It: $2.68 Approach 1 Price-to-book (P/B) ratio Approach 2 Price-to-carnings (P/E) ratio using trailing earnings Approach 3 Price-to-carnings ratio using normalized earnings Cannan tells Ritter that he calculated the price-to-sales ratio (P/S) for You Fix it, but chose not to use it in the valuation of the shares. Cannan states to Ritter that it is more appro- priate to use the P/E ratio rather than the P/S ratio because Reason 1 Earnings are more stable than sales. Reason 2 Earnings are less easily manipulated than sales. Reason 3 The P/E ratio reflects financial leverage whereas the P/S ratio does not. Cannan also informs Ritter that he did not use a price-to-cash flow multiple in valuing the shares of Delite or You Fix It. The reason is that he could not identify a cash flow measure that would both account for working capital and non-cash revenues, and also be after interest expense and thus not be mismatched with share price. Ritter advises Cannan that such a cash flow measure does exist. Ritter provides Cannan with financial data on three close competitors as well as the overall beverage sector, which includes other competitors, in Exhibit 2. She asks Cannan to deter- mine, based on the price-to-earnings growth (PEG) ratio, whether Delite shares are overval- ued, fairly valued, or undervalued. a 9 Marker-Based Valuation Price and Enterprise Vue Muse Chapter EXHIBIT 2 Beverage Secrets 553 Forward Ering Delite Fresh Iced Tea Company Nonutter Soda Tasty Root Beer Beverage sector sverige Grow 12A 1699 15.64 14.10 16AD 11. 10. After providing Ritter his answer, Cannan is concerned about the inclusion of Tauty Root Beer in the comparables analysis. Specifically. Cannan ass Ritter. "I feel we should mitigate the effect of large outliers, but not the impact of small outliers (ie, those dose to zero), when calculating the beverage sector PE. What measure of central tendency would you suggest we use to address this concern!" Ritter requests that Cannan incorporate their discussion points before submitting the reports for final approval. 18. Based on the information in Exhibit 1, the most appropriate price-to-earnings ratio to use in the valuation of Delite is closest to A 18.71. B. 19.04. C. 24.44. 19. Based upon the information in Exhibit 1, the price-to-sales ratio for You Fix It is closest to A 0.28 B. 0.55. C. 0.90. 20. Which valuation approach would be most appropriate in valuing shares of You Fix It? A. Approach 1 B. Approach 2 C. Approach 3 21. Cannan's preference to use the P/E ratio over the P/S ratio is best supported by A Reason 1 B. Reason 2 C. Reason 3 22. The cash flow measure that Ritter would most likely recommend to address Cannan's con- cern is: A. free cash flow to equity B. earnings plus non-cash charges. C. earnings before interest, tax, depreciation, and amortization. 23. Based upon the information in Exhibits 1 and 2. Cannan would most likely conclude that Delite's shares are: A. overvalued. B. undervalued C. fairly valued. 24. The measure of central tendency that Ritter will most likely recommend is the: A. median. B. harmonic mean. C. arithmetic mean

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started