Please answer question 2 & 3 (journal entries). Thanks!

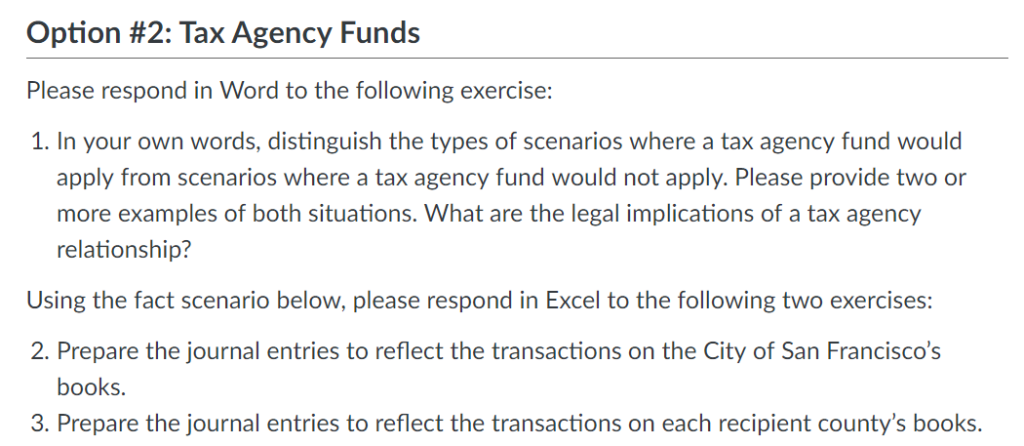

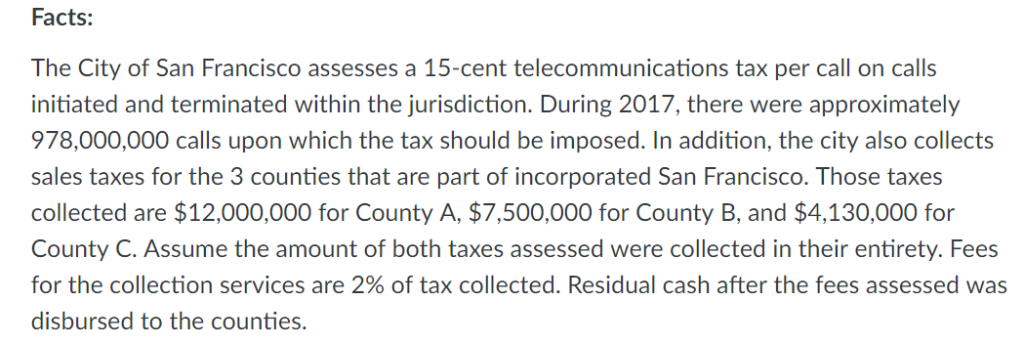

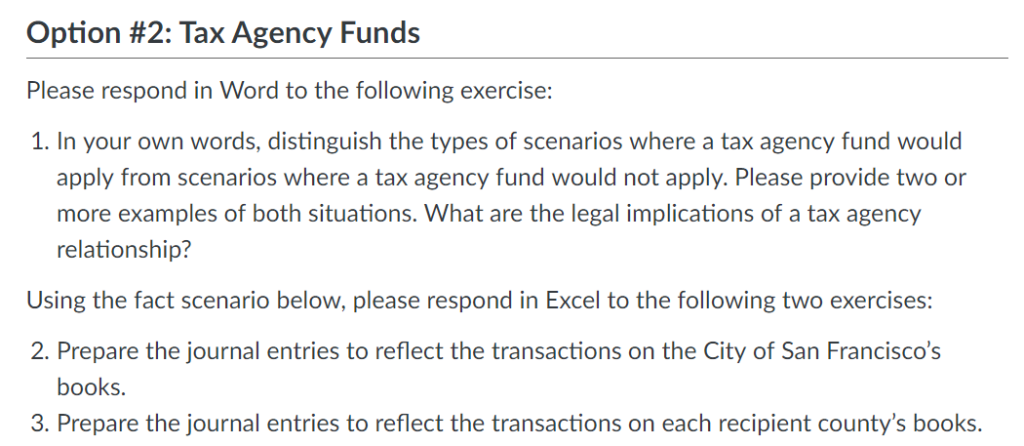

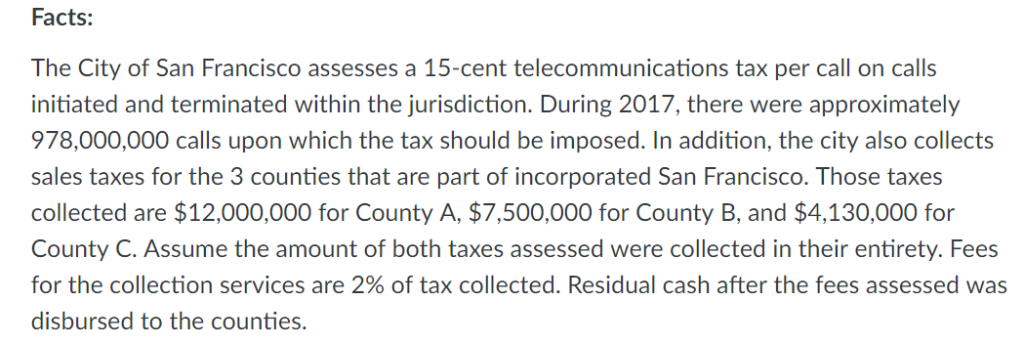

Option #2: Tax Agency Funds Please respond in Word to the following exercise: 1. In your own words, distinguish the types of scenarios where a tax agency fund would apply from scenarios where a tax agency fund would not apply. Please provide two or more examples of both situations. What are the legal implications of a tax agency relationship? Using the fact scenario below, please respond in Excel to the following two exercises: 2. Prepare the journal entries to reflect the transactions on the City of San Francisco's books. 3. Prepare the journal entries to reflect the transactions on each recipient county's books Facts: The City of San Francisco assesses a 15-cent telecommunications tax per call on calls initiated and terminated within the jurisdiction. During 2017, there were approximately 978,000,000 calls upon which the tax should be imposed. In addition, the city also collects sales taxes for the 3 counties that are part of incorporated San Francisco. Those taxes collected are $12,000,000 for County A, $7,500,000 for County B, and $4,130,000 for County C. Assume the amount of both taxes assessed were collected in their entirety. Fees for the collection services are 2% of tax collected. Residual cash after the fees assessed was disbursed to the counties. Option #2: Tax Agency Funds Please respond in Word to the following exercise: 1. In your own words, distinguish the types of scenarios where a tax agency fund would apply from scenarios where a tax agency fund would not apply. Please provide two or more examples of both situations. What are the legal implications of a tax agency relationship? Using the fact scenario below, please respond in Excel to the following two exercises: 2. Prepare the journal entries to reflect the transactions on the City of San Francisco's books. 3. Prepare the journal entries to reflect the transactions on each recipient county's books Facts: The City of San Francisco assesses a 15-cent telecommunications tax per call on calls initiated and terminated within the jurisdiction. During 2017, there were approximately 978,000,000 calls upon which the tax should be imposed. In addition, the city also collects sales taxes for the 3 counties that are part of incorporated San Francisco. Those taxes collected are $12,000,000 for County A, $7,500,000 for County B, and $4,130,000 for County C. Assume the amount of both taxes assessed were collected in their entirety. Fees for the collection services are 2% of tax collected. Residual cash after the fees assessed was disbursed to the counties