Please Answer

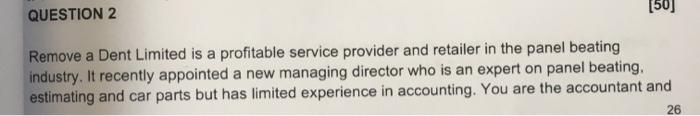

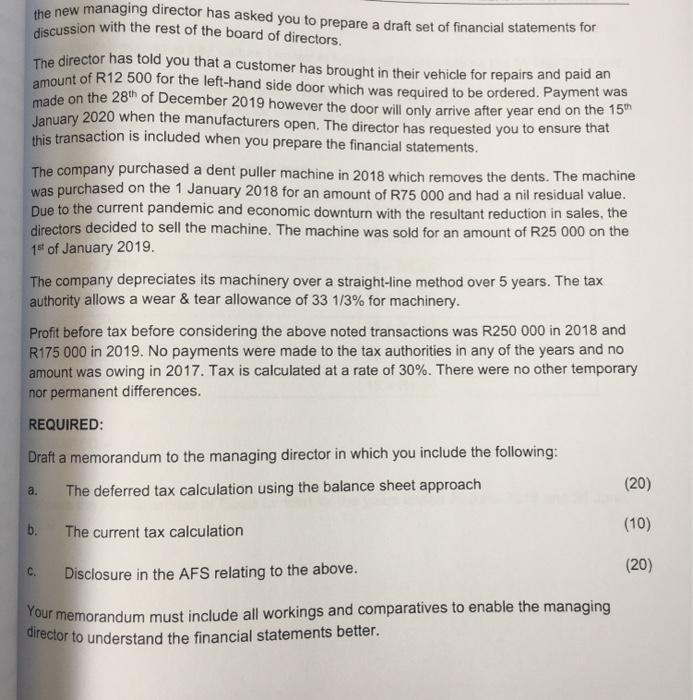

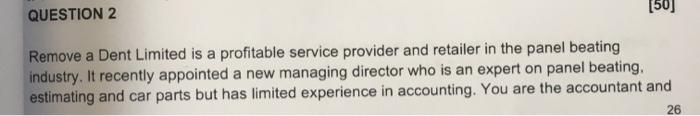

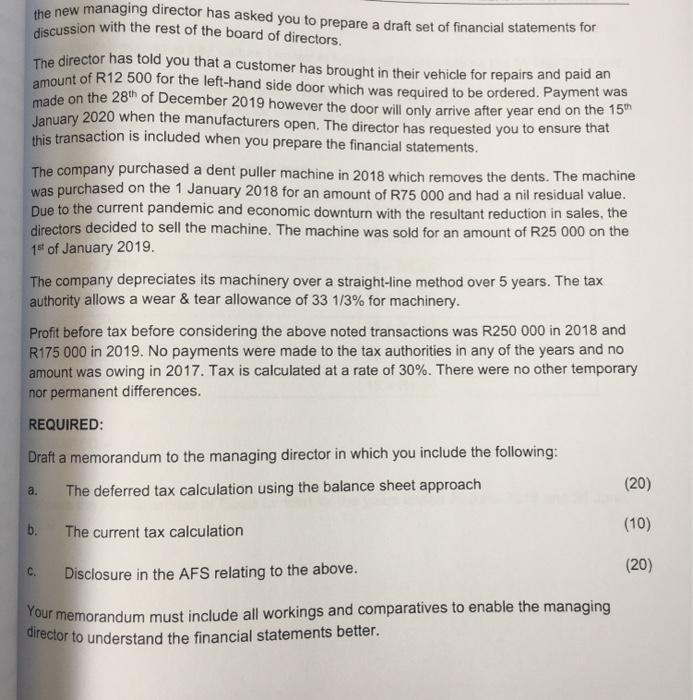

QUESTION 2 (50) Remove a Dent Limited is a profitable service provider and retailer in the panel beating industry. It recently appointed a new managing director who is an expert on panel beating. estimating and car parts but has limited experience in accounting. You are the accountant and 26 the new managing director has asked you to prepare a draft set of financial statements for discussion with the rest of the board of directors. The director has told you that a customer has brought in their vehicle for repairs and paid an amount of R12 500 for the left-hand side door which was required to be ordered. Payment was made on the 28th of December 2019 however the door will only arrive after year end on the 15" January 2020 when the manufacturers open. The director has requested you to ensure that this transaction is included when you prepare the financial statements. The company purchased a dent puller machine in 2018 which removes the dents. The machine was purchased on the 1 January 2018 for an amount of R75 000 and had a nil residual value. Due to the current pandemic and economic downturn with the resultant reduction in sales, the directors decided to sell the machine. The machine was sold for an amount of R25 000 on the 1 of January 2019. The company depreciates its machinery over a straight-line method over 5 years. The tax authority allows a wear & tear allowance of 33 1/3% for machinery. Profit before tax before considering the above noted transactions was R250 000 in 2018 and R175 000 in 2019. No payments were made to the tax authorities in any of the years and no amount was owing in 2017. Tax is calculated at a rate of 30%. There were no other temporary nor permanent differences. REQUIRED: Draft a memorandum to the managing director in which you include the following: The deferred tax calculation using the balance sheet approach (20) a. b. The current tax calculation (10) (20) C. Disclosure in the AFS relating to the above. Your memorandum must include all workings and comparatives to enable the managing director to understand the financial statements better. QUESTION 2 (50) Remove a Dent Limited is a profitable service provider and retailer in the panel beating industry. It recently appointed a new managing director who is an expert on panel beating. estimating and car parts but has limited experience in accounting. You are the accountant and 26 the new managing director has asked you to prepare a draft set of financial statements for discussion with the rest of the board of directors. The director has told you that a customer has brought in their vehicle for repairs and paid an amount of R12 500 for the left-hand side door which was required to be ordered. Payment was made on the 28th of December 2019 however the door will only arrive after year end on the 15" January 2020 when the manufacturers open. The director has requested you to ensure that this transaction is included when you prepare the financial statements. The company purchased a dent puller machine in 2018 which removes the dents. The machine was purchased on the 1 January 2018 for an amount of R75 000 and had a nil residual value. Due to the current pandemic and economic downturn with the resultant reduction in sales, the directors decided to sell the machine. The machine was sold for an amount of R25 000 on the 1 of January 2019. The company depreciates its machinery over a straight-line method over 5 years. The tax authority allows a wear & tear allowance of 33 1/3% for machinery. Profit before tax before considering the above noted transactions was R250 000 in 2018 and R175 000 in 2019. No payments were made to the tax authorities in any of the years and no amount was owing in 2017. Tax is calculated at a rate of 30%. There were no other temporary nor permanent differences. REQUIRED: Draft a memorandum to the managing director in which you include the following: The deferred tax calculation using the balance sheet approach (20) a. b. The current tax calculation (10) (20) C. Disclosure in the AFS relating to the above. Your memorandum must include all workings and comparatives to enable the managing director to understand the financial statements better