PLEASE ANSWER QUESTION 2

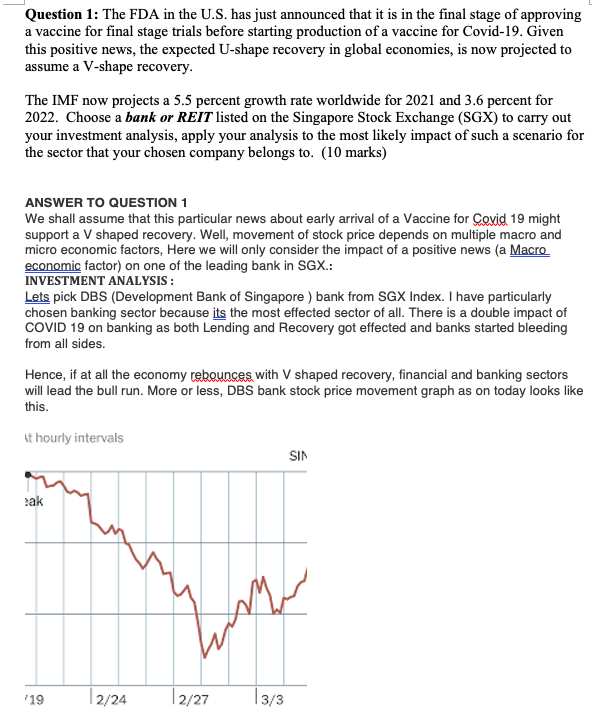

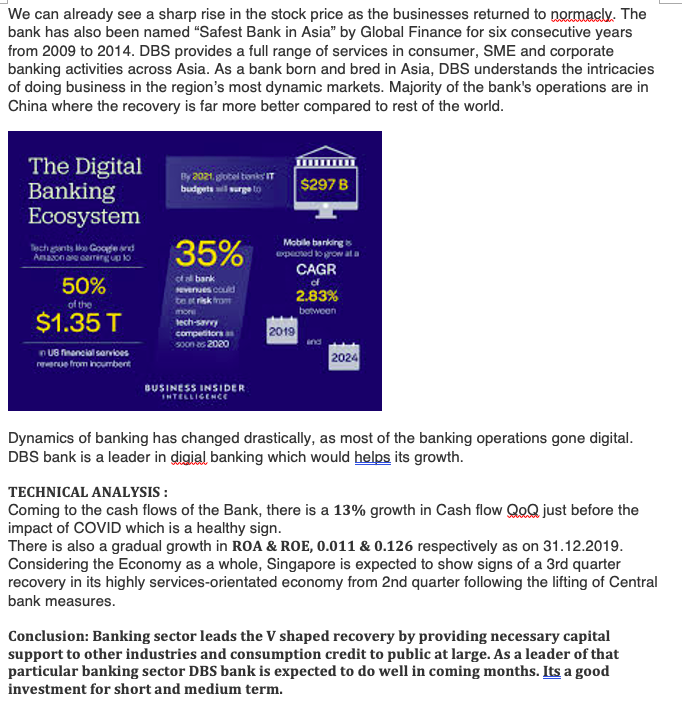

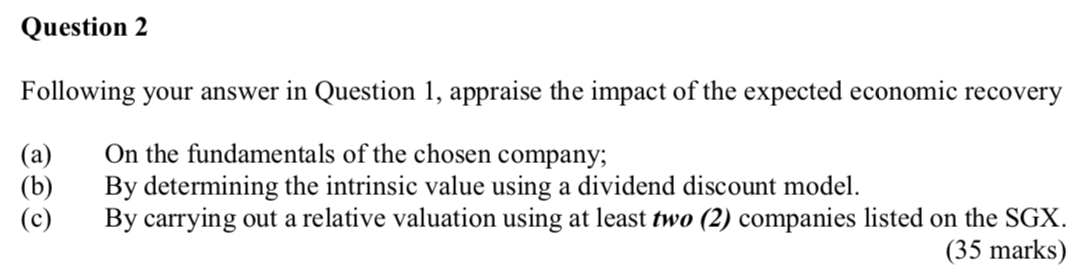

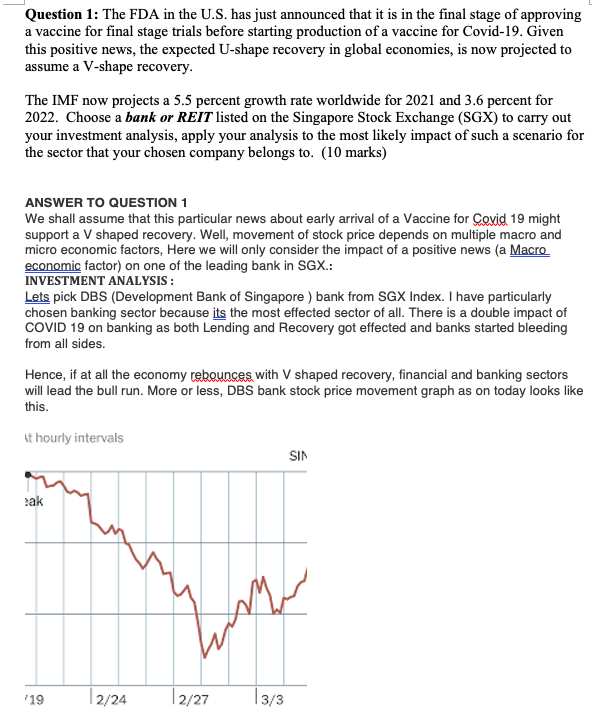

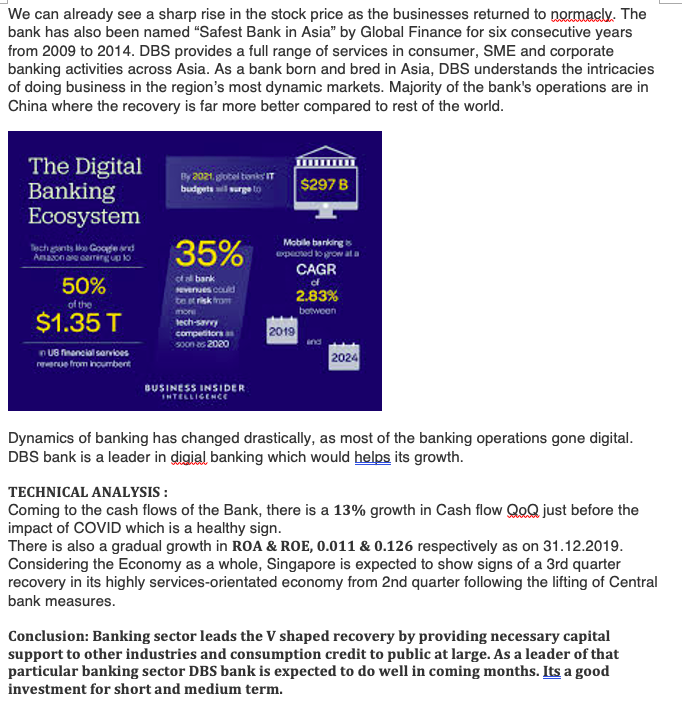

Question 1: The FDA in the U.S. has just announced that it is in the final stage of approving a vaccine for final stage trials before starting production of a vaccine for Covid-19. Given this positive news, the expected U-shape recovery in global economies, is now projected to assume a V-shape recovery. The IMF now projects a 5.5 percent growth rate worldwide for 2021 and 3.6 percent for 2022. Choose a bank or REIT listed on the Singapore Stock Exchange (SGX) to carry out your investment analysis, apply your analysis to the most likely impact of such a scenario for the sector that your chosen company belongs to. (10 marks) ANSWER TO QUESTION 1 We shall assume that this particular news about early arrival of a Vaccine for Coxid 19 might support a V shaped recovery. Well, movement of stock price depends on multiple macro and micro economic factors, Here we will only consider the impact of a positive news (a Macro economic factor) on one of the leading bank in SGX.: INVESTMENT ANALYSIS: Lets pick DBS (Development Bank of Singapore ) bank from SGX Index. I have particularly chosen banking sector because its the most effected sector of all. There is a double impact of COVID 19 on banking as both Lending and Recovery got effected and banks started bleeding from all sides. Hence, if at all the economy rebounces with V shaped recovery, financial and banking sectors will lead the bull run. More or less, DBS bank stock price movement graph as on today looks like this. At hourly intervals SIN ak wy 19 2/24 2/27 13/3 We can already see a sharp rise in the stock price as the businesses returned to normacly. The bank has also been named "Safest Bank in Asia" by Global Finance for six consecutive years from 2009 to 2014. DBS provides a full range of services in consumer, SME and corporate banking activities across Asia. As a bank born and bred in Asia, DBS understands the intricacies of doing business in the region's most dynamic markets. Majority of the bank's operations are in China where the recovery is far more better compared to rest of the world. 35% The Digital By 2021. gobetonks IT Banking budget wil surge to $297 B Ecosystem Toch gants de Google Mobile banking Asason were exposed to prowada CAGR skal bank 50% of Nevenues could of the to risk trom 2.83% more between $1.357 tech-savvy Competitions 2019 US Financial services son 26 2020 ore from houbert 2024 BUSINESS INSIDER INTELLIGENCE Dynamics of banking has changed drastically, as most of the banking operations gone digital. DBS bank is a leader in digial banking which would helps its growth. TECHNICAL ANALYSIS: Coming to the cash flows of the Bank, there is a 13% growth in Cash flow QeQ just before the impact of COVID which is a healthy sign. There is also a gradual growth in ROA & ROE, 0.011 & 0.126 respectively as on 31.12.2019. Considering the Economy as a whole, Singapore is expected to show signs of a 3rd quarter recovery in its highly services-orientated economy from 2nd quarter following the lifting of Central bank measures. Conclusion: Banking sector leads the V shaped recovery by providing necessary capital support to other industries and consumption credit to public at large. As a leader of that particular banking sector DBS bank is expected to do well in coming months. Its a good investment for short and medium term. Question 2 Following your answer in Question 1, appraise the impact of the expected economic recovery (a) (b) On the fundamentals of the chosen company; By determining the intrinsic value using a dividend discount model. By carrying out a relative valuation using at least two (2) companies listed on the SGX. (35 marks) Question 1: The FDA in the U.S. has just announced that it is in the final stage of approving a vaccine for final stage trials before starting production of a vaccine for Covid-19. Given this positive news, the expected U-shape recovery in global economies, is now projected to assume a V-shape recovery. The IMF now projects a 5.5 percent growth rate worldwide for 2021 and 3.6 percent for 2022. Choose a bank or REIT listed on the Singapore Stock Exchange (SGX) to carry out your investment analysis, apply your analysis to the most likely impact of such a scenario for the sector that your chosen company belongs to. (10 marks) ANSWER TO QUESTION 1 We shall assume that this particular news about early arrival of a Vaccine for Coxid 19 might support a V shaped recovery. Well, movement of stock price depends on multiple macro and micro economic factors, Here we will only consider the impact of a positive news (a Macro economic factor) on one of the leading bank in SGX.: INVESTMENT ANALYSIS: Lets pick DBS (Development Bank of Singapore ) bank from SGX Index. I have particularly chosen banking sector because its the most effected sector of all. There is a double impact of COVID 19 on banking as both Lending and Recovery got effected and banks started bleeding from all sides. Hence, if at all the economy rebounces with V shaped recovery, financial and banking sectors will lead the bull run. More or less, DBS bank stock price movement graph as on today looks like this. At hourly intervals SIN ak wy 19 2/24 2/27 13/3 We can already see a sharp rise in the stock price as the businesses returned to normacly. The bank has also been named "Safest Bank in Asia" by Global Finance for six consecutive years from 2009 to 2014. DBS provides a full range of services in consumer, SME and corporate banking activities across Asia. As a bank born and bred in Asia, DBS understands the intricacies of doing business in the region's most dynamic markets. Majority of the bank's operations are in China where the recovery is far more better compared to rest of the world. 35% The Digital By 2021. gobetonks IT Banking budget wil surge to $297 B Ecosystem Toch gants de Google Mobile banking Asason were exposed to prowada CAGR skal bank 50% of Nevenues could of the to risk trom 2.83% more between $1.357 tech-savvy Competitions 2019 US Financial services son 26 2020 ore from houbert 2024 BUSINESS INSIDER INTELLIGENCE Dynamics of banking has changed drastically, as most of the banking operations gone digital. DBS bank is a leader in digial banking which would helps its growth. TECHNICAL ANALYSIS: Coming to the cash flows of the Bank, there is a 13% growth in Cash flow QeQ just before the impact of COVID which is a healthy sign. There is also a gradual growth in ROA & ROE, 0.011 & 0.126 respectively as on 31.12.2019. Considering the Economy as a whole, Singapore is expected to show signs of a 3rd quarter recovery in its highly services-orientated economy from 2nd quarter following the lifting of Central bank measures. Conclusion: Banking sector leads the V shaped recovery by providing necessary capital support to other industries and consumption credit to public at large. As a leader of that particular banking sector DBS bank is expected to do well in coming months. Its a good investment for short and medium term. Question 2 Following your answer in Question 1, appraise the impact of the expected economic recovery (a) (b) On the fundamentals of the chosen company; By determining the intrinsic value using a dividend discount model. By carrying out a relative valuation using at least two (2) companies listed on the SGX. (35 marks)