Question

Please answer question 2 since Question 1 has been answered. Assignment questions for the Role of Capital Market Intermediaries in the Dot-Com Crash of 2000

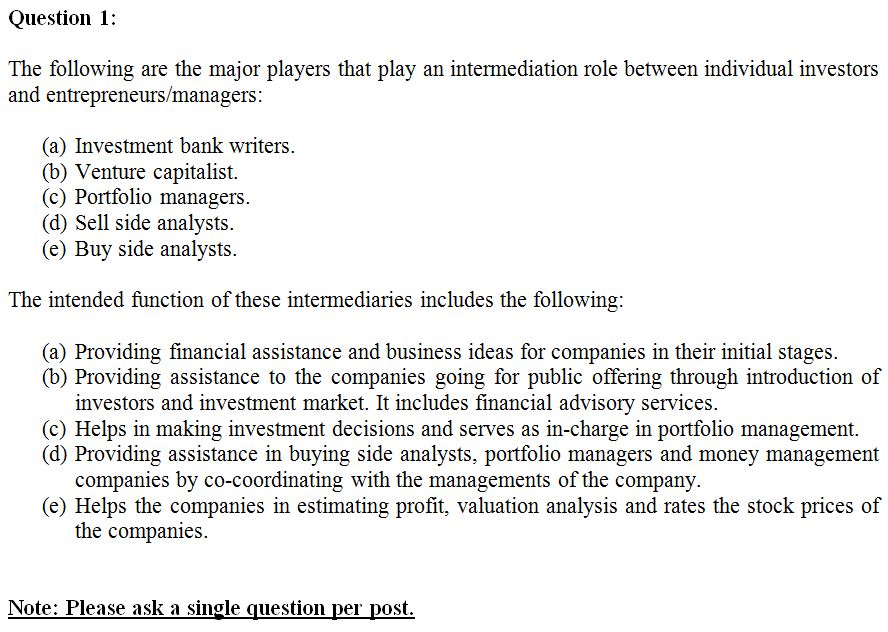

Please answer question 2 since Question 1 has been answered. Assignment questions for the Role of Capital Market Intermediaries in the Dot-Com Crash of 2000 1. List all the major players that play an intermediation role between individual investors and entrepreneurs/managers. What is the intended function of each of the intermediaries? 2. How is each of the intermediaries you identified compensated for performing its respective function? Is the compensation arrangement likely to lead any dysfunctional incentives? 3. Identify the role each intermediary might have played in the creation of the dot-com bubble. Was this behavior related to the potential dysfunctional behavior identified in question 2? 4. How do you fix these problems?

Question 1 provide last time

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started