Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer question 5 3. You are assessing the average performance of two mutual fund managers with the Fama-French 3-factor model. The fund managers and

Please answer question 5

Please answer question 5

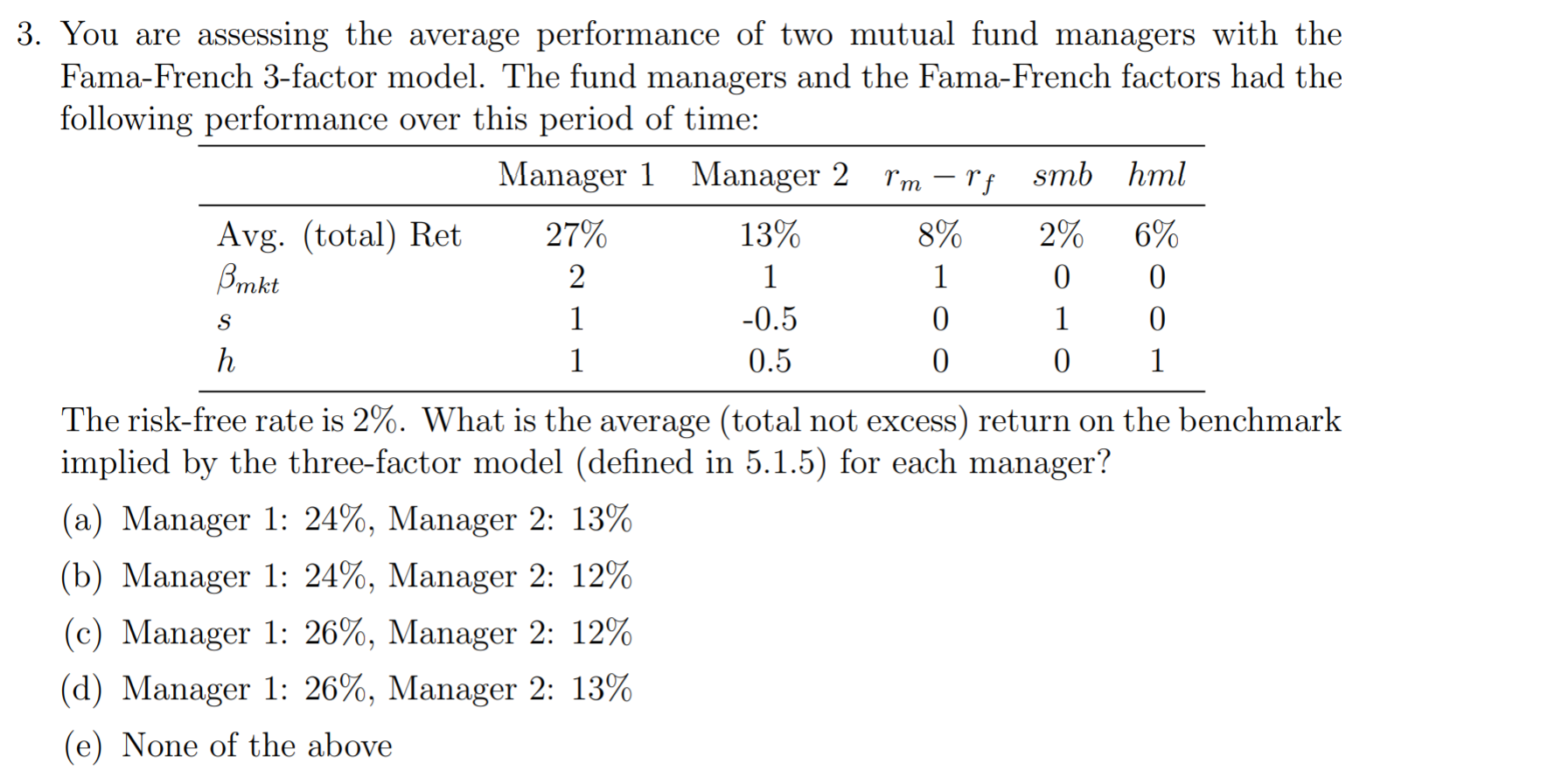

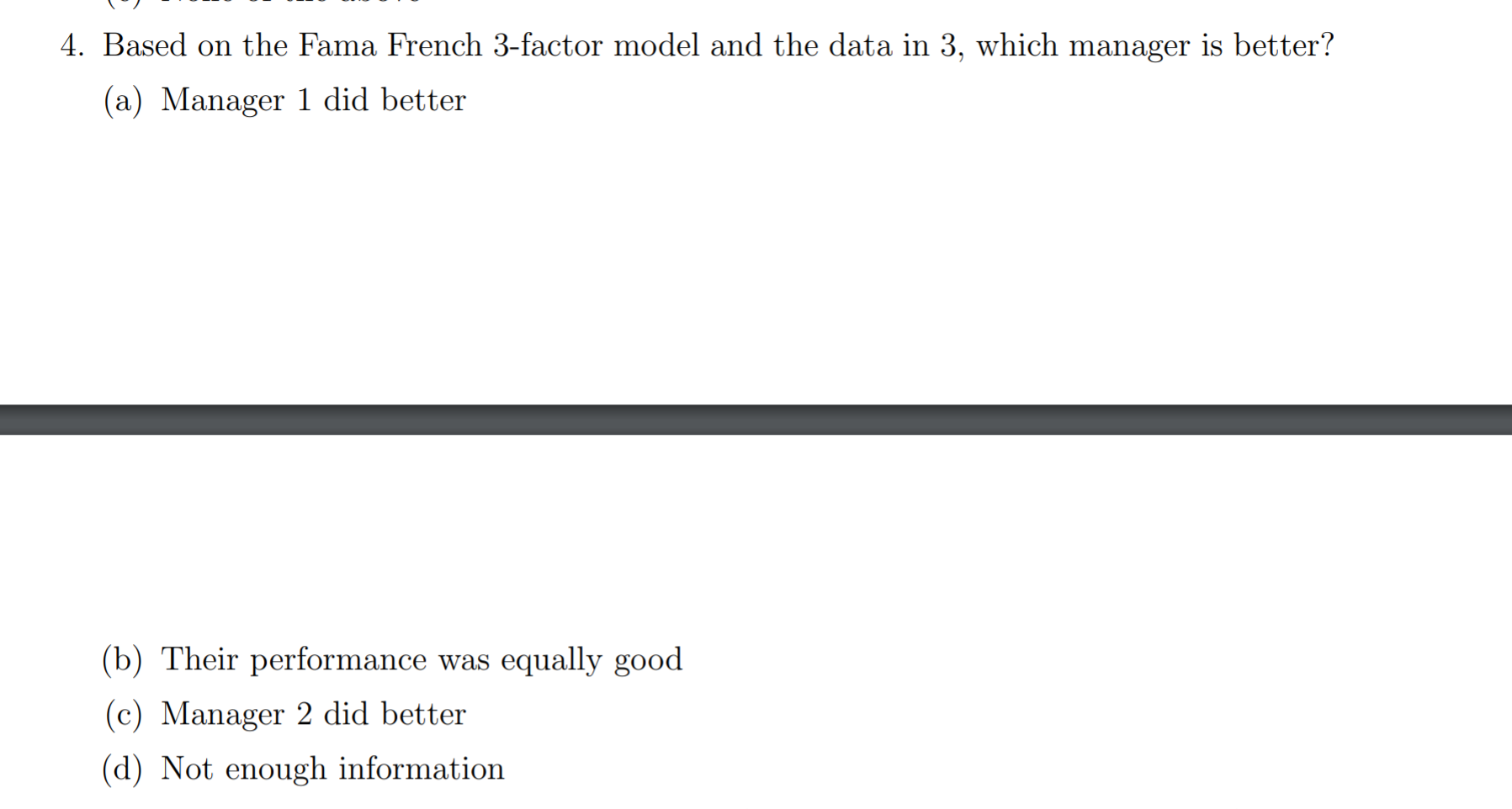

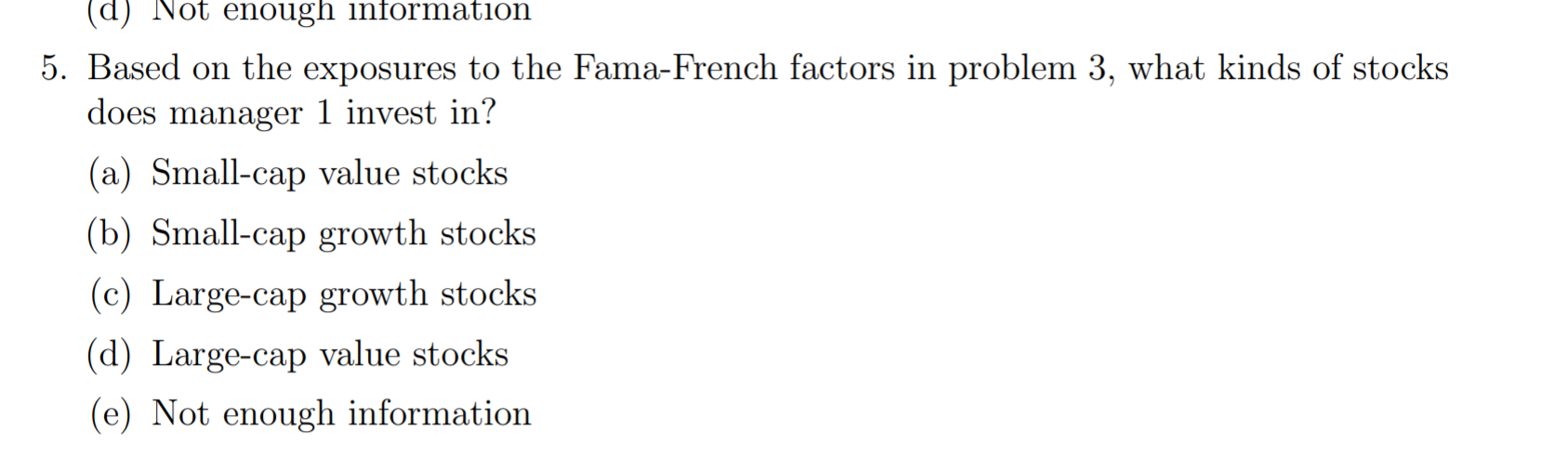

3. You are assessing the average performance of two mutual fund managers with the Fama-French 3-factor model. The fund managers and the Fama-French factors had the following performance over this period of time: Manager 1 Manager 2 I'm -rf smb hml Avg. (total) Ret 27% 8% 2% 6% 1 0 0 -0.5 0 1 0 0.5 0 0 1 13% Bmkt 2 The risk-free rate is 2%. What is the average (total not excess) return on the benchmark implied by the three-factor model (defined in 5.1.5) for each manager? (a) Manager 1: 24%, Manager 2: 13% (b) Manager 1: 24%, Manager 2: 12% (c) Manager 1: 26%, Manager 2: 12% (d) Manager 1: 26%, Manager 2: 13% (e) None of the above 4. Based on the Fama French 3-factor model and the data in 3, which manager is better? (a) Manager 1 did better (b) Their performance was equally good (c) Manager 2 did better (d) Not enough information (d) Not enough information 5. Based on the exposures to the Fama-French factors in problem 3, what kinds of stocks does manager 1 invest in? (a) Small-cap value stocks (b) Small-cap growth stocks (c) Large-cap growth stocks (d) Large-cap value stocks (e) Not enough information 3. You are assessing the average performance of two mutual fund managers with the Fama-French 3-factor model. The fund managers and the Fama-French factors had the following performance over this period of time: Manager 1 Manager 2 I'm -rf smb hml Avg. (total) Ret 27% 8% 2% 6% 1 0 0 -0.5 0 1 0 0.5 0 0 1 13% Bmkt 2 The risk-free rate is 2%. What is the average (total not excess) return on the benchmark implied by the three-factor model (defined in 5.1.5) for each manager? (a) Manager 1: 24%, Manager 2: 13% (b) Manager 1: 24%, Manager 2: 12% (c) Manager 1: 26%, Manager 2: 12% (d) Manager 1: 26%, Manager 2: 13% (e) None of the above 4. Based on the Fama French 3-factor model and the data in 3, which manager is better? (a) Manager 1 did better (b) Their performance was equally good (c) Manager 2 did better (d) Not enough information (d) Not enough information 5. Based on the exposures to the Fama-French factors in problem 3, what kinds of stocks does manager 1 invest in? (a) Small-cap value stocks (b) Small-cap growth stocks (c) Large-cap growth stocks (d) Large-cap value stocks (e) Not enough information

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started