Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE ANSWER QUESTION PARTS A, B, C AND D PLEASE!! SHOW ALL WORK!!! #3. Zahira Corporation manufactures and sells custom storm windows for enclosed porches.

PLEASE ANSWER QUESTION PARTS A, B, C AND D PLEASE!! SHOW ALL WORK!!!

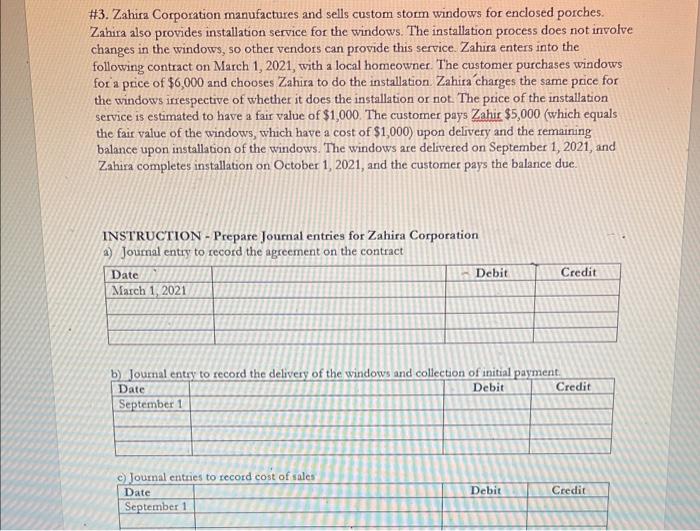

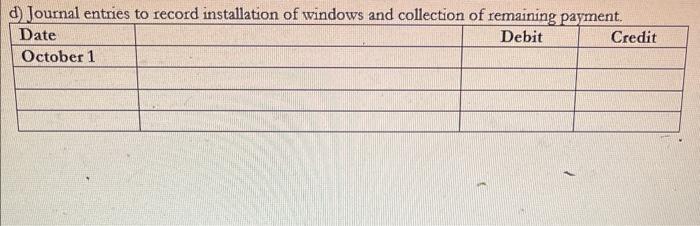

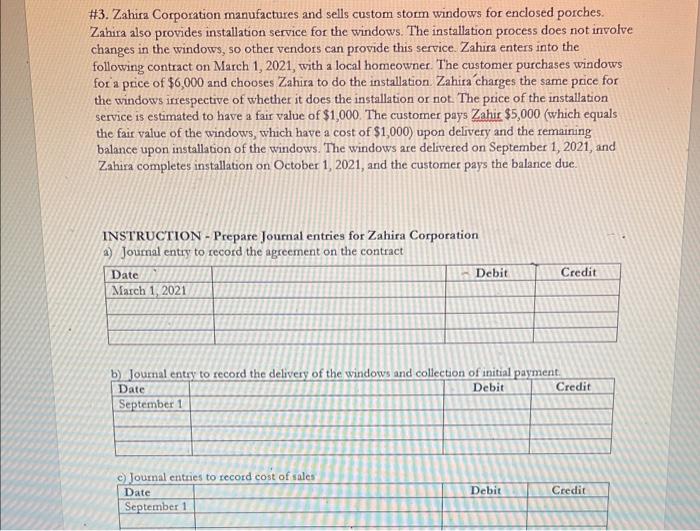

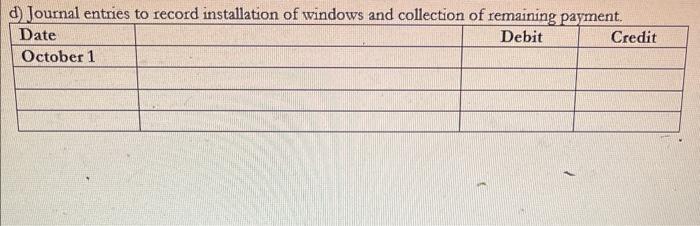

\#3. Zahira Corporation manufactures and sells custom storm windows for enclosed porches. Zahira also provides installation service for the windows. The installation process does not involve changes in the windows, so other vendors can provide this service. Zahira enters into the following contract on March 1, 2021, with a local homeowner. The customer purchases windows for a price of $6,000 and chooses Zahira to do the installation. Zahira charges the same price for the windows irrespective of whether it does the installation or not. The price of the installation service is estimated to have a fair value of $1,000. The customer pays Zahir $5,000 (which equals the fair value of the windows, which have a cost of $1,000) upon delivery and the remaining balance upon installation of the windows. The windows are delivered on September 1, 2021, and Zahira completes installation on October 1, 2021, and the customer pays the balance due. INSTRUCIION - Prepare Journal entries for Zahira Corporation 2) Journal entry to record the agreement on the contract b) Iournal entry to record the deliverv of the windows and collection of initial payment. d) Journal entries to record installation of windows and collection of remaining payment. \begin{tabular}{|l|l|l|l|} \hline Date & & Debit & Credit \\ \hline October 1 & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started