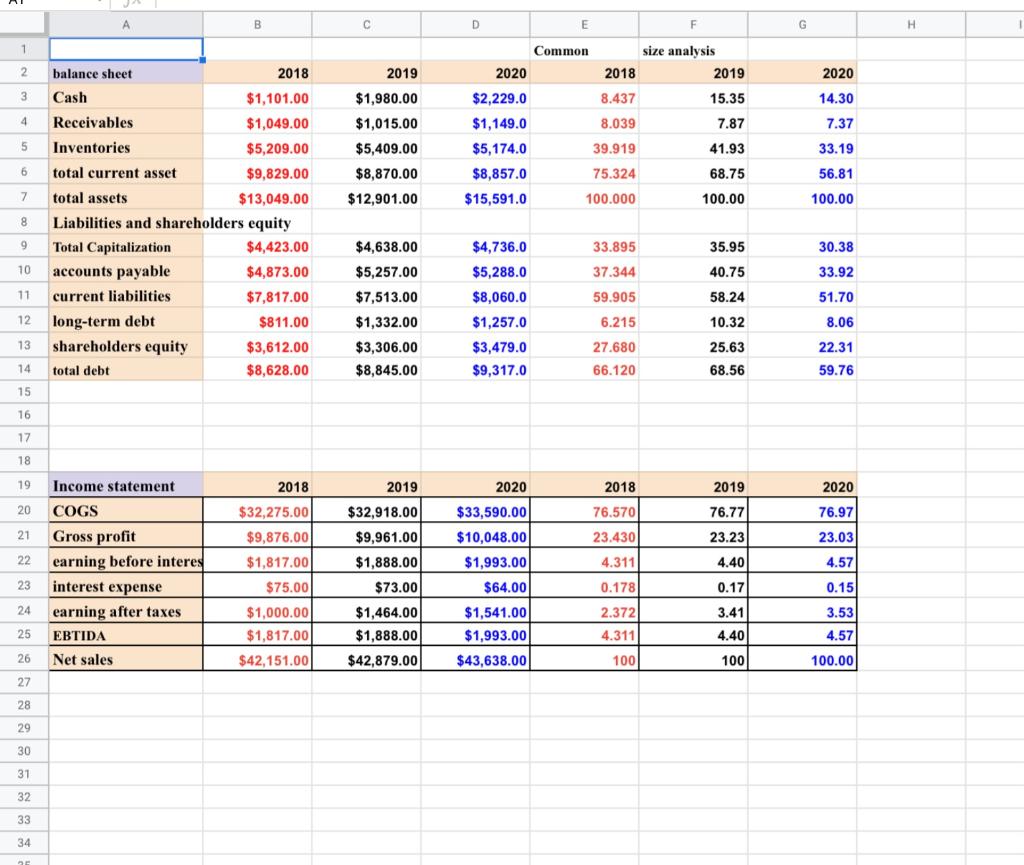

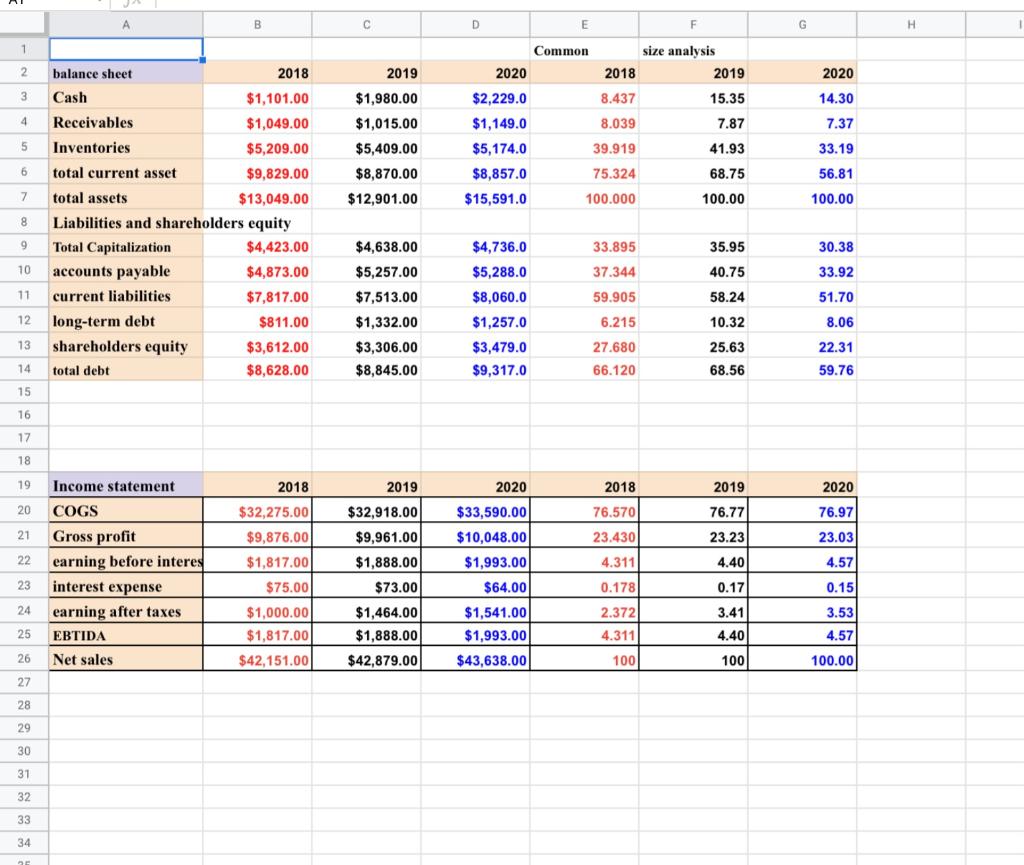

Please answer quickly. Analyze the following common size analysis

A B D E F G H 1 Common 2020 size analysis 2019 2 2019 2018 2020 3 $1,980.00 8.437 15.35 14.30 4 8.039 7.87 7.37 5 $1,015.00 $5,409.00 $8,870.00 $2,229.0 $1,149.0 $5,174.0 $8,857.0 $15,591.0 39.919 41.93 33.19 6 75.324 68.75 56.81 7 $12,901.00 100.000 100.00 100.00 8 balance sheet 2018 Cash $1,101.00 Receivables $1,049.00 Inventories $5,209.00 total current asset $9,829.00 total assets $13,049.00 Liabilities and shareholders equity Total Capitalization $4,423.00 accounts payable $4,873.00 current liabilities $7,817.00 long-term debt $811.00 shareholders equity $3,612.00 total debt $8,628.00 9 $4,736.0 33.895 35.95 30.38 10 $4,638.00 $5,257.00 $7,513.00 $5,288.0 37.344 40.75 33.92 11 59.905 58.24 51.70 $8,060.0 $1,257.0 12 6.215 10.32 8.06 13 $1,332.00 $3,306.00 $8,845.00 $3,479.0 $9,317.0 27.680 66.120 25.63 68.56 22.31 59.76 14 15 16 17 18 19 Income statement 2018 2019 2020 2018 2019 2020 20 $32,275.00 $33,590.00 76.570 76.77 76.97 $32,918.00 $9,961.00 21 $9,876.00 $10,048.00 23.430 23.23 23.03 22 $1,817.00 $1,888.00 $1,993.00 4.311 4.40 4.57 23 COGS Gross profit earning before interes interest expense earning after taxes EBTIDA Net sales $75.00 $73.00 $64.00 0.178 0.17 0.15 24 $1,000.00 $1,817.00 $42,151.00 $1,464.00 $1,888.00 $1,541.00 $1,993.00 $43,638.00 2.372 4.311 3.41 4.40 25 3.53 4.57 26 $42,879.00 100 100 100.00 27 28 29 30 31 32 33 34 A B D E F G H 1 Common 2020 size analysis 2019 2 2019 2018 2020 3 $1,980.00 8.437 15.35 14.30 4 8.039 7.87 7.37 5 $1,015.00 $5,409.00 $8,870.00 $2,229.0 $1,149.0 $5,174.0 $8,857.0 $15,591.0 39.919 41.93 33.19 6 75.324 68.75 56.81 7 $12,901.00 100.000 100.00 100.00 8 balance sheet 2018 Cash $1,101.00 Receivables $1,049.00 Inventories $5,209.00 total current asset $9,829.00 total assets $13,049.00 Liabilities and shareholders equity Total Capitalization $4,423.00 accounts payable $4,873.00 current liabilities $7,817.00 long-term debt $811.00 shareholders equity $3,612.00 total debt $8,628.00 9 $4,736.0 33.895 35.95 30.38 10 $4,638.00 $5,257.00 $7,513.00 $5,288.0 37.344 40.75 33.92 11 59.905 58.24 51.70 $8,060.0 $1,257.0 12 6.215 10.32 8.06 13 $1,332.00 $3,306.00 $8,845.00 $3,479.0 $9,317.0 27.680 66.120 25.63 68.56 22.31 59.76 14 15 16 17 18 19 Income statement 2018 2019 2020 2018 2019 2020 20 $32,275.00 $33,590.00 76.570 76.77 76.97 $32,918.00 $9,961.00 21 $9,876.00 $10,048.00 23.430 23.23 23.03 22 $1,817.00 $1,888.00 $1,993.00 4.311 4.40 4.57 23 COGS Gross profit earning before interes interest expense earning after taxes EBTIDA Net sales $75.00 $73.00 $64.00 0.178 0.17 0.15 24 $1,000.00 $1,817.00 $42,151.00 $1,464.00 $1,888.00 $1,541.00 $1,993.00 $43,638.00 2.372 4.311 3.41 4.40 25 3.53 4.57 26 $42,879.00 100 100 100.00 27 28 29 30 31 32 33 34