Please answer REQ 3-6 only.

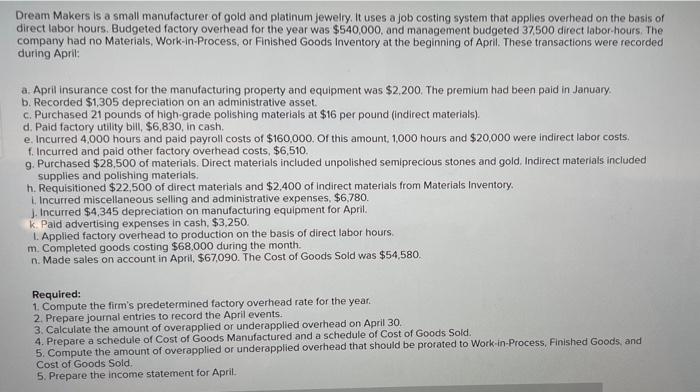

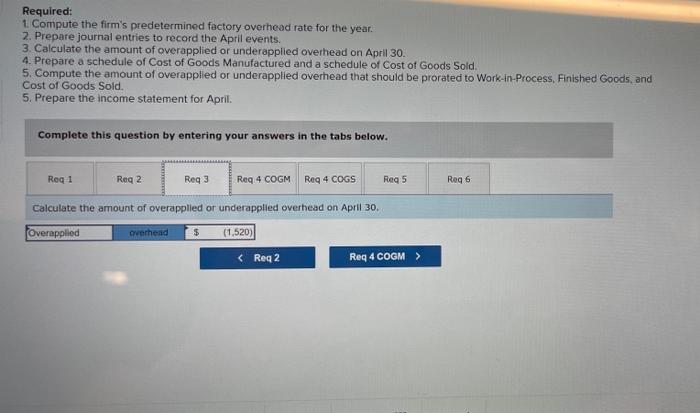

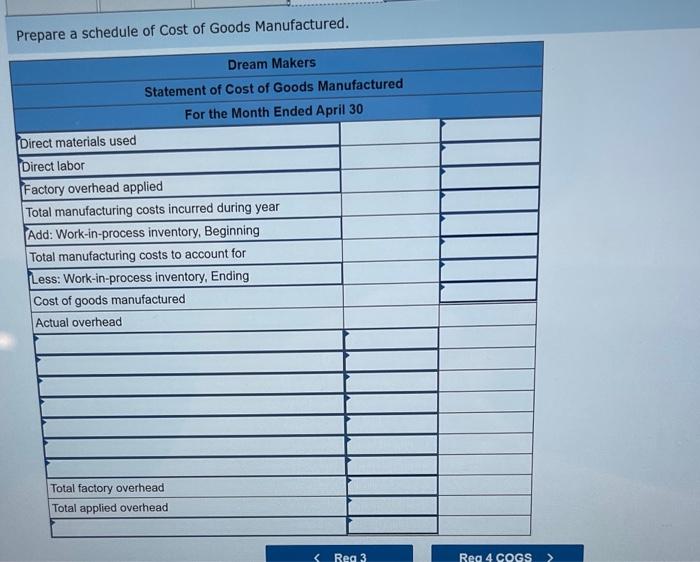

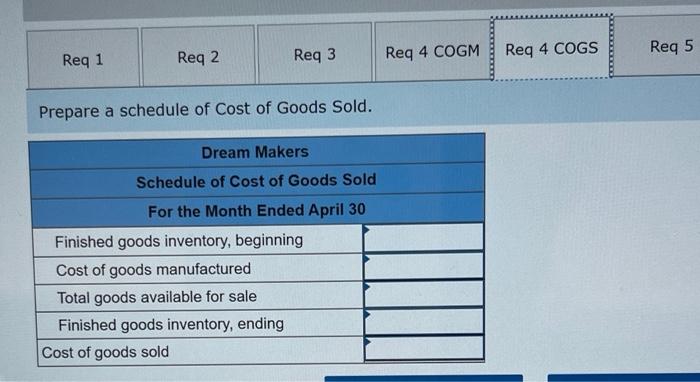

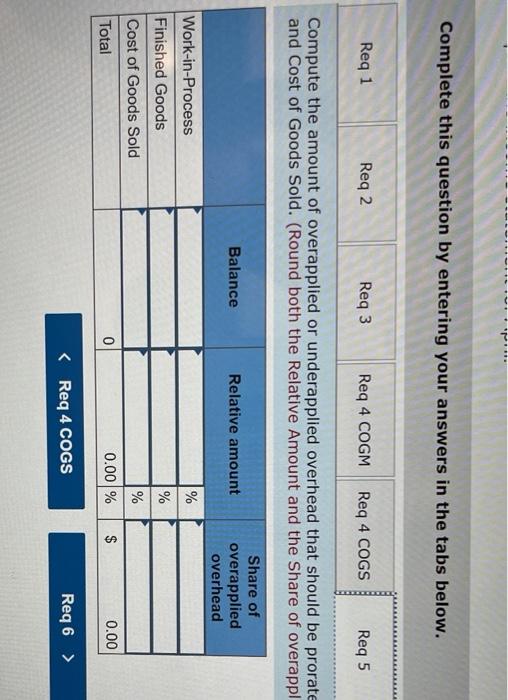

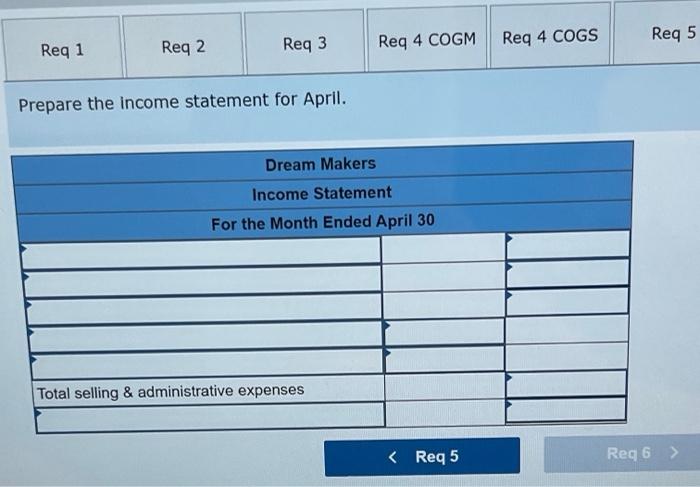

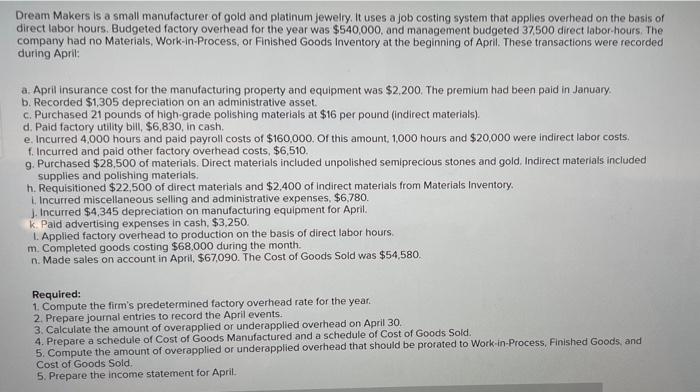

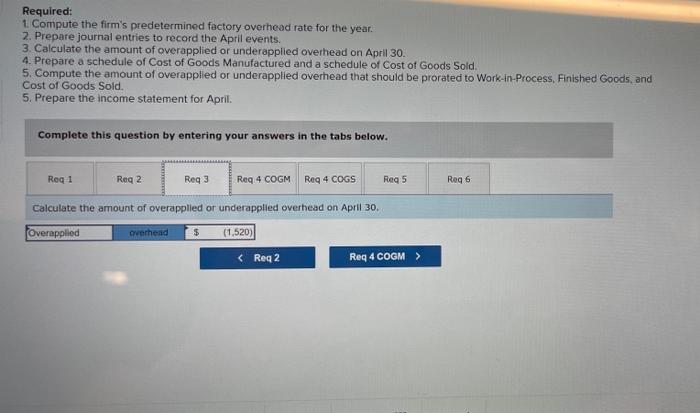

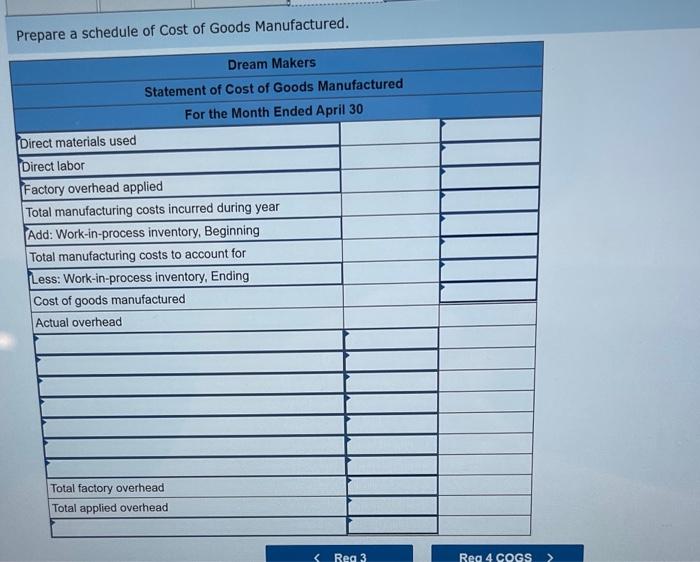

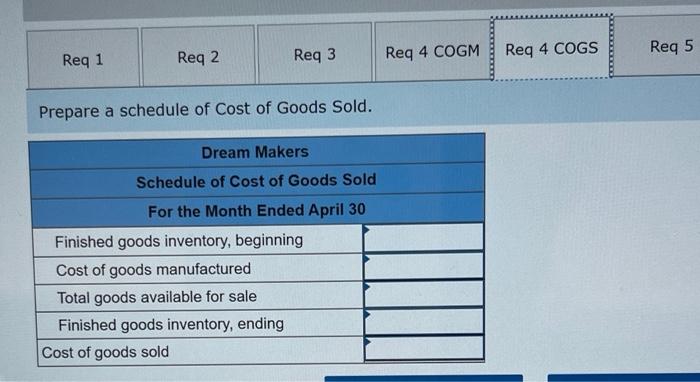

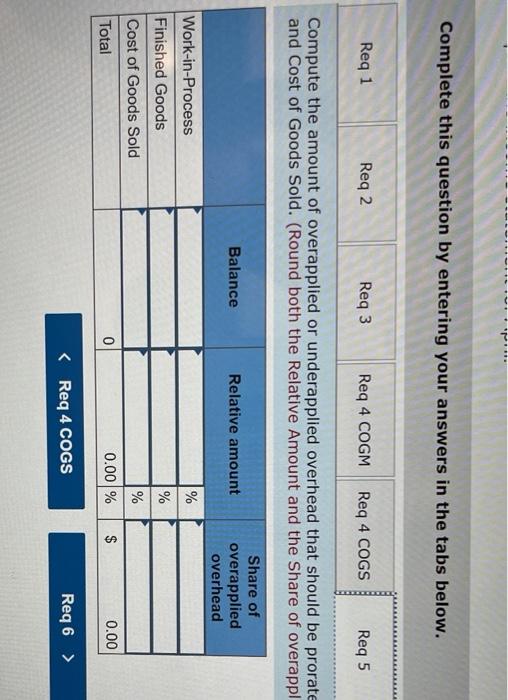

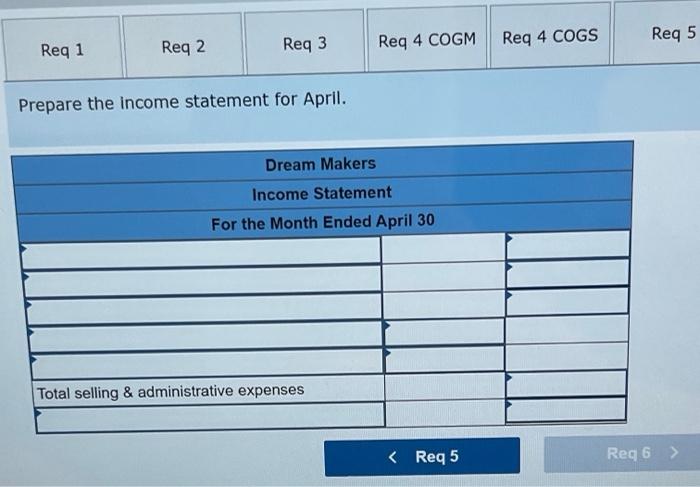

Dream Makers is a small manufacturer of gold and platinum jewelry. It uses a job costing system that apples overhead on the basis of direct labor hours, Budgeted factory overhead for the year was $540,000, and management budgeted 37,500 direct labor hours. The company had no Materials, Work-in-process, or Finished Goods Inventory at the beginning of April. These transactions were recorded during April: a April insurance cost for the manufacturing property and equipment was $2,200. The premium had been paid in January b. Recorded $1,305 depreciation on an administrative asset. c. Purchased 21 pounds of high-grade polishing materials at $16 per pound (indirect materials). d. Paid factory utility bill, $6,830, in cash. e. Incurred 4.000 hours and paid payroll costs of $160,000. Of this amount. 1,000 hours and $20,000 were indirect labor costs. f. Incurred and paid other factory overhead costs $6,510. 9. Purchased $28,500 of materials. Direct materials included unpolished semiprecious stones and gold. Indirect materials included supplies and polishing materials. h. Requisitioned $22,500 of direct materials and $2,400 of Indirect materials from Materials Inventory. Incurred miscellaneous selling and administrative expenses $6,780. J. Incurred $4,345 depreciation on manufacturing equipment for April. k Pald advertising expenses in cash, $3,250 1. Applied factory overhead to production on the basis of direct labor hours m. Completed goods costing $68,000 during the month. n. Made sales on account in April, $67,090. The Cost of Goods Sold was $54,580. Required: 1. Compute the firm's predetermined factory overhead rate for the year. 2. Prepare journal entries to record the April events. 3. Calculate the amount of overapplied or underapplied overhead on April 30. 4. Prepare a schedule of Cost of Goods Manufactured and a schedule of Cost of Goods Sold. 5. Compute the amount of overapplied or underapplied overhead that should be prorated to Work-in-process, Finished Goods, and Cost of Goods Sold. 5. Prepare the income statement for April Required: 1. Compute the firm's predetermined factory overhead rate for the year. 2. Prepare journal entries to record the April events. 3. Calculate the amount of overapplied or underapplied overhead on April 30. 4. Prepare a schedule of Cost of Goods Manufactured and a schedule of Cost of Goods Sold. 5. Compute the amount of overapplied or underapplied overhead that should be prorated to Work-in-process, Finished Goods, and Cost of Goods Sold. 5. Prepare the income statement for April Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 Reg 3 Req 4 COGM Reg 4 COGS Reg 5 Reg 6 Calculate the amount of overapplied or underapplied overhead on April 30. Overapplied overhead $ (1.520) Prepare a schedule of Cost of Goods Manufactured. Dream Makers Statement of Cost of Goods Manufactured For the Month Ended April 30 Direct materials used Direct labor Factory overhead applied Total manufacturing costs incurred during year Add: Work-in-process inventory, Beginning Total manufacturing costs to account for Less: Work-in-process inventory, Ending Cost of goods manufactured Actual overhead Total factory overhead Total applied overhead Reg 1 Req 2 Req3 Req 4 COGM Req 4 COGS Reg 5 Prepare a schedule of Cost of Goods Sold. Dream Makers Schedule of Cost of Goods Sold For the Month Ended April 30 Finished goods inventory, beginning Cost of goods manufactured Total goods available for sale Finished goods inventory, ending Cost of goods sold Complete this question by entering your answers in the tabs below. Req 1 Req 2 Req3 Req 4 COGM Req 4 COGS Req 5 Compute the amount of overapplied or underapplied overhead that should be prorate and Cost of Goods Sold. (Round both the Relative Amount and the Share of overappl Balance Relative amount Share of overapplied overhead Work-in-Process % Finished Goods % Cost of Goods Sold % Total 0 0.00 % $ 0.00 Req 1 Req 4 COGS Req 5 Req 2 Req3 Req 4 COGM Prepare the income statement for April. Dream Makers Income Statement For the Month Ended April 30 Total selling & administrative expenses