Please Answer.

Thank you!

Thank you!

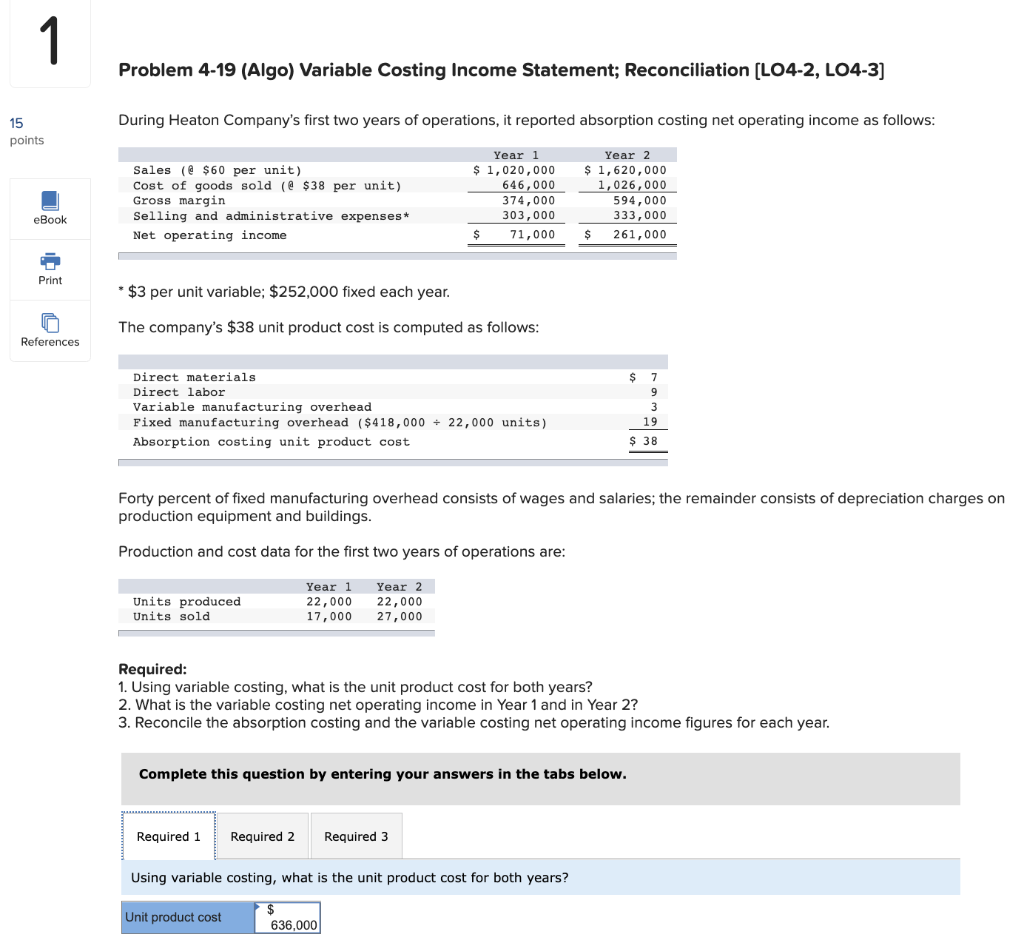

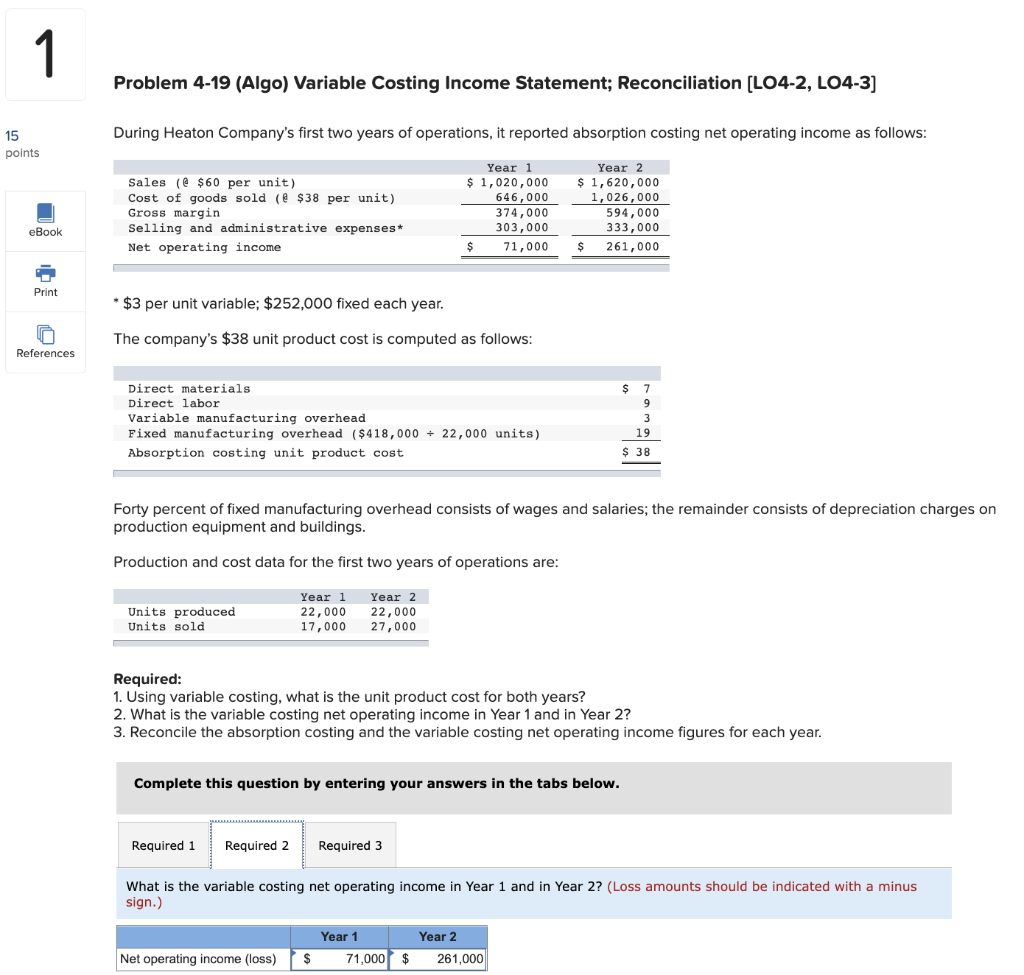

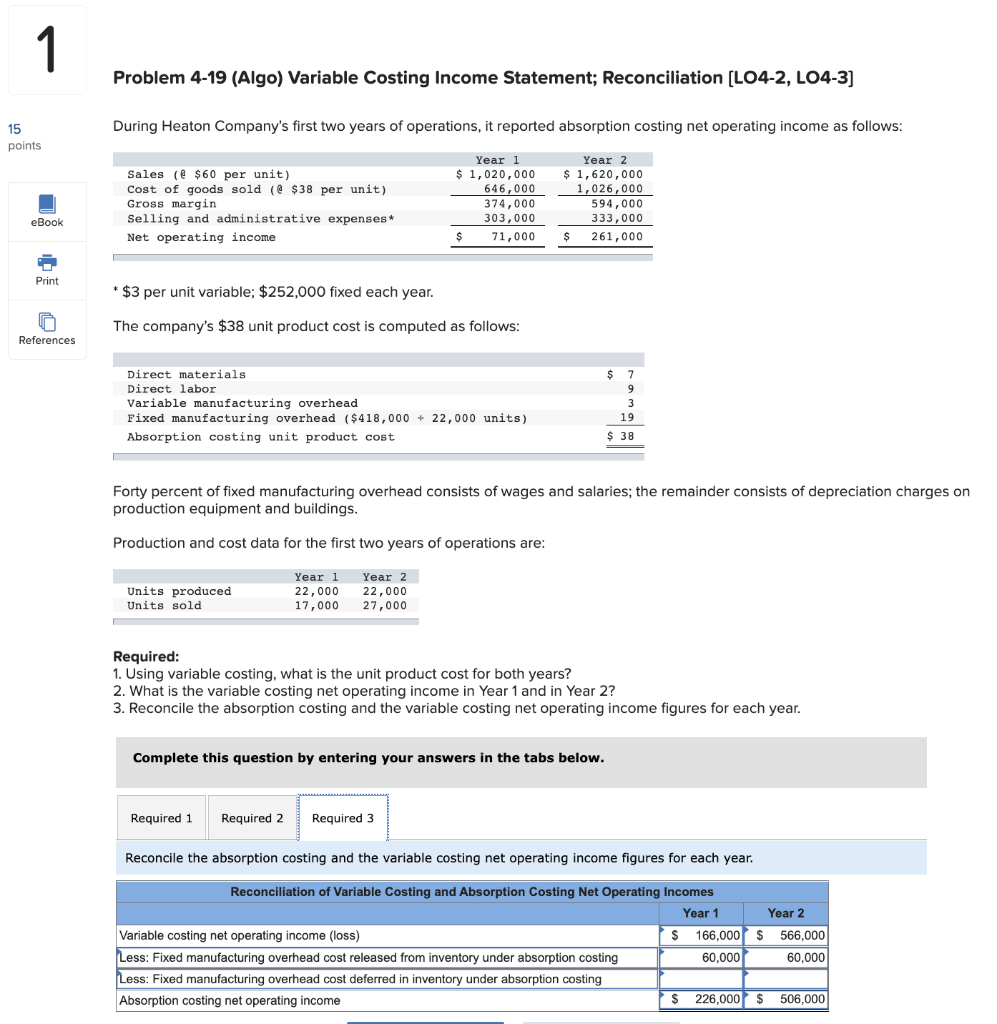

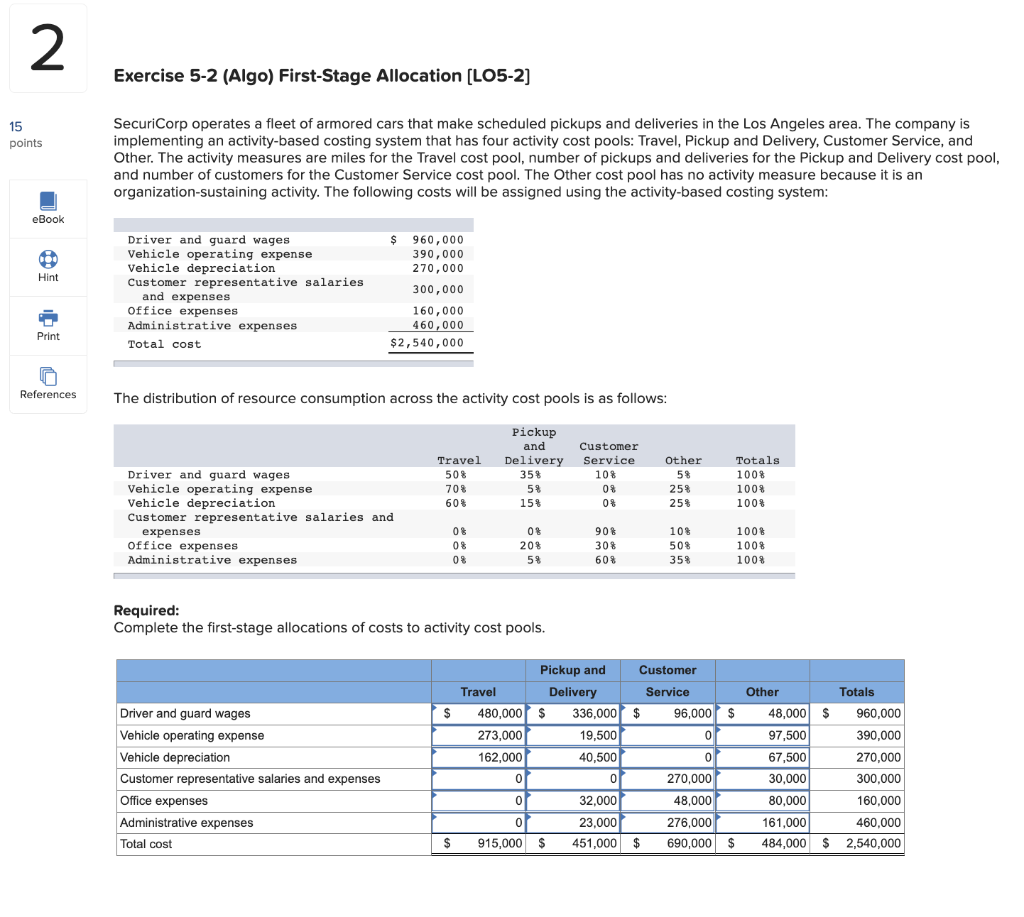

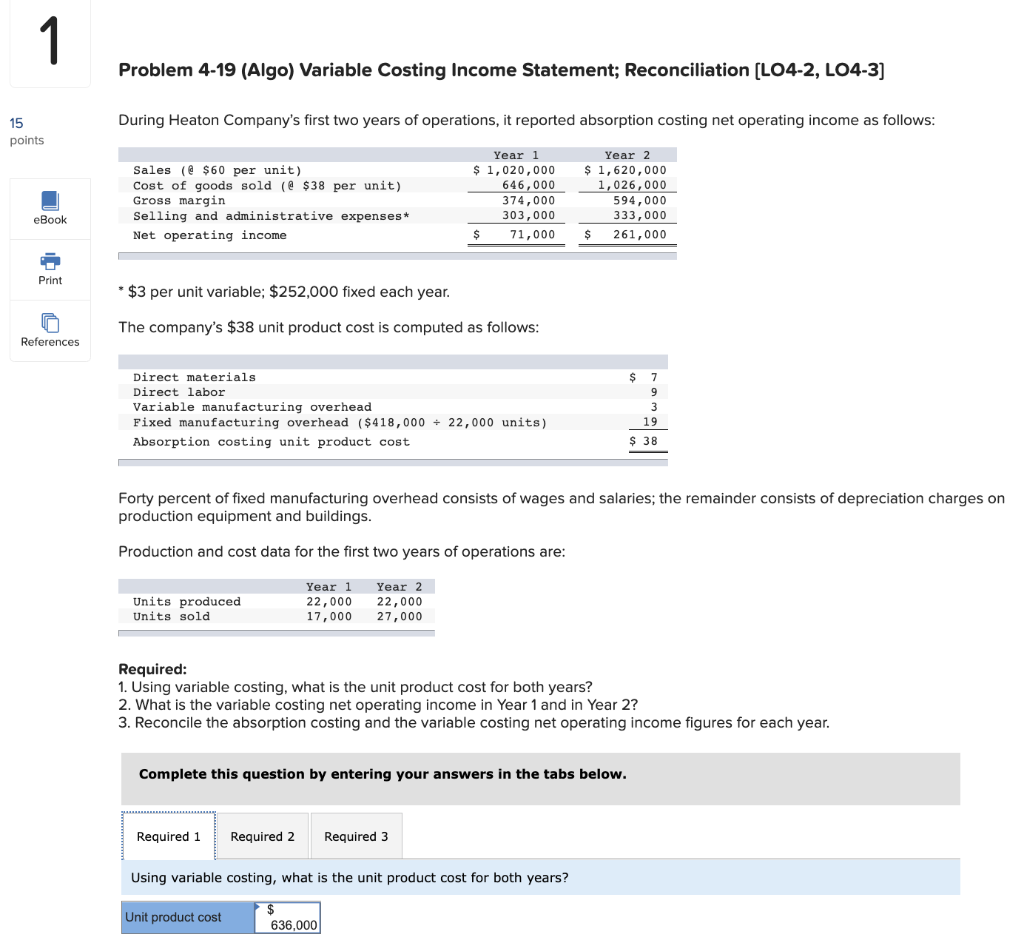

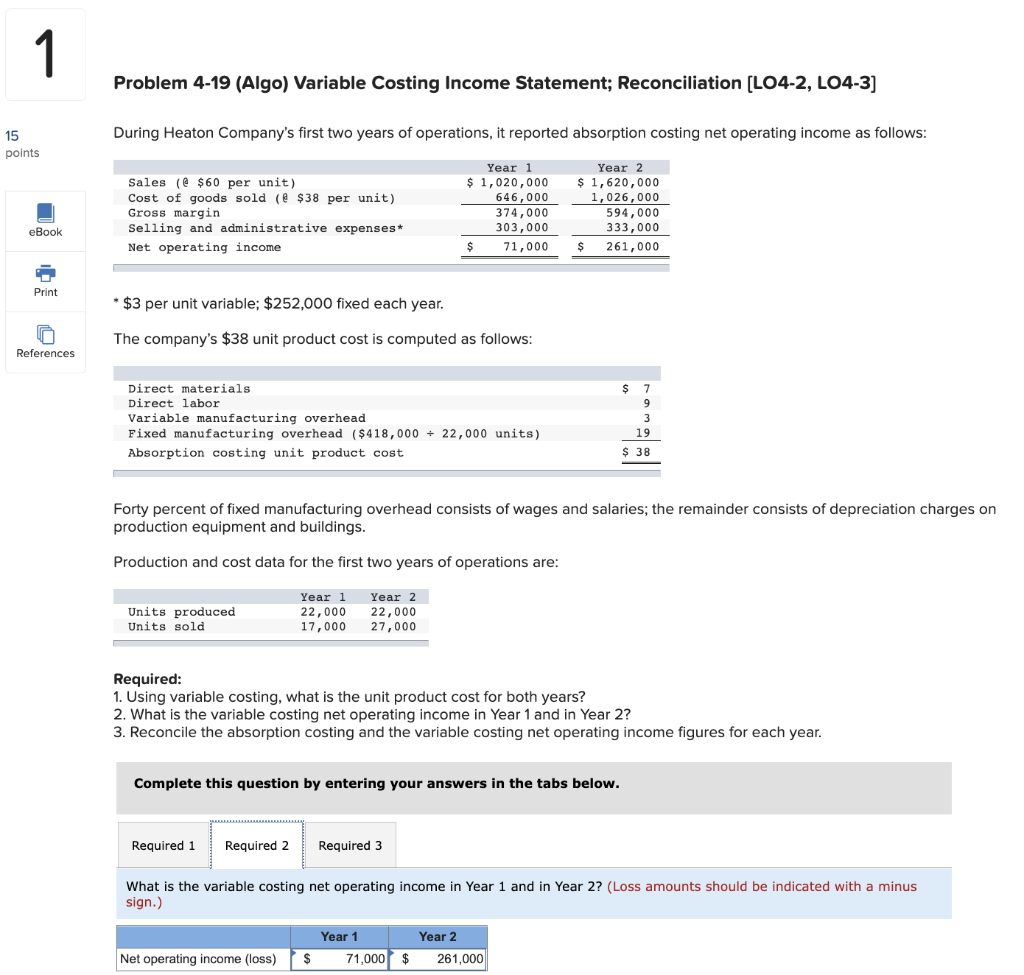

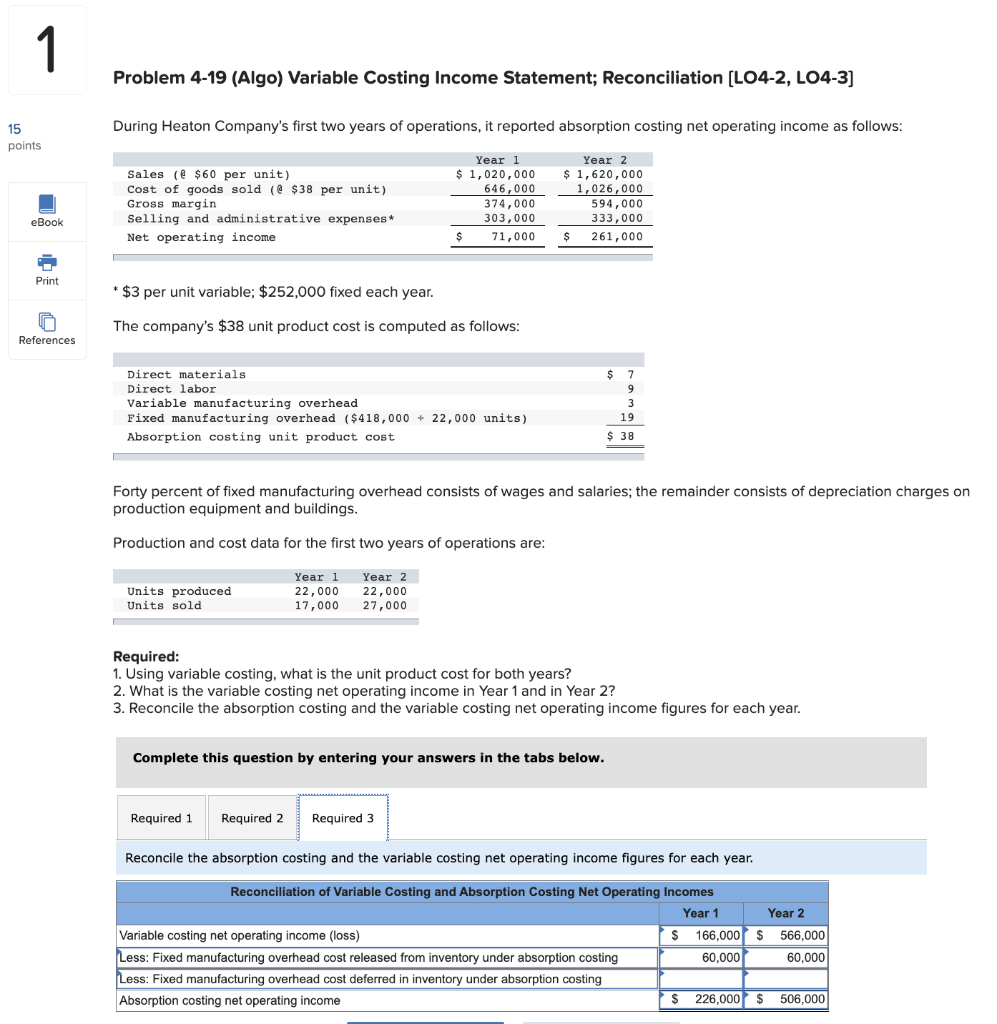

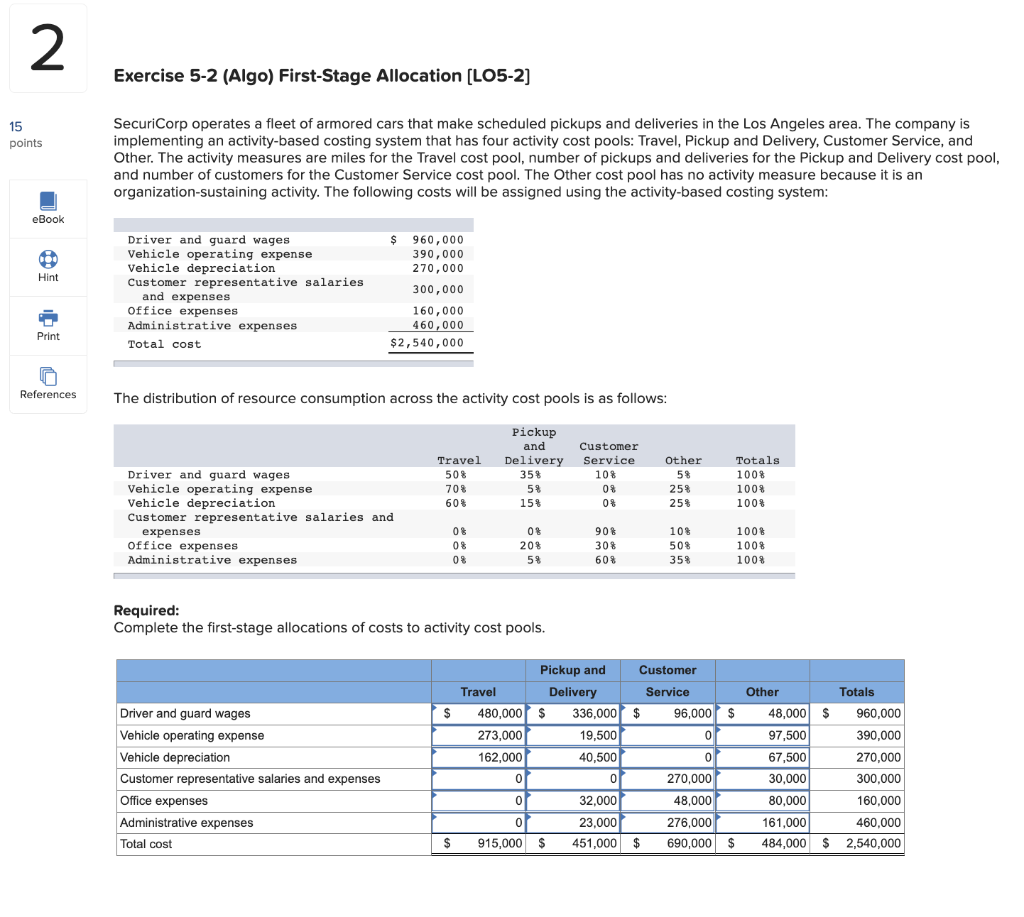

Problem 4-19 (Algo) Variable Costing Income Statement; Reconciliation [LO4-2, LO4-3] During Heaton Company's first two years of operations, it reported absorption costing net operating income as follows: * \$3 per unit variable; $252,000 fixed each year. The company's $38 unit product cost is computed as follows: Forty percent of fixed manufacturing overhead consists of wages and salaries; the remainder consists of depreciation charges on production equipment and buildings. Production and cost data for the first two years of operations are: Required: 1. Using variable costing, what is the unit product cost for both years? 2. What is the variable costing net operating income in Year 1 and in Year 2? 3. Reconcile the absorption costing and the variable costing net operating income figures for each year. Complete this question by entering your answers in the tabs below. Using variable costing, what is the unit product cost for both years? Problem 4-19 (Algo) Variable Costing Income Statement; Reconciliation [LO4-2, LO4-3] During Heaton Company's first two years of operations, it reported absorption costing net operating income as follows: * \$3 per unit variable; $252,000 fixed each year. The company's $38 unit product cost is computed as follows: Forty percent of fixed manufacturing overhead consists of wages and salaries; the remainder consists of depreciation charges on production equipment and buildings. Production and cost data for the first two years of operations are: Required: 1. Using variable costing, what is the unit product cost for both years? 2. What is the variable costing net operating income in Year 1 and in Year 2? 3. Reconcile the absorption costing and the variable costing net operating income figures for each year. Complete this question by entering your answers in the tabs below. What is the variable costing net operating income in Year 1 and in Year 2? (Loss amounts should be indicated with a minus sign.) Problem 4-19 (Algo) Variable Costing Income Statement; Reconciliation [LO4-2, LO4-3] During Heaton Company's first two years of operations, it reported absorption costing net operating income as follows: * $3 per unit variable; $252,000 fixed each year. The company's $38 unit product cost is computed as follows: Forty percent of fixed manufacturing overhead consists of wages and salaries; the remainder consists of depreciation charges on production equipment and buildings. Production and cost data for the first two years of operations are: Required: 1. Using variable costing, what is the unit product cost for both years? 2. What is the variable costing net operating income in Year 1 and in Year 2? 3. Reconcile the absorption costing and the variable costing net operating income figures for each year. Complete this question by entering your answers in the tabs below. Reconcile the absorption costing and the variable costing net operating income figures for each year. Exercise 5-2 (Algo) First-Stage Allocation [LO5-2] SecuriCorp operates a fleet of armored cars that make scheduled pickups and deliveries in the Los Angeles area. The company is implementing an activity-based costing system that has four activity cost pools: Travel, Pickup and Delivery, Customer Service, and Other. The activity measures are miles for the Travel cost pool, number of pickups and deliveries for the Pickup and Delivery cost pool, and number of customers for the Customer Service cost pool. The Other cost pool has no activity measure because it is an organization-sustaining activity. The following costs will be assigned using the activity-based costing system: The distribution of resource consumption across the activity cost pools is as follows: Required: Complete the first-stage allocations of costs to activity cost pools

Thank you!

Thank you!