Answered step by step

Verified Expert Solution

Question

1 Approved Answer

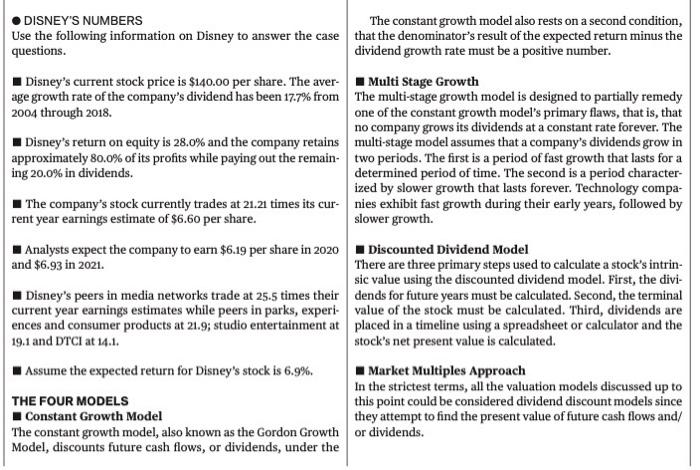

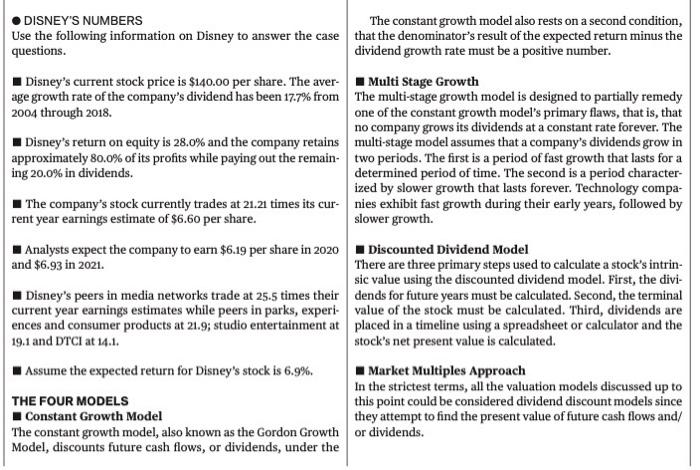

Please answer the Case questions 1 and 2 with full explanation on calculations. Excel is preferred. Please help!! DISNEY'S NUMBERS The constant growth model also

Please answer the Case questions 1 and 2 with full explanation on calculations. Excel is preferred. Please help!!

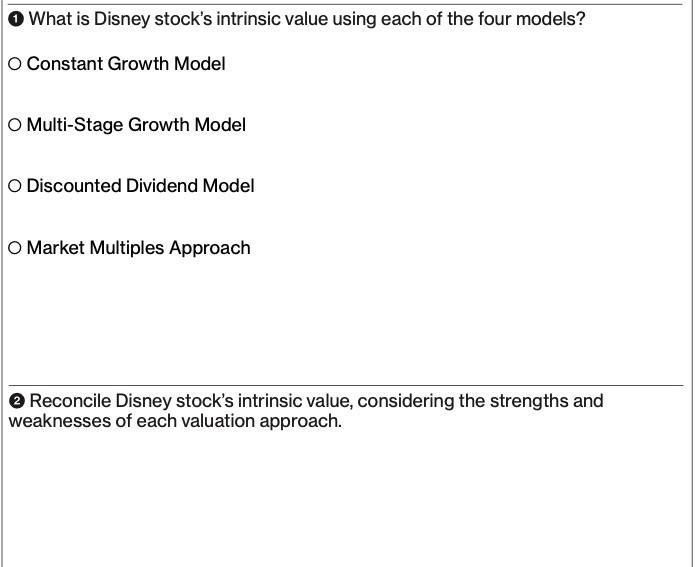

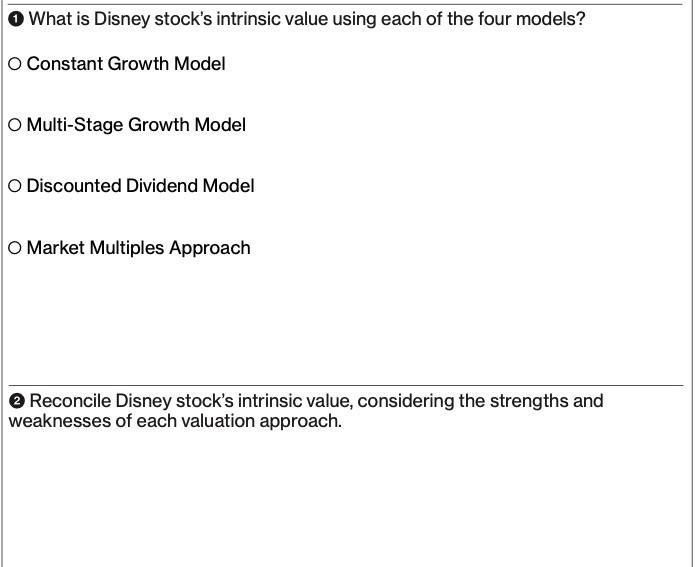

DISNEY'S NUMBERS The constant growth model also rests on a second condition, Use the following information on Disney to answer the case that the denominator's result of the expected return minus the questions. dividend growth rate must be a positive number. Disney's current stock price is $140.00 per share. The aver- Multi Stage Growth age growth rate of the company's dividend has been 17.7% from The multi-stage growth model is designed to partially remedy 2004 through 2018. one of the constant growth model's primary flaws, that is, that no company grows its dividends at a constant rate forever. The Disney's return on equity is 28.0% and the company retains multi-stage model assumes that a company's dividends grow in approximately 80.0% of its profits while paying out the remain- two periods. The first is a period of fast growth that lasts for a ing 20.0% in dividends. determined period of time. The second is a period character- ized by slower growth that lasts forever. Technology compa- 1 The company's stock currently trades at 21.21 times its cur- nies exhibit fast growth during their early years, followed by rent year earnings estimate of $6.60 per share. slower growth. Analysts expect the company to earn $6.19 per share in 2020 Discounted Dividend Model and $6.93 in 2021. There are three primary steps used to calculate a stock's intrin- sic value using the discounted dividend model. First, the divi- Disney's peers in media networks trade at 25.5 times their dends for future years must be calculated. Second, the terminal current year earnings estimates while peers in parks, experi- value of the stock must be calculated. Third, dividends are ences and consumer products at 21.9; studio entertainment at placed in a timeline using a spreadsheet or calculator and the 19.1 and DTCI at 14.1. stock's net present value is calculated. Assume the expected return for Disney's stock is 6.9%. Market Multiples Approach In the strictest terms, all the valuation models discussed up to THE FOUR MODELS this point could be considered dividend discount models since Constant Growth Model they attempt to find the present value of future cash flows and/ The constant growth model, also known as the Gordon Growth or dividends. Model, discounts future cash flows, or dividends, under the What is Disney stock's intrinsic value using each of the four models? O Constant Growth Model O Multi-Stage Growth Model O Discounted Dividend Model O Market Multiples Approach Reconcile Disney stock's intrinsic value, considering the strengths and weaknesses of each valuation approach. DISNEY'S NUMBERS The constant growth model also rests on a second condition, Use the following information on Disney to answer the case that the denominator's result of the expected return minus the questions. dividend growth rate must be a positive number. Disney's current stock price is $140.00 per share. The aver- Multi Stage Growth age growth rate of the company's dividend has been 17.7% from The multi-stage growth model is designed to partially remedy 2004 through 2018. one of the constant growth model's primary flaws, that is, that no company grows its dividends at a constant rate forever. The Disney's return on equity is 28.0% and the company retains multi-stage model assumes that a company's dividends grow in approximately 80.0% of its profits while paying out the remain- two periods. The first is a period of fast growth that lasts for a ing 20.0% in dividends. determined period of time. The second is a period character- ized by slower growth that lasts forever. Technology compa- 1 The company's stock currently trades at 21.21 times its cur- nies exhibit fast growth during their early years, followed by rent year earnings estimate of $6.60 per share. slower growth. Analysts expect the company to earn $6.19 per share in 2020 Discounted Dividend Model and $6.93 in 2021. There are three primary steps used to calculate a stock's intrin- sic value using the discounted dividend model. First, the divi- Disney's peers in media networks trade at 25.5 times their dends for future years must be calculated. Second, the terminal current year earnings estimates while peers in parks, experi- value of the stock must be calculated. Third, dividends are ences and consumer products at 21.9; studio entertainment at placed in a timeline using a spreadsheet or calculator and the 19.1 and DTCI at 14.1. stock's net present value is calculated. Assume the expected return for Disney's stock is 6.9%. Market Multiples Approach In the strictest terms, all the valuation models discussed up to THE FOUR MODELS this point could be considered dividend discount models since Constant Growth Model they attempt to find the present value of future cash flows and/ The constant growth model, also known as the Gordon Growth or dividends. Model, discounts future cash flows, or dividends, under the What is Disney stock's intrinsic value using each of the four models? O Constant Growth Model O Multi-Stage Growth Model O Discounted Dividend Model O Market Multiples Approach Reconcile Disney stock's intrinsic value, considering the strengths and weaknesses of each valuation approach

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started