Answered step by step

Verified Expert Solution

Question

1 Approved Answer

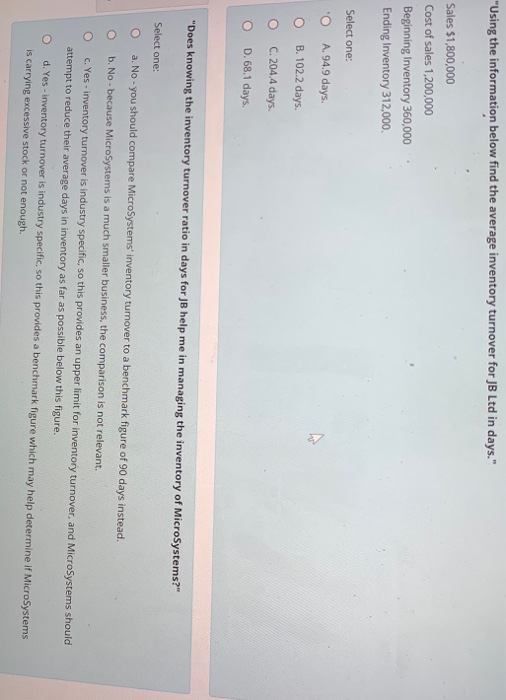

Please answer the following MCQs. Using the information below find the average inventory turnover for JB Ltd in days. Sales $1,800,000 Cost of sales 1,200,000

Please answer the following MCQs.

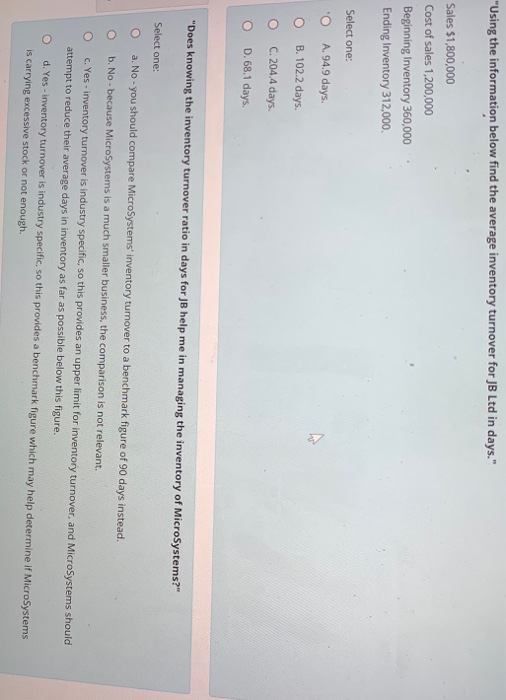

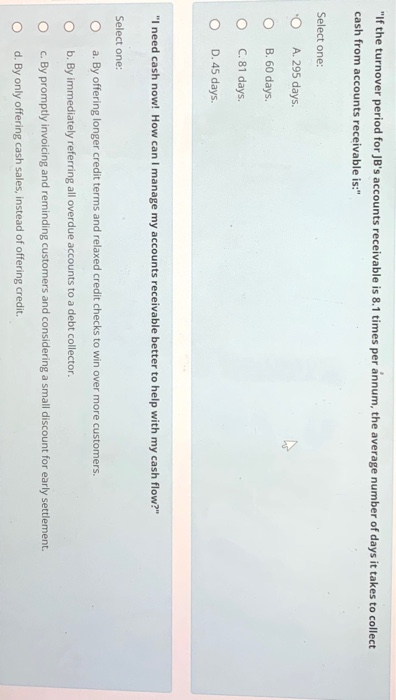

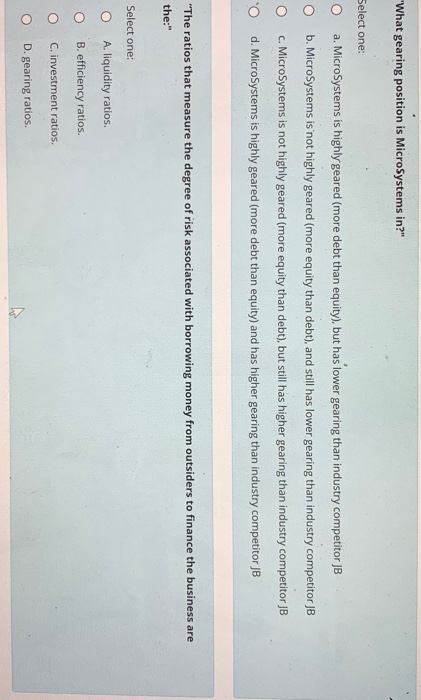

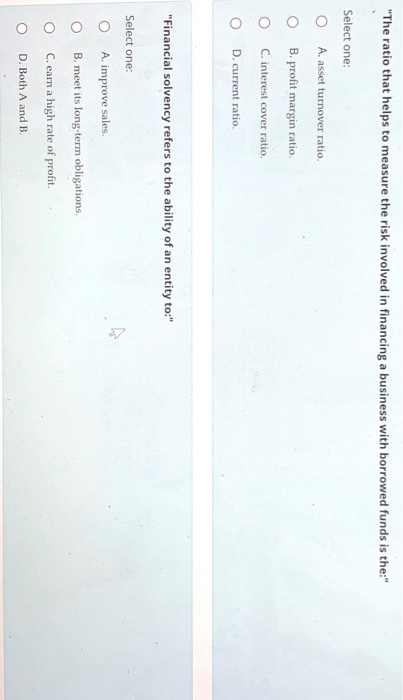

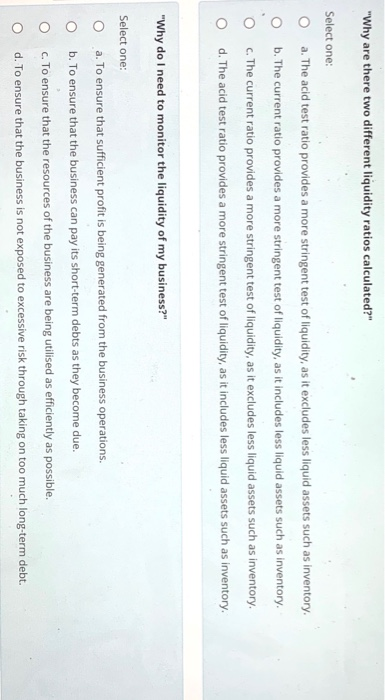

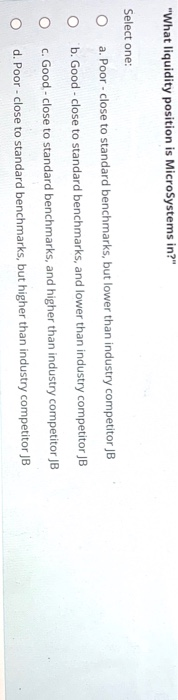

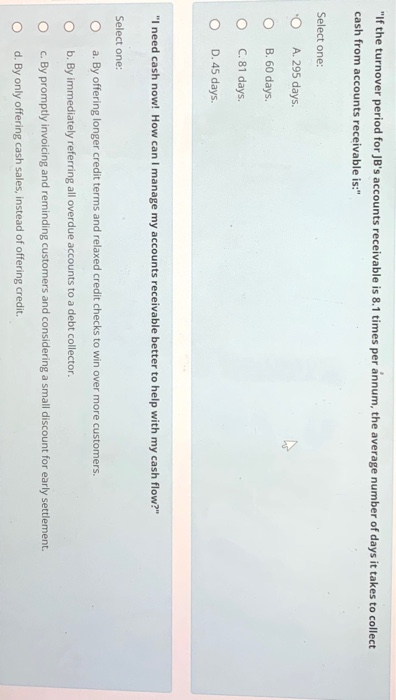

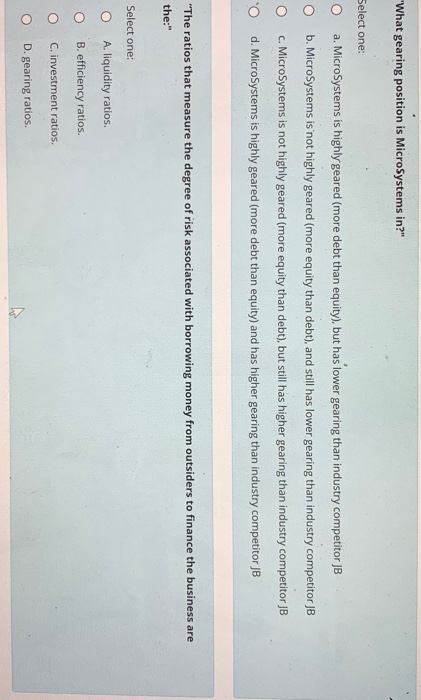

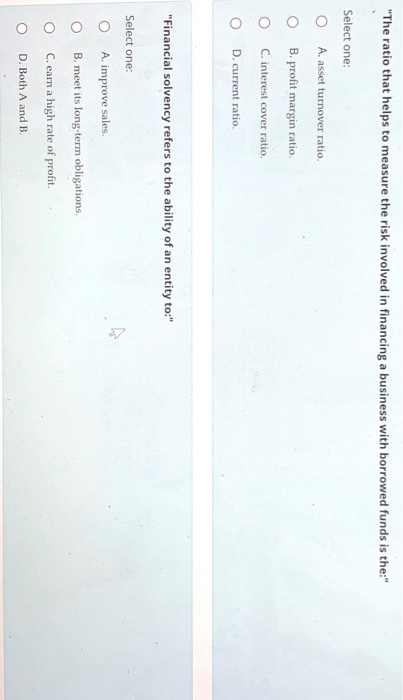

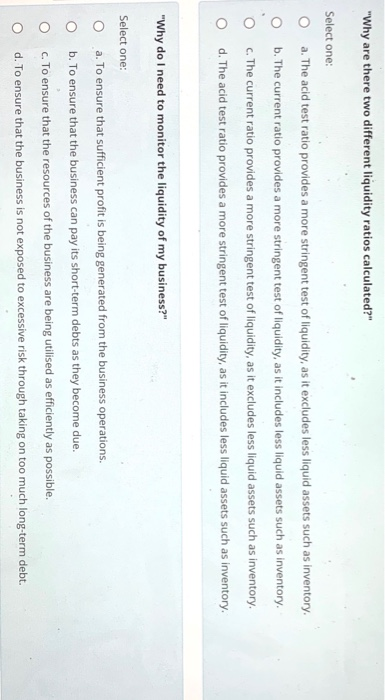

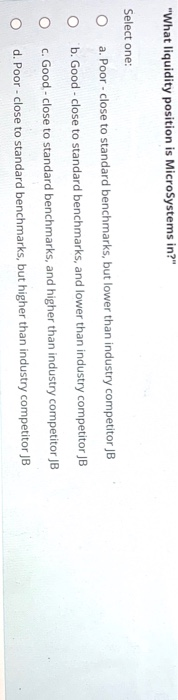

"Using the information below find the average inventory turnover for JB Ltd in days." Sales $1,800,000 Cost of sales 1,200,000 Beginning Inventory 360,000 Ending Inventory 312,000 Select one: 'O A. 94.9 days. O B. 102.2 days. C. 204.4 days. O O D. 68.1 days "Does knowing the inventory turnover ratio in days for JB help me in managing the inventory of MicroSystems?" Select one: a. No - you should compare MicroSystems' inventory turnover to a benchmark figure of 90 days instead. O b. No. because MicroSystems is a much smaller business, the comparison is not relevant c. Yes - inventory turnover is industry specific, so this provides an upper limit for inventory turnover, and MicroSystems should attempt to reduce their average days in inventory as far as possible below this figure. O d. Yes - inventory turnover is industry specific, so this provides a benchmark figure which may help determine if MicroSystems is carrying excessive stock or not enough. "If the turnover period for JB's accounts receivable is 8.1 times per annum, the average number of days it takes to collect cash from accounts receivable is: Select one: O A. 295 days. O B.60 days. O C. 81 days D. 45 days. "I need cash now! How can I manage my accounts receivable better to help with my cash flow?" Select one: O a. By offering longer credit terms and relaxed credit checks to win over more customers. O b. By immediately referring all overdue accounts to a debt collector. O c. By promptly invoicing and reminding customers and considering a small discount for early settlement. O d. By only offering cash sales, instead of offering credit. "What gearing position is MicroSystems in?" Select one: O a. MicroSystems is highly geared (more debt than equity), but has lower gearing than industry competitor JB O O b. MicroSystems is not highly geared (more equity than debt), and still has lower gearing than industry competitor JB c. MicroSystems is not highly geared (more equity than debt), but still has higher gearing than industry competitor JB "O d. MicroSystems is highly geared (more debt than equity) and has higher gearing than industry competitor JB "The ratios that measure the degree of risk associated with borrowing money from outsiders to finance the business are the:" Select one: O A. liquidity ratios. O B. efficiency ratios. O C. investment ratios. O D. gearing ratios. "The ratio that helps to measure the risk involved in financing a business with borrowed funds is the: Select one: O A. asset turnover ratio. O B. profit margin ratio. O C. interest cover ratio. O D . current ratio. "Financial solvency refers to the ability of an entity to: Select one: O A. improve sales. O B. meet its long-term obligations. O C. earn a high rate of profit. O D. Both A and B. "Why are there two different liquidity ratios calculated?" Select one: O a. The acid test ratio provides a more stringent test of liquidity, as it excludes less liquid assets such as inventory. b. The current ratio provides a more stringent test of liquidity, as it includes less liquid assets such as inventory. o C. The current ratio provides a more stringent test of liquidity, as it excludes less liquid assets such as inventory. O d. The acid test ratio provides a more stringent test of liquidity, as it includes less liquid assets such as inventory. "Why do I need to monitor the liquidity of my business?" Select one: O a. To ensure that sufficient profit is being generated from the business operations. O b. To ensure that the business can pay its short-term debts as they become due. O C. To ensure that the resources of the business are being utilised as efficiently as possible. O d. To ensure that the business is not exposed to excessive risk through taking on too much long-term debt. "What liquidity position is MicroSystems in?" Select one: O a. Poor close to standard benchmarks, but lower than industry competitor JB O b. Good - close to standard benchmarks, and lower than industry competitor JB O C. Good - close to standard benchmarks, and higher than industry competitor JB O d. Poor-close to standard benchmarks, but higher than industry competitor JB

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started