PLEASE ANSWER THE FOLLOWING PROBLEMS AND EXPLAIN IT STEP BY STEP:

ACCOUNTING FOR BUSINESS COMBINATION

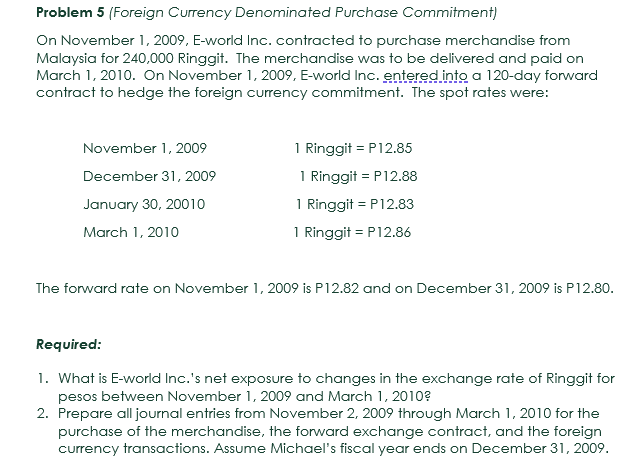

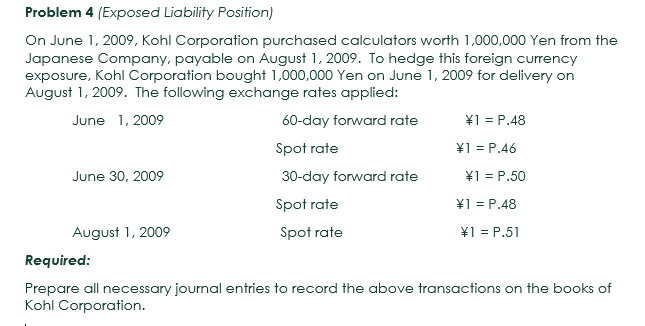

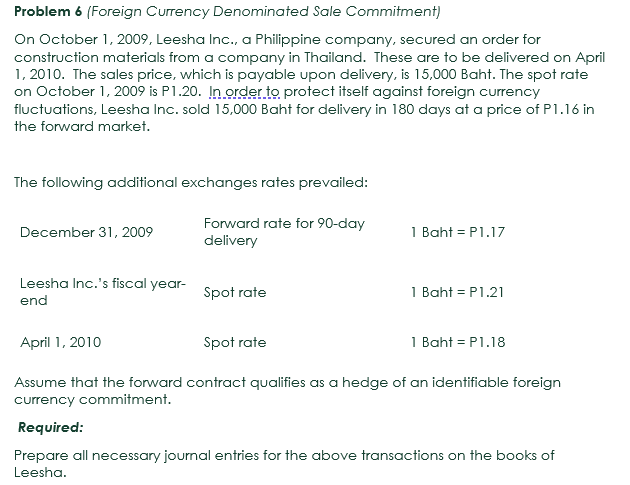

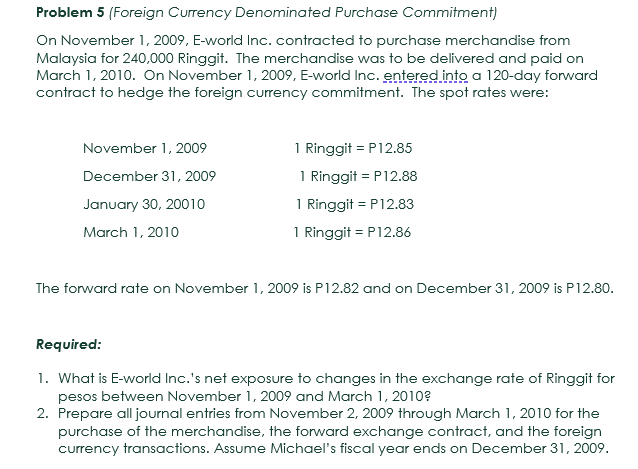

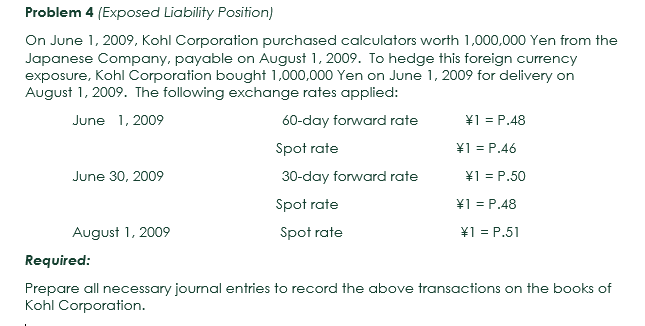

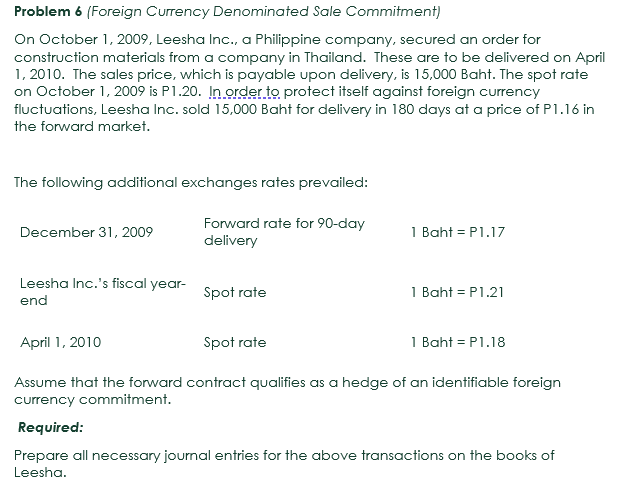

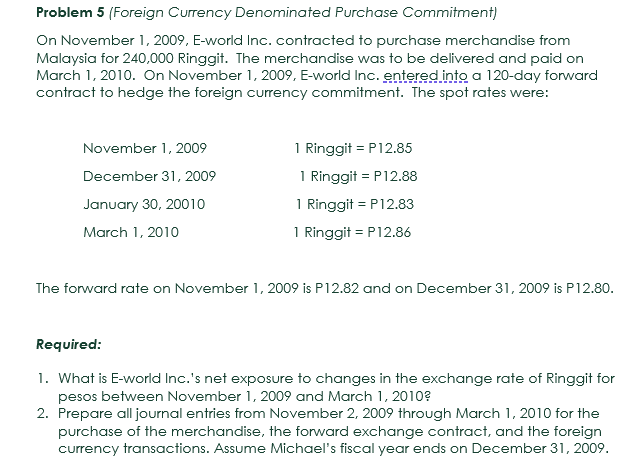

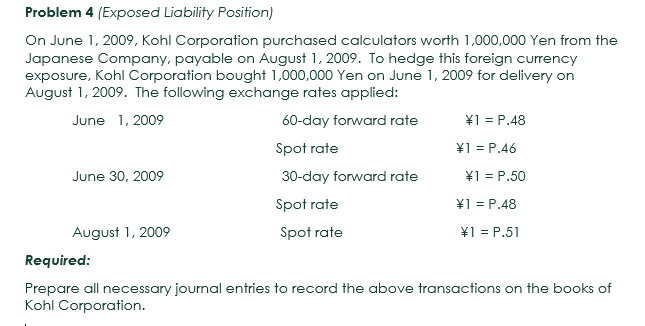

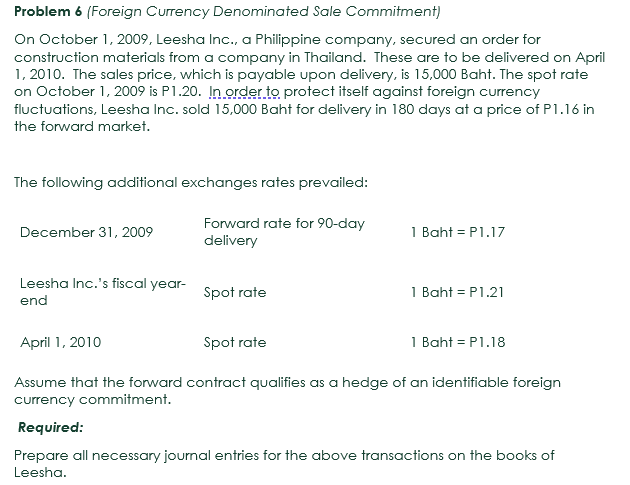

Problem 5 (Foreign Currency Denominated Purchase Commitment) On November 1, 2009, E-world Inc. contracted to purchase merchandise from Malaysia for 240,000 Ringgit. The merchandise was to be delivered and paid on March 1, 2010. On November 1, 2009, E-world Inc. entered into a 120-day forward contract to hedge the foreign currency commitment. The spot rates were: November 1, 2009 1 Ringgit = P12.85 December 31, 2009 1 Ringgit = P12.88 January 30, 20010 1 Ringgit = P12.83 March 1, 2010 1 Ringgit = P12.86 The forward rate on November 1, 2009 is P12.82 and on December 31, 2009 is P12.80. Required: 1. What is E-world Inc.'s net exposure to changes in the exchange rate of Ringgit for pesos between November 1, 2009 and March 1, 2010? 2. Prepare all journal entries from November 2, 2009 through March 1, 2010 for the purchase of the merchandise, the forward exchange contract, and the foreign currency transactions. Assume Michael's fiscal year ends on December 31, 2009.Problem 4 (Exposed Liability Position) On June 1, 2009, Kohl Corporation purchased calculators worth 1,000,000 Yen from the Japanese Company, payable on August 1, 2009. To hedge this foreign currency exposure, Kohl Corporation bought 1,000,000 Yen on June 1, 2009 for delivery on August 1, 2009. The following exchange rates applied: June 1, 2009 60-day forward rate V1 = P.48 Spot rate *1 = P.46 June 30, 2009 30-day forward rate *1 = P.50 Spot rate *1 = P.48 August 1, 2009 Spot rate *1 = P.51 Required: Prepare all necessary journal entries to record the above transactions on the books of Kohl Corporation.Problem 6 (Foreign Currency Denominated Sale Commitment) On October 1, 2009, Leesha Inc., a Philippine company, secured an order for construction materials from a company in Thailand. These are to be delivered on April 1, 2010. The sales price, which is payable upon delivery, is 15,000 Baht. The spot rate on October 1, 2009 is P1.20. In order to protect itself against foreign currency fluctuations, Leesha Inc. sold 15,000 Baht for delivery in 180 days at a price of P1.16 in the forward market. The following additional exchanges rates prevailed: December 31, 2009 Forward rate for 90-day delivery 1 Baht = P1.17 Leesha Inc.'s fiscal year- end Spot rate 1 Baht = P1.21 April 1, 2010 Spot rate 1 Baht = P1.18 Assume that the forward contract qualifies as a hedge of an identifiable foreign currency commitment. Required: Prepare all necessary journal entries for the above transactions on the books of Leesha