Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer the following questions. 1:54 PO . Case 9-3 Thor Limited 6th ed - Read-only Sign in to edit and save changes to this

Please answer the following questions.

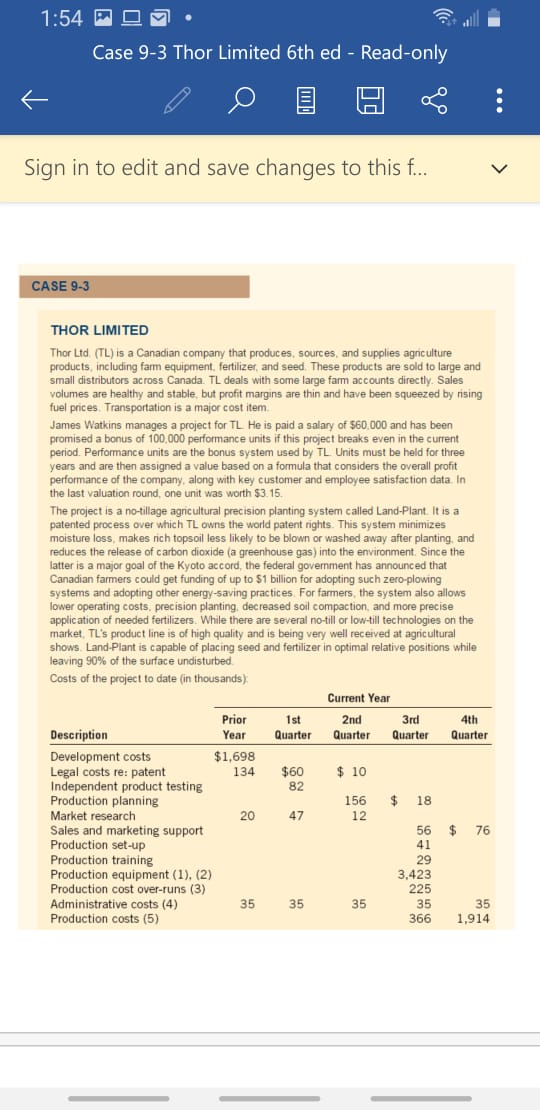

1:54 PO . Case 9-3 Thor Limited 6th ed - Read-only Sign in to edit and save changes to this f... v CASE 9-3 THOR LIMITED Thor Ltd (TL) is a Canadian company that produces sources, and supplies agnculture products, including farm equipment, fertilizer, and seed. These products are sold to large and small distributors across Canada. TL deals with some large farm accounts directly. Sales volumes are healthy and stable, but profit margins are thin and have been squeezed by rising fuel prices Transportation is a major cost item James Watkins manages a project for TL He is paid a salary of $60,000 and has been promised a bonus of 100,000 performance units if this project breaks even in the current period. Performance units are the bonus system used by TL Units must be held for three years and are then assigned a value based on a formula that considers the overall profit performance of the company, along with key customer and employee satisfaction data. In the last valuation round, one unit was worth $3.15. The project is a no-tillage agncultural precision planting system called Land-Plant. It is a patented process over which TL owns the world patent rights. This system minimizes moisture loss, makes nich topsoil less likely to be blown or washed away after planting, and reduces the release of carbon dioxide (a greenhouse gas) into the environment. Since the latter is a major goal of the Kyoto accord, the federal government has announced that Canadian farmers could get funding of up to $1 billion for adopting such zero-plowing systems and adopting other energy-saving practices For farmers, the system also allows lower operating costs, precision planting decreased soil compaction, and more precise application of needed fertilizers. While there are several no-till or low-till technologies on the market. TL's product line is of high quality and is being very well received at agricultural shows Land-Plant is capable of placing seed and fertilizer in optimal relative positions while leaving 90% of the surface undisturbed Costs of the project to date in thousands) Current Year Prior 1st 2nd 3rd 4th Description Year Quarter Quarter Quarter Quarter Development costs $1,698 Legal costs re: patent 134 $60 $ 10 Independent product testing 82 Production planning 156 $ 18 Market research Sales and marketing support 56 $ 76 Production set-up 41 Production training 29 Production equipment (1), (2) 3,423 Production cost over-runs (3) 225 Administrative costs (4) 35 35 35 35 35 Production costs (5) 366 1,914 20 47 12 Cas9-3 Thor Limited 6th ed - Read-only Sign in to edit and save changes to this f... v 1. The production equipment is expected to have a service life of eight years, or approximately 18,000 manufacturing hours. It was used in the third and fourth quarter of the current year for 570 hours 2. The expenditure on manufacturing equipment will entitle TL to an investment tax credit (income tax relief) equal to 20% of the cost of the equipment 3. Quality concerns with the initial units produced led them to be scrapped 4 Watkins' salary is $15 per quarter plus an administrative fee of $20 for overall supervision and accounting systems support 5. In the third and fourth quarter, a total of 48 good units of the 3300T Land Plant system were produced. These costs exclude amortization on related assets Financing of this project was uncertain until the third quarter of the current year. While TL'S Board of Directors has been very enthusiastic about the project and has funded the development work, TL had no deep well of financing as would be needed to finance the project. Then late in the second quarter, TL was approved as an Eligible Business Corporation under the provincial Small Business Venture Capital Act. This allowed the company to issue 50,000 preferred shares in a private placement at $100 per share. The individual shareholders are entitled to a 30% investment tax credit on their investment These shares were successfully issued in the third quarter. This funding plus a lending arrangement secured the project and production was geared up Production was limited to the latter part of the third quarter and all the fourth quarter Manufacturing operations were increased to full capacity to meet demand Fortunately for Watkins, he had a backlog of orders from marketing efforts, especially trade shows. He sold 42 units of model 3300T before the end of the fourth quarter at an average price of $67.400 In all other divisions, TL ships essentially the same day as the order is received and thus recognizes revenue when orders are received. Because of the size and complexity of the Land-Plant equipment it can take up to a week to have the unit shipped. Investigation showed that four units of model 3300T were not yet shipped at the end of the fourth quarter although they were completed and ready for shipment In addition, invoices show that 12 units of model 3300T were to dealers who were told that if the units did not sell in six months, they could be returned to TL with no penalty or charge Watkins views this as a clever marketing strategy because he is confident that if the units are shown to agriculture producers, they will be very impressed with the operation and ingenuity of the system. He plans more volume under this plan in the coming year Overall market demand for the system is hard to predict because much depends on continued federal government support for the system, and the development of rival systems by competitors Watkins feels that he likely has three to five years before competition is much of a factor, but he acknowledges that this is largely a guess Watkins has requested a preliminary income statement, along with a discussion of the accounting issues. He knows that any income statement used for performance evaluation will have to be in accordance with GAAP as it will be based on the information that is used for external reporting and TL's lenders require GAAP financial statements. The tax rate is 40% Required: Prepare the information requested by Watkins Part A. Assume that TL will adopt accounting standards for public companies Part B. Assume that TL will adopt accounting standards for private companies 1:54 PO . Case 9-3 Thor Limited 6th ed - Read-only Sign in to edit and save changes to this f... v CASE 9-3 THOR LIMITED Thor Ltd (TL) is a Canadian company that produces sources, and supplies agnculture products, including farm equipment, fertilizer, and seed. These products are sold to large and small distributors across Canada. TL deals with some large farm accounts directly. Sales volumes are healthy and stable, but profit margins are thin and have been squeezed by rising fuel prices Transportation is a major cost item James Watkins manages a project for TL He is paid a salary of $60,000 and has been promised a bonus of 100,000 performance units if this project breaks even in the current period. Performance units are the bonus system used by TL Units must be held for three years and are then assigned a value based on a formula that considers the overall profit performance of the company, along with key customer and employee satisfaction data. In the last valuation round, one unit was worth $3.15. The project is a no-tillage agncultural precision planting system called Land-Plant. It is a patented process over which TL owns the world patent rights. This system minimizes moisture loss, makes nich topsoil less likely to be blown or washed away after planting, and reduces the release of carbon dioxide (a greenhouse gas) into the environment. Since the latter is a major goal of the Kyoto accord, the federal government has announced that Canadian farmers could get funding of up to $1 billion for adopting such zero-plowing systems and adopting other energy-saving practices For farmers, the system also allows lower operating costs, precision planting decreased soil compaction, and more precise application of needed fertilizers. While there are several no-till or low-till technologies on the market. TL's product line is of high quality and is being very well received at agricultural shows Land-Plant is capable of placing seed and fertilizer in optimal relative positions while leaving 90% of the surface undisturbed Costs of the project to date in thousands) Current Year Prior 1st 2nd 3rd 4th Description Year Quarter Quarter Quarter Quarter Development costs $1,698 Legal costs re: patent 134 $60 $ 10 Independent product testing 82 Production planning 156 $ 18 Market research Sales and marketing support 56 $ 76 Production set-up 41 Production training 29 Production equipment (1), (2) 3,423 Production cost over-runs (3) 225 Administrative costs (4) 35 35 35 35 35 Production costs (5) 366 1,914 20 47 12 Cas9-3 Thor Limited 6th ed - Read-only Sign in to edit and save changes to this f... v 1. The production equipment is expected to have a service life of eight years, or approximately 18,000 manufacturing hours. It was used in the third and fourth quarter of the current year for 570 hours 2. The expenditure on manufacturing equipment will entitle TL to an investment tax credit (income tax relief) equal to 20% of the cost of the equipment 3. Quality concerns with the initial units produced led them to be scrapped 4 Watkins' salary is $15 per quarter plus an administrative fee of $20 for overall supervision and accounting systems support 5. In the third and fourth quarter, a total of 48 good units of the 3300T Land Plant system were produced. These costs exclude amortization on related assets Financing of this project was uncertain until the third quarter of the current year. While TL'S Board of Directors has been very enthusiastic about the project and has funded the development work, TL had no deep well of financing as would be needed to finance the project. Then late in the second quarter, TL was approved as an Eligible Business Corporation under the provincial Small Business Venture Capital Act. This allowed the company to issue 50,000 preferred shares in a private placement at $100 per share. The individual shareholders are entitled to a 30% investment tax credit on their investment These shares were successfully issued in the third quarter. This funding plus a lending arrangement secured the project and production was geared up Production was limited to the latter part of the third quarter and all the fourth quarter Manufacturing operations were increased to full capacity to meet demand Fortunately for Watkins, he had a backlog of orders from marketing efforts, especially trade shows. He sold 42 units of model 3300T before the end of the fourth quarter at an average price of $67.400 In all other divisions, TL ships essentially the same day as the order is received and thus recognizes revenue when orders are received. Because of the size and complexity of the Land-Plant equipment it can take up to a week to have the unit shipped. Investigation showed that four units of model 3300T were not yet shipped at the end of the fourth quarter although they were completed and ready for shipment In addition, invoices show that 12 units of model 3300T were to dealers who were told that if the units did not sell in six months, they could be returned to TL with no penalty or charge Watkins views this as a clever marketing strategy because he is confident that if the units are shown to agriculture producers, they will be very impressed with the operation and ingenuity of the system. He plans more volume under this plan in the coming year Overall market demand for the system is hard to predict because much depends on continued federal government support for the system, and the development of rival systems by competitors Watkins feels that he likely has three to five years before competition is much of a factor, but he acknowledges that this is largely a guess Watkins has requested a preliminary income statement, along with a discussion of the accounting issues. He knows that any income statement used for performance evaluation will have to be in accordance with GAAP as it will be based on the information that is used for external reporting and TL's lenders require GAAP financial statements. The tax rate is 40% Required: Prepare the information requested by Watkins Part A. Assume that TL will adopt accounting standards for public companies Part B. Assume that TL will adopt accounting standards for private companiesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started