Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer the following questions and all its parts. Failure to do so will result in negative rating. Try answering on a piece of paper

Please answer the following questions and all its parts. Failure to do so will result in negative rating. Try answering on a piece of paper if possible and scan it please and i will give good rating. Thanks!

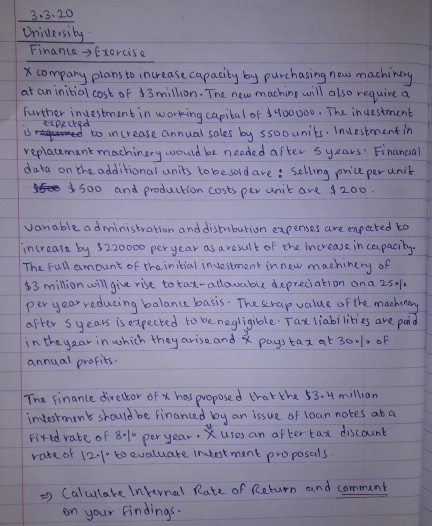

3.3.20 Unillersity Finance Exercise x company plans to increase capacity by purchasing new machinery at an initial cost of $3 million. The new maching will also require a Further investment in working capital of $4000oo. The investment. is required to increase annual sales by ssoo units. Investment in replacement machinery would be needed after 5 years. Financial data on the additional units to be sold are selling price per unit $500 $500 and production costs per unit are $200 expected Vonable administration and distribution expenses are expected to intes by 5220000 per year as a result of the increase in capacity. The full amount of the initial investment in new machinery of $3 million will give rise to tax-allowable depreciation ana 25% per year reducing balance basis. The scrap value of the machinery after syears is expected to be negligible. Tax liabilities are paid in the year in which they arise and & pays tax at 30% off annual profits. The finance director of t has proposed that the $3.4 million investment should be financed by an issue of loan notes at a Fixed rate of 80/o per year. Xuses an after tax discount rate of 121 to evaluate intestment proposals. - Calellate Internal Rate of Return and comment on your findings. 3.3.20 Unillersity Finance Exercise x company plans to increase capacity by purchasing new machinery at an initial cost of $3 million. The new maching will also require a Further investment in working capital of $4000oo. The investment. is required to increase annual sales by ssoo units. Investment in replacement machinery would be needed after 5 years. Financial data on the additional units to be sold are selling price per unit $500 $500 and production costs per unit are $200 expected Vonable administration and distribution expenses are expected to intes by 5220000 per year as a result of the increase in capacity. The full amount of the initial investment in new machinery of $3 million will give rise to tax-allowable depreciation ana 25% per year reducing balance basis. The scrap value of the machinery after syears is expected to be negligible. Tax liabilities are paid in the year in which they arise and & pays tax at 30% off annual profits. The finance director of t has proposed that the $3.4 million investment should be financed by an issue of loan notes at a Fixed rate of 80/o per year. Xuses an after tax discount rate of 121 to evaluate intestment proposals. - Calellate Internal Rate of Return and comment on your findingsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started