Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer the following questions and all its parts(max 4 parts according to chegg). Failure to do so will result in negative rating. Question continues

Please answer the following questions and all its parts(max 4 parts according to chegg). Failure to do so will result in negative rating. Question continues on next image. Try answering on a piece of paper if possible and scan it please and i will give good rating. Thanks!

Anyone having knowledge about this topic, do answer! Thanks.

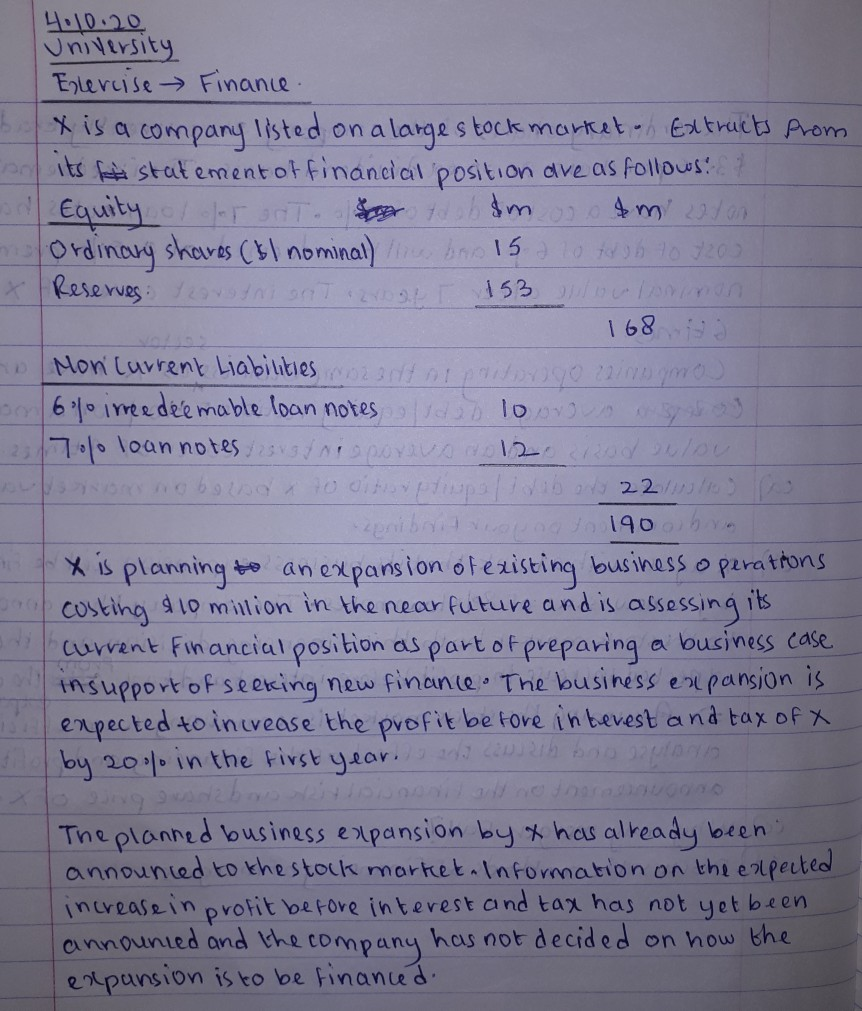

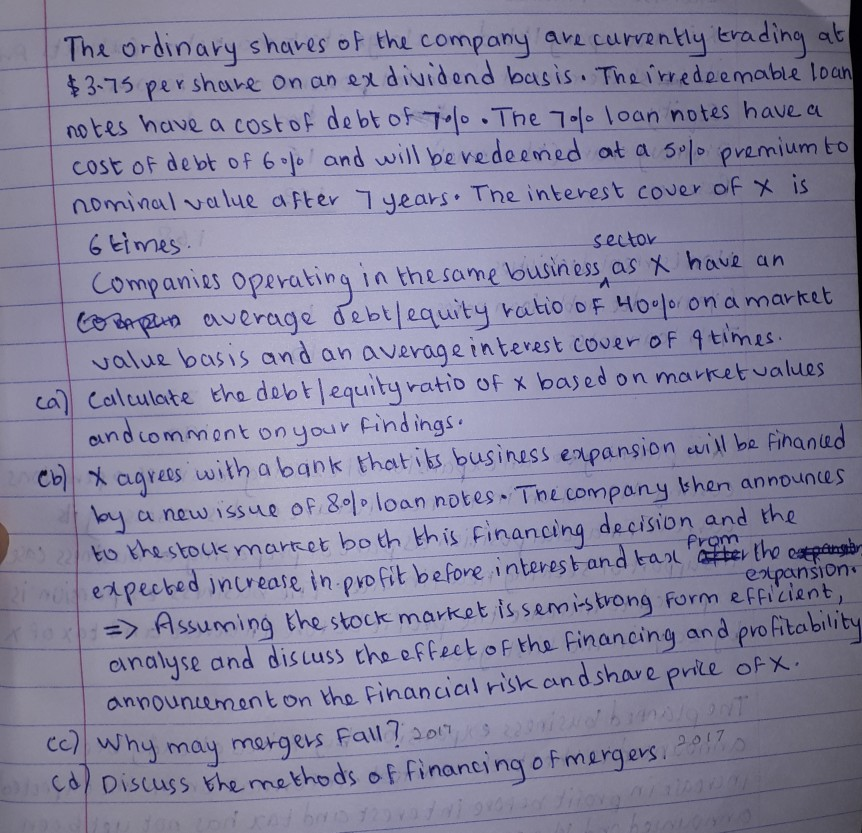

4.10.20 University Exercise Finance. x is a company listed on a large stock market Extracts from its fi statement of financial position are as follows: Equity of her an son dobimo sam olan Ordinary shares (I nominal) line brs 15 d 10 to 16 10 7200 Reserves: learl Nient 2 root 153 toutonnon 168 93 Mon Current Liabilities corentaipailprogo zinegro on 6% irreedeemable loan notes ludod 10 or 375 23170/0 loan notes/rsist nieporius ao 12 Rod sulou s oboto optapovib 22 pribor 190 by X is planning to an expansion of existing business operations. costing $10 million in the near future and is assessing its current Financial position as part of preparing a business case insupport of seeking new finance. The business expansion is. expected to increase the profit before interest and tax of x by 2000 in the first year. 2023 bo NO 22000 The planned business expansion by & has already been". announced to the stock market. Information on the expected increase in profit before interest and tax has not yet been announced and the company has not decided on how the expansion is to be financed. The ordinary shares of the company are currently trading at $3-75 pershare on an ex dividend basis. The irredeemable loan notes have a cost of debt of too. The 70% loan notes have a cost of debt of 6.1 and will be redeemed at a solo premium to nominal value after 7 years. The interest cover of x is 6 times. sector Companies operating in the same business as t have an Compen average debtlequity ratio of 40% on a market value basis and an average interest cover of 9 times. ca) Calculate the debt equity ratio of x based on market values and comment on your findings. Cbx agrees with a bank that its business expansion will be financed I by a new issue of 80% loan notes. The company then announces to the stock market both this financing decision and the expected increase in profit before interest and bas after the expansion => Assuming the stock market is semistrong form efficient, analyse and discuss the effect of the financing and profitability announument on the financial risk and share price ofx. Col Why may mergers fall? 2012 ond baansgen 2017 el cd/ Discuss the methods of financing of mergers.com from expansion. 4.10.20 University Exercise Finance. x is a company listed on a large stock market Extracts from its fi statement of financial position are as follows: Equity of her an son dobimo sam olan Ordinary shares (I nominal) line brs 15 d 10 to 16 10 7200 Reserves: learl Nient 2 root 153 toutonnon 168 93 Mon Current Liabilities corentaipailprogo zinegro on 6% irreedeemable loan notes ludod 10 or 375 23170/0 loan notes/rsist nieporius ao 12 Rod sulou s oboto optapovib 22 pribor 190 by X is planning to an expansion of existing business operations. costing $10 million in the near future and is assessing its current Financial position as part of preparing a business case insupport of seeking new finance. The business expansion is. expected to increase the profit before interest and tax of x by 2000 in the first year. 2023 bo NO 22000 The planned business expansion by & has already been". announced to the stock market. Information on the expected increase in profit before interest and tax has not yet been announced and the company has not decided on how the expansion is to be financed. The ordinary shares of the company are currently trading at $3-75 pershare on an ex dividend basis. The irredeemable loan notes have a cost of debt of too. The 70% loan notes have a cost of debt of 6.1 and will be redeemed at a solo premium to nominal value after 7 years. The interest cover of x is 6 times. sector Companies operating in the same business as t have an Compen average debtlequity ratio of 40% on a market value basis and an average interest cover of 9 times. ca) Calculate the debt equity ratio of x based on market values and comment on your findings. Cbx agrees with a bank that its business expansion will be financed I by a new issue of 80% loan notes. The company then announces to the stock market both this financing decision and the expected increase in profit before interest and bas after the expansion => Assuming the stock market is semistrong form efficient, analyse and discuss the effect of the financing and profitability announument on the financial risk and share price ofx. Col Why may mergers fall? 2012 ond baansgen 2017 el cd/ Discuss the methods of financing of mergers.com from expansionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started