Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer the following questions and all its parts(max 4 parts according to chegg). Failure to do so will result in negative rating. Try answering

Please answer the following questions and all its parts(max 4 parts according to chegg). Failure to do so will result in negative rating. Try answering on a piece of paper if possible and scan it please and i will give good rating. Thanks!

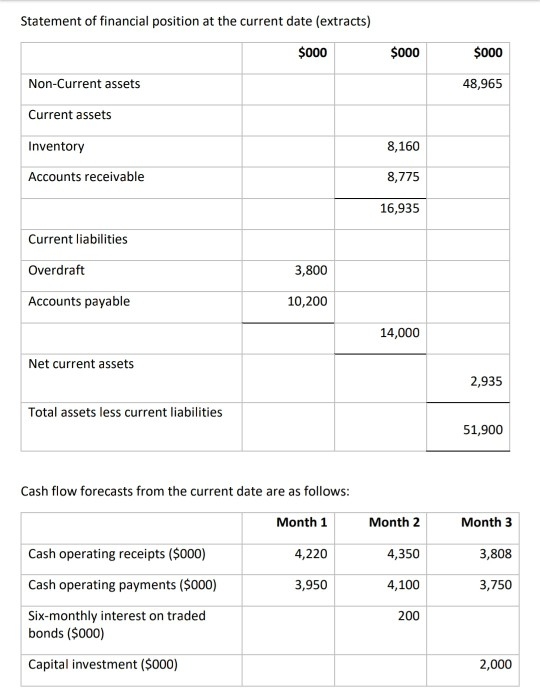

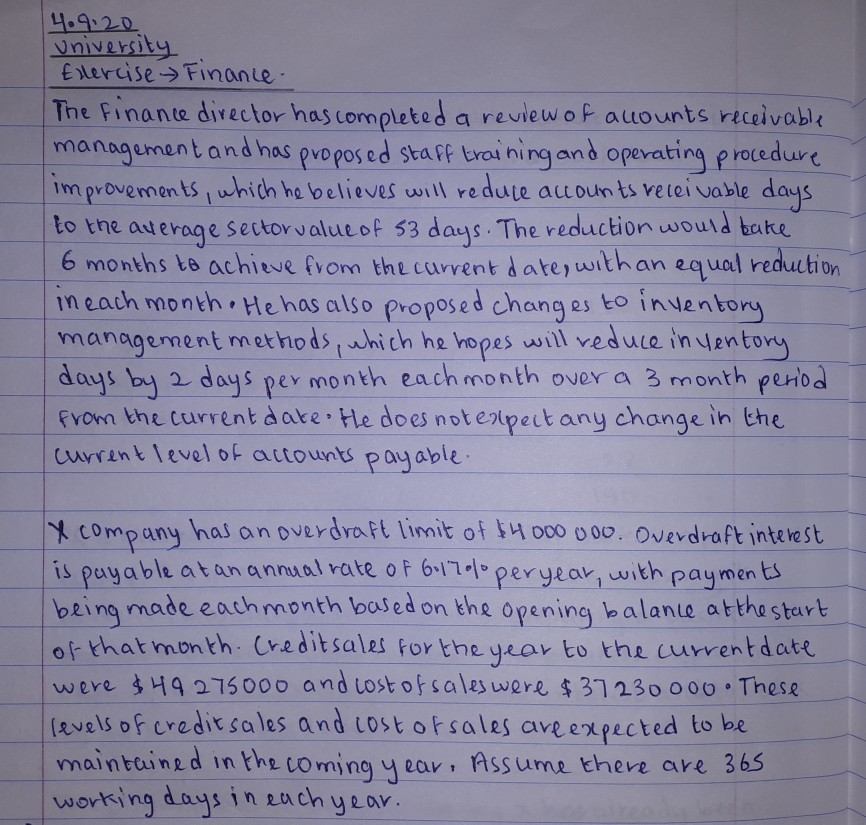

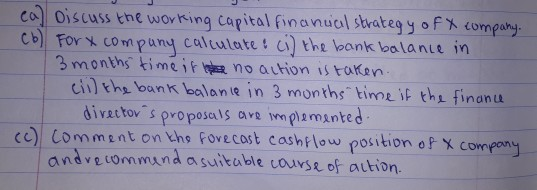

Statement of financial position at the current date (extracts) $000 $000 $000 Non-Current assets 48,965 Current assets Inventory 8,160 Accounts receivable 8,775 16,935 Current liabilities Overdraft 3,800 Accounts payable 10,200 14,000 Net current assets 2,935 Total assets less current liabilities 51,900 Cash flow forecasts from the current date are as follows: Month 1 Month 3 Cash operating receipts ($000) 4,220 4,350 3,808 Cash operating payments ($000) 3,950 4,100 3,750 200 Six-monthly interest on traded bonds ($000) Capital investment ($000) 2,000 university Enercise Finance. The Finance director has completed a review of accounts receivable management and has proposed staff training and operating procedure improvements, which he believes will reduce accounts receivable days to the average sector value of 53 days. The reduction would take 6 months to achieve from the current date, with an equal reduction ineach month. He has also proposed changes to inventory management methods, which he hopes will reduce inventory days by 2 days per month each month over a 3 month period from the current date the does not expect any change in the current level of accounts payable. y company has an overdraft limit of $4000 voo. Overdraft interest is payable at an annual rate of 6.17000 peryear, with payments. being made each month based on the opening balance at the start were $49275000 and cost of sales were $37230000. These levels of credit sales and cost of sales are expected to be maintained in the coming year. Assume there are 365 working days in each year. cal Discuss the working capital financial strategy of company. (6) Forx company calculate & ci) the bank balance in 3 months time if no action is taken. cii) the bank balance in 3 months time if the finance director's proposals are implemented. (c) comment on the forecast cashflow position of a company Statement of financial position at the current date (extracts) $000 $000 $000 Non-Current assets 48,965 Current assets Inventory 8,160 Accounts receivable 8,775 16,935 Current liabilities Overdraft 3,800 Accounts payable 10,200 14,000 Net current assets 2,935 Total assets less current liabilities 51,900 Cash flow forecasts from the current date are as follows: Month 1 Month 3 Cash operating receipts ($000) 4,220 4,350 3,808 Cash operating payments ($000) 3,950 4,100 3,750 200 Six-monthly interest on traded bonds ($000) Capital investment ($000) 2,000 university Enercise Finance. The Finance director has completed a review of accounts receivable management and has proposed staff training and operating procedure improvements, which he believes will reduce accounts receivable days to the average sector value of 53 days. The reduction would take 6 months to achieve from the current date, with an equal reduction ineach month. He has also proposed changes to inventory management methods, which he hopes will reduce inventory days by 2 days per month each month over a 3 month period from the current date the does not expect any change in the current level of accounts payable. y company has an overdraft limit of $4000 voo. Overdraft interest is payable at an annual rate of 6.17000 peryear, with payments. being made each month based on the opening balance at the start were $49275000 and cost of sales were $37230000. These levels of credit sales and cost of sales are expected to be maintained in the coming year. Assume there are 365 working days in each year. cal Discuss the working capital financial strategy of company. (6) Forx company calculate & ci) the bank balance in 3 months time if no action is taken. cii) the bank balance in 3 months time if the finance director's proposals are implemented. (c) comment on the forecast cashflow position of a companyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started