Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer the following questions and all its parts(max 4 parts according to chegg). Failure to do so will result in negative rating. Try answering

Please answer the following questions and all its parts(max 4 parts according to chegg). Failure to do so will result in negative rating. Try answering on a piece of paper if possible and scan it please and i will give good rating. Questions are on next image! Thanks!

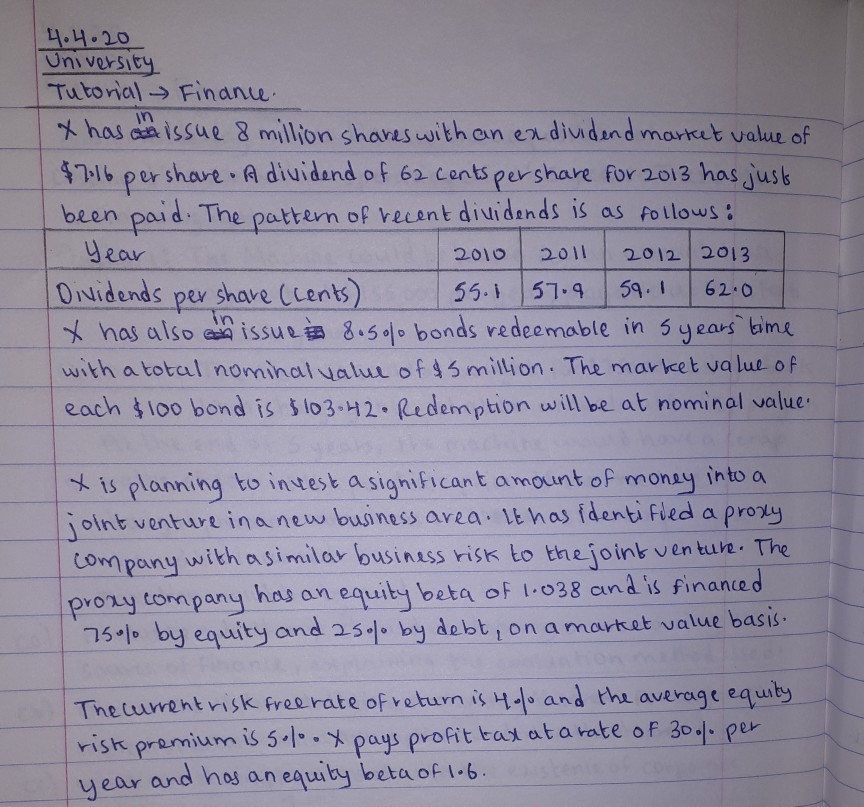

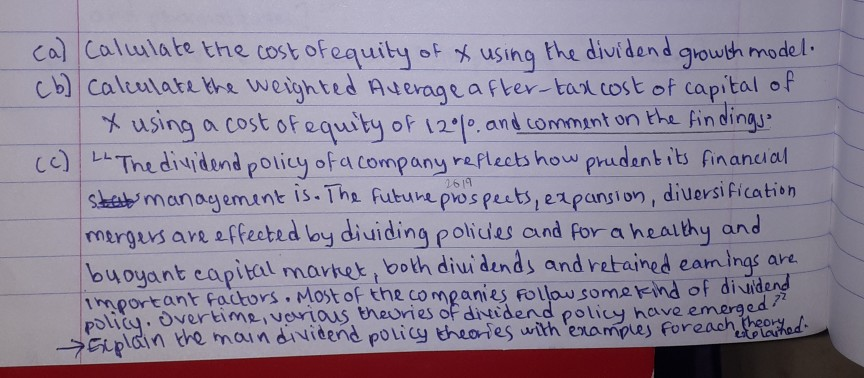

4.4.20 University Tutorial Finance. x has ath issue 8 million shares with an ex dividend market value of $7.16 per share. A dividend of 62 cents pershare for 2013 has just been paid. The pattern of recent dividends is as follows: Year 2010 2011 2012 2013 | Dividends per shave (cents) S5.1 57.9 59. 1 62.0 X has also an issue 8.solo bonds redeemable in 5 years time with a total nominal value of $5 million. The market value of each $100 bond is $103.42 Redemption will be at nominal value X is planning to invest a significant amount of money into a joint venture in a new business area. It has identified a proxy company with a similar business risk to the joint venture. The proxy company has an equity beta of 1.038 and is financed 75% by equity and 25% by debt, on a market value basis. The current risk free rate of return is 4% and the average equity risk premium is solo.x pays profit tax at a rate of 30.1. per year and has an equity beta of lof. cal Calculate the cost of equity of & using the dividend growth model. (6) calinate the weighted Average after-tax cost of capital of X using a cost of equity of 12%, and comment on the findings (c) LL. The dividend policy of a company reflects how prudent its financial stab management is. The future prospects, expansion, diversification mergers are effected by dividing policies and for a healthy and buoyant capital market, both dividends and retained eamings are important factors. Most of the companies follow some kind of dividend policy. overtime various theories of dividend policy have emerged siplain the main dividend policy theories with examples foreach theory hadStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started