Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer the following questions: La J UULI de 2. Lender lends out pay $5,000 in period. The intere for payment of each ye made

Please answer the following questions:

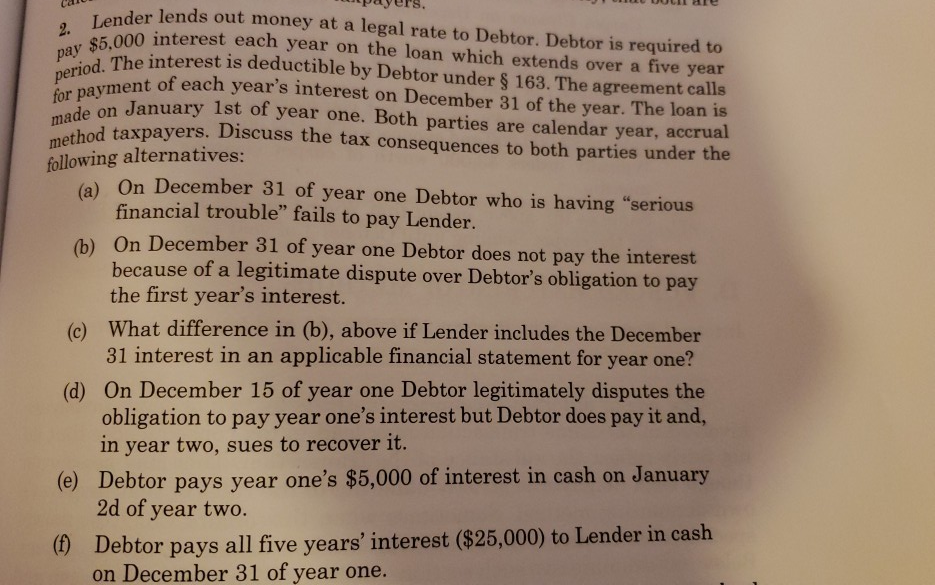

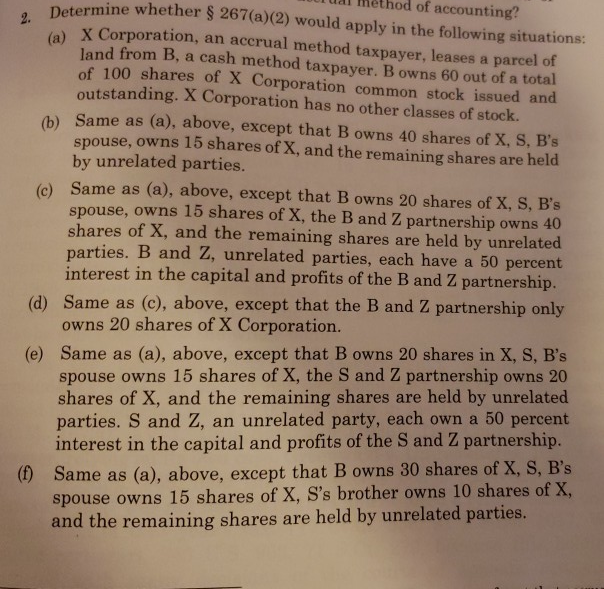

La J UULI de 2. Lender lends out pay $5,000 in period. The intere for payment of each ye made on Janua method taxpaver payers. der lends out money at a legal rate to Debtor. Debtor is required to 000 interest each year on the loan which extends over a five year The interest is deductible by Debtor under $ 163. The agreement calls perment of each year's interest on December 31 of the year. The loan is on January 1st of year one. Both parties are calendar year, accrual bod taxpayers. Discuss the tax consequences to both parties under the following alternatives: (a) On December 31 of year one Debtor who is having "serious financial trouble" fails to pay Lender. (b) On December 31 of year one Debtor does not pay the interest because of a legitimate dispute over Debtor's obligation to pay the first year's interest. What difference in (b), above if Lender includes the December 31 interest in an applicable financial statement for year one? (d) On December 15 of year one Debtor legitimately disputes the obligation to pay year one's interest but Debtor does pay it and, in year two, sues to recover it. (e) Debtor pays year one's $5,000 of interest in cash on January 2d of year two. (1) Debtor pays all five years' interest ($25,000) to Lender in cash on December 31 of year one. (c) 2. Determine al method of accounting? Determine whether $ 267(a)(2) would apply in the following situations: 1 x Corporation, an accrual method taxpaver leases a parcel of land from B a cash method taxpayer. Bowns 60 out of a total of 100 shares of X Corporation common stock issued and outstanding. X Corporation has no other classes of stock. (b) Same as (a), above, except that B owns 40 shares of X, S, B's spouse, owns 15 shares of X, and the remaining shares are held by unrelated parties. (c) Same as (a), above, except that B owns 20 shares of X, S, B's spouse, owns 15 shares of X, the B and Z partnership owns 40 shares of X, and the remaining shares are held by unrelated parties. B and Z, unrelated parties, each have a 50 percent interest in the capital and profits of the Band Z partnership. (d) Same as (c), above, except that the B and Z partnership only owns 20 shares of X Corporation. (e) Same as (a), above, except that B owns 20 shares in X, S, B's spouse owns 15 shares of X, the S and Z partnership owns 20 shares of X, and the remaining shares are held by unrelated parties. S and Z, an unrelated party, each own a 50 percent interest in the capital and profits of the S and Z partnership. (1) Same as (a), above, except that B owns 30 shares of X, S, B's spouse owns 15 shares of X, S's brother owns 10 shares of X, and the remaining shares are held by unrelated parties. La J UULI de 2. Lender lends out pay $5,000 in period. The intere for payment of each ye made on Janua method taxpaver payers. der lends out money at a legal rate to Debtor. Debtor is required to 000 interest each year on the loan which extends over a five year The interest is deductible by Debtor under $ 163. The agreement calls perment of each year's interest on December 31 of the year. The loan is on January 1st of year one. Both parties are calendar year, accrual bod taxpayers. Discuss the tax consequences to both parties under the following alternatives: (a) On December 31 of year one Debtor who is having "serious financial trouble" fails to pay Lender. (b) On December 31 of year one Debtor does not pay the interest because of a legitimate dispute over Debtor's obligation to pay the first year's interest. What difference in (b), above if Lender includes the December 31 interest in an applicable financial statement for year one? (d) On December 15 of year one Debtor legitimately disputes the obligation to pay year one's interest but Debtor does pay it and, in year two, sues to recover it. (e) Debtor pays year one's $5,000 of interest in cash on January 2d of year two. (1) Debtor pays all five years' interest ($25,000) to Lender in cash on December 31 of year one. (c) 2. Determine al method of accounting? Determine whether $ 267(a)(2) would apply in the following situations: 1 x Corporation, an accrual method taxpaver leases a parcel of land from B a cash method taxpayer. Bowns 60 out of a total of 100 shares of X Corporation common stock issued and outstanding. X Corporation has no other classes of stock. (b) Same as (a), above, except that B owns 40 shares of X, S, B's spouse, owns 15 shares of X, and the remaining shares are held by unrelated parties. (c) Same as (a), above, except that B owns 20 shares of X, S, B's spouse, owns 15 shares of X, the B and Z partnership owns 40 shares of X, and the remaining shares are held by unrelated parties. B and Z, unrelated parties, each have a 50 percent interest in the capital and profits of the Band Z partnership. (d) Same as (c), above, except that the B and Z partnership only owns 20 shares of X Corporation. (e) Same as (a), above, except that B owns 20 shares in X, S, B's spouse owns 15 shares of X, the S and Z partnership owns 20 shares of X, and the remaining shares are held by unrelated parties. S and Z, an unrelated party, each own a 50 percent interest in the capital and profits of the S and Z partnership. (1) Same as (a), above, except that B owns 30 shares of X, S, B's spouse owns 15 shares of X, S's brother owns 10 shares of X, and the remaining shares are held by unrelated parties

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started