Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer The Honourable Pierre Poilievre, a full-time hot dog vendor in Dundas Square and part-time party leader in Ottawa, wants to invest in commercial

Please answer

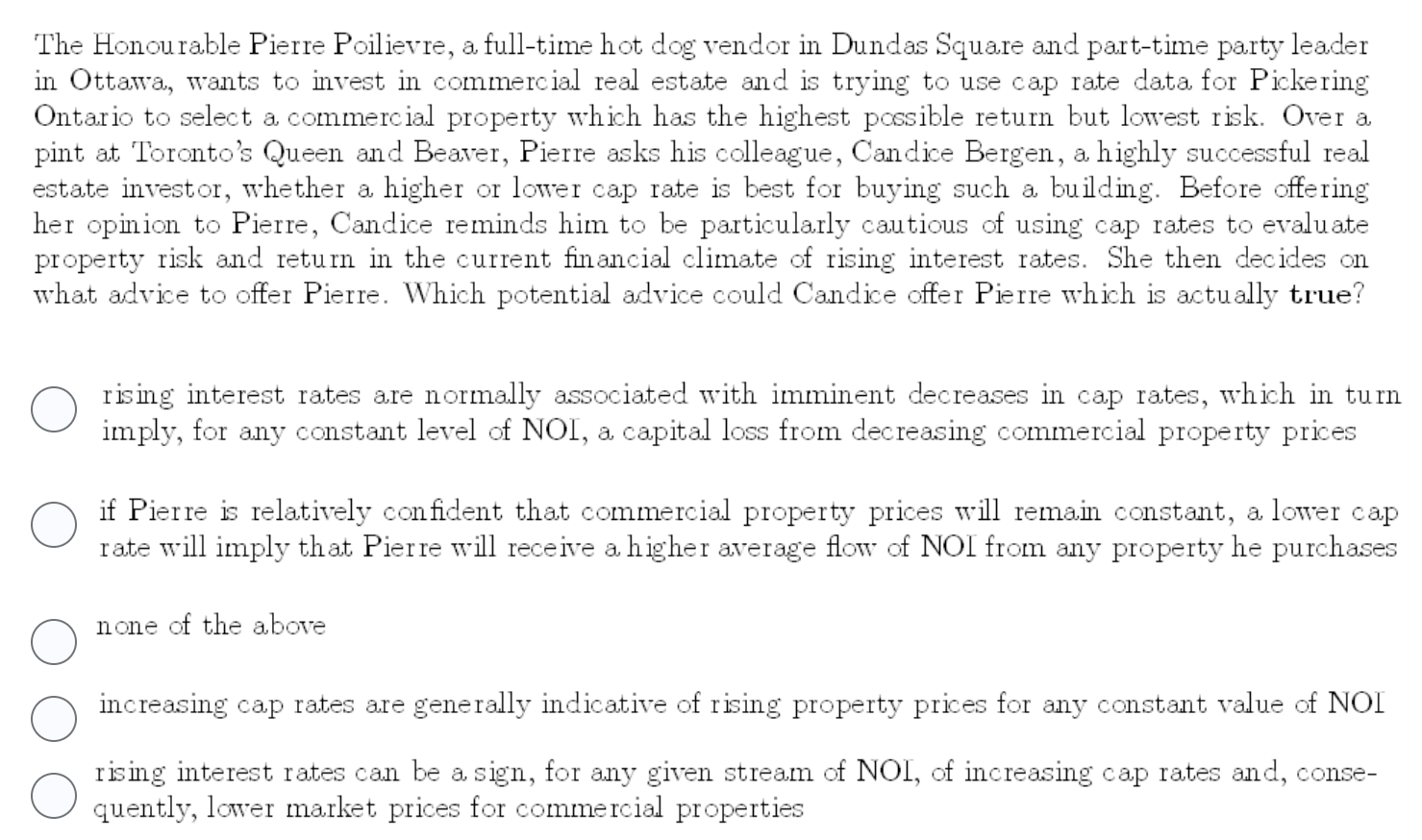

The Honourable Pierre Poilievre, a full-time hot dog vendor in Dundas Square and part-time party leader in Ottawa, wants to invest in commercial real estate and is trying to use cap rate data for Pickering Ontario to select a commercial property which has the highest possible return but lowest risk. Over a pint at Toronto's Queen and Beaver, Pierre asks his colleague, Candice Bergen, a highly successful real estate investor, whether a higher or lower cap rate is best for buying such a building. Before offering her opinion to Pierre, Candice reminds him to be particularly cautious of using cap rates to evaluate property risk and return in the current financial climate of rising interest rates. She then decides on what advice to offer Pierre. Which potential advice could Candice offer Pierre which is actually true? rising interest rates are normally associated with imminent decreases in cap rates, which in turn imply, for any constant level of NOI, a capital loss from decreasing commercial property prices if Pierre is relatively confident that commercial property prices will remain constant, a lower cap rate will imply that Pierre will receive a higher average flow of NOI from any property he purchases none of the above increasing cap rates are generally indicative of rising property prices for any constant value of NOI rising interest rates can be a sign, for any given stream of NOI, of increasing cap rates and, consequently, lower market prices for commercial propertiesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started