Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE ANSWER THE LETTERED QUESTIONS G3 IG4 Susan Lussier is 35 years old and employed as a tax accountant for a major oil and gas

PLEASE ANSWER THE LETTERED QUESTIONS

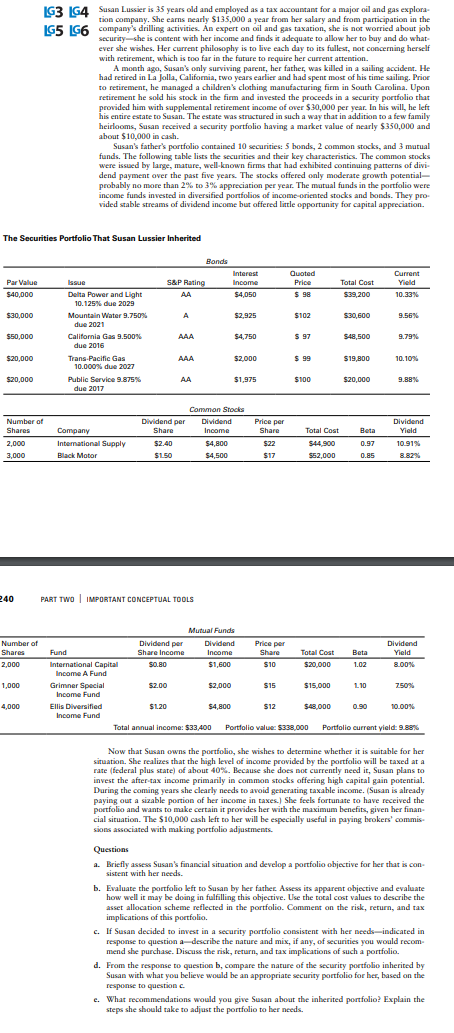

G3 IG4 Susan Lussier is 35 years old and employed as a tax accountant for a major oil and gas explora- tion company. She earns nearly $135,000 a year from her salary and from participation in the G5 IG6 company's drilling actives. An expert on oil and gas taxation, she is not worried about job security-she is content with her income and finds it adequate to allow her to buy and do what ever she wishes. Her current philosophy is to live each day to its fullest, not concerning herself with retirement, which is too far in the future to require her current attention. A month ago, Susan's only surviving parent, her father, was killed in a sailing accident. He had retired in La Jolla, Califomia, two years earlier and had spent most of his time sailing. Prioe to retirement, he managed a children's clothing mantuing firm in South Carolina. Upon retirement he sold his stock in the firm and invested the proceeds in a security portfolio that provided him with supplemental retirement income of over $30,000 per year. In his will, he left his entire estate to Susan. The estate was stractured in such a way that in addition to a few family heirlooms, Susan received a security portfolio having a market value of nearly $350,000 and about $10,000 in cash. Susan's father's portfolio contained 10 securities: 5 bonds, 2 common stocks, and 3 mutual funds. The following table lists the securities and their key characteristics. The common stocks were issued by large, mature, well-known firms that had exhibited continuing patterns of divi- dend payment over the past five years. The stocks offered only moderate growth potential probably no more than 2% to 3% appreciation per year. The mutual funds in the portfolio were income funds invested in diversified portfolios of income oriented stocks and bonds. They pro vided stable streams of dividend income but offered lttle opportunity for capital appreciation. The Securities Portfolio That Susan Lussier Inherited Total CostCurrens Delita Power and Light $ 98 $2,925 due 2021 due 2016 10.000% due 2027 California Gas 9.500% $4,750 9.79% $19,800 1,975 $100 due 2017 Dividend Sh per 2,000 3,000 Intermational Supply $150 $17 $52,000 40 PART TWO I IMPORTANT CONCEPTUAL TOOLS NumberoiFund Income Dde 50.80 International Capital Grimner Special Ellis Diersified $1,600 S10 $2,000 $15,000 $120 Total annual income: S33,400 Portfolio value S33800 Portfolio current yield: 9.88% Now that Susan owns the portfolio, she wishes to determine whether it is suitable for her situation. She realizes that the high level of income provided by the portfolio will be taxed at a rate (federal plus state) of about 40%. Because she does not currently need it, Susan plans to invest the after-tax income primarily in common stocks offering high capital gain potential During the coming years she clearly needs to avoid generating taxable income. (Susan is already paying out a sizable portfolio and wants to make certain it provides her with the maximum benefits, given her finan cial situation. The $10,000 cash left to her will be especially useful in paying brokers' commis sions associated with making portfolio adjustments portion of her income in taxes. She feels fortunate to have received the a. Briefly assess Susan's financial situation and develop a portfolio objective for her that is con sistent with her needs. b. Evaluate the portfolio left to Susan by her father. Assess its apparent objective and evaluate how well it may be doing in fulfilling this objective. Use the total cost values to describe the asset allocation scheme reflected in the portfolio. Comment on the risk, return, and tax implications of this portfolio. c. If Susan decided to invest in a security portfolio consistent with her eedsindicated in ould recom response to question a- describe the nature mend she purchase. Discuss the risk, return, and tax implications of such a portfolio. From the response to question b, compare the nature of the security portfolio inherited by Susan with what you believe would be an appropriate security portfolio for her, based on the response to question c and mix, if any, of securities you w d. e. What recommendations would you give Susan about the inherited portfolio? Explain the steps she should take to adjust the portfolio to her needsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started