Question

Please answer the question accurately. 1. Suppose Kappa does not add leverage in 2024 and 2025 but instead keeps its debt fixed at 100$ million

Please answer the question accurately.

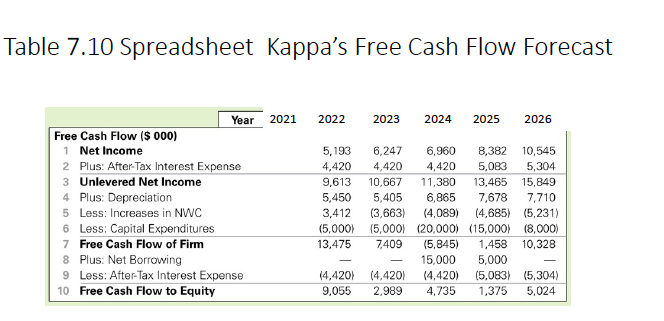

1. Suppose Kappa does not add leverage in 2024 and 2025 but instead keeps its debt fixed at 100$ million until 2026. How would this change in its leverage policy affect its expected free cash flow? How would it affect the free cash flow to equity?

Hint: You copy lines 7, 8, 9, 10 from Table 7.10 on Excel. You recompute the Free cash flow of equity if net borrowing is 0 each year and after-tax interest expenses remain at 4,420 each year from 2022 to 2027, i.e. Kappa does not add leverage in 2024 and 2025. You copy/paste the table on your answer sheet and answer the questions.

Table 7.10 Spreadsheet Kappa's Free Cash Flow Forecast 2022 2023 2024 2025 2026 Year 2021 Free Cash Flow ($ 000) 1 Net Income 2 Plus: After-Tax Interest Expense 3 Unlevered Net Income 4 Plus: Depreciation 5 Less: Increases in NWC 6 Less: Capital Expenditures 7 Free Cash Flow of Firm 8 Plus: Net Borrowing 9 Less: After-Tax Interest Expense 10 Free Cash Flow to Equity 5,193 4,420 9,613 5,450 3,412 (5,000) 13,475 6,247 6,960 8,382 10,545 4,420 4,420 5,083 5,304 10,667 11,380 13,465 15,849 5,405 6,865 7,678 7.710 (3,663) (4,089) (4,685) (5,231) (5,000) (20,000) (15,000) (8,000) 7,409 (5,845) 1,458 10,328 15,000 5,000 (4,420) (4,420) (5,083) (5,304) 2.989 4,735 1,375 5,024 14,420) 9,055 Table 7.10 Spreadsheet Kappa's Free Cash Flow Forecast 2022 2023 2024 2025 2026 Year 2021 Free Cash Flow ($ 000) 1 Net Income 2 Plus: After-Tax Interest Expense 3 Unlevered Net Income 4 Plus: Depreciation 5 Less: Increases in NWC 6 Less: Capital Expenditures 7 Free Cash Flow of Firm 8 Plus: Net Borrowing 9 Less: After-Tax Interest Expense 10 Free Cash Flow to Equity 5,193 4,420 9,613 5,450 3,412 (5,000) 13,475 6,247 6,960 8,382 10,545 4,420 4,420 5,083 5,304 10,667 11,380 13,465 15,849 5,405 6,865 7,678 7.710 (3,663) (4,089) (4,685) (5,231) (5,000) (20,000) (15,000) (8,000) 7,409 (5,845) 1,458 10,328 15,000 5,000 (4,420) (4,420) (5,083) (5,304) 2.989 4,735 1,375 5,024 14,420) 9,055

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started