Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer the question as soon as possible I will thumbs up. thank you Intel needed to raise money to purchase additional long-term assets, so

please answer the question as soon as possible I will thumbs up. thank you

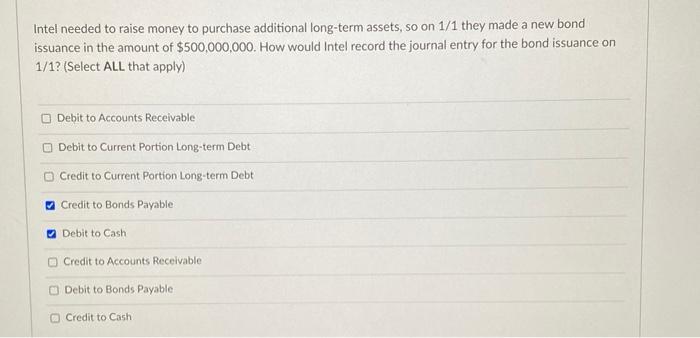

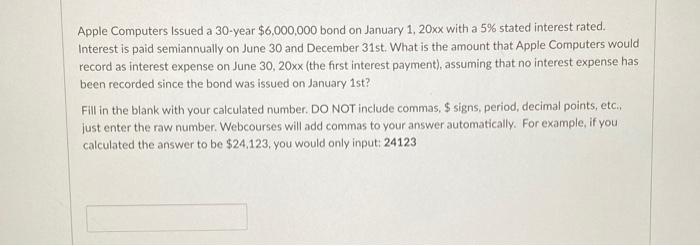

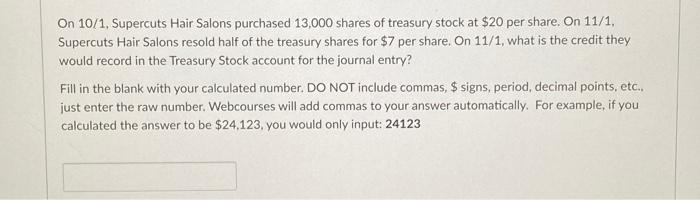

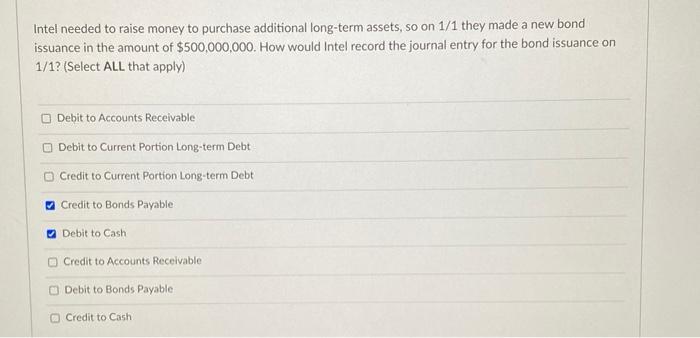

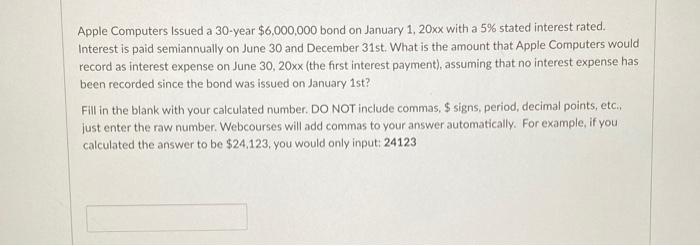

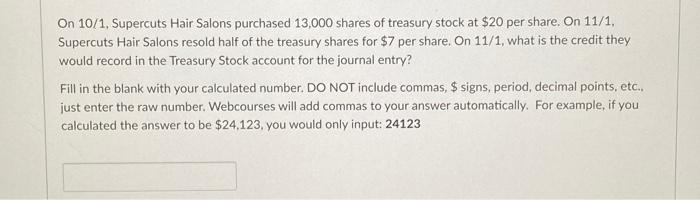

Intel needed to raise money to purchase additional long-term assets, so on 1/1 they made a new bond issuance in the amount of $500,000,000. How would Intel record the journal entry for the bond issuance on 1/1? (Select ALL that apply) Debit to Accounts Receivable Debit to Current Portion long-term Debt Credit to Current Portion Long-term Debt Credit to Bonds Payable Debit to Cash Credit to Accounts Receivable Debit to Bonds Payable Credit to Cash Apple Computers issued a 30-year $6,000,000 bond on January 1, 20xx with a 5% stated interest rated. Interest is paid semiannually on June 30 and December 31st. What is the amount that Apple Computers would record as interest expense on June 30, 20xx (the first interest payment), assuming that no interest expense has been recorded since the bond was issued on January 1st? Fill in the blank with your calculated number. DO NOT include commas. S signs, period, decimal points, etc., just enter the raw number. Webcourses will add commas to your answer automatically. For example, if you calculated the answer to be $24.123, you would only input: 24123 On 10/1, Supercuts Hair Salons purchased 13,000 shares of treasury stock at $20 per share. On 11/1, Supercuts Hair Salons resold half of the treasury shares for $7 per share. On 11/1, what is the credit they would record in the Treasury Stock account for the journal entry? Fill in the blank with your calculated number. DO NOT include commas, $ signs, period, decimal points, etc.. just enter the raw number. Webcourses will add commas to your answer automatically. For example, if you calculated the answer to be $24,123, you would only input: 24123

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started