Answered step by step

Verified Expert Solution

Question

1 Approved Answer

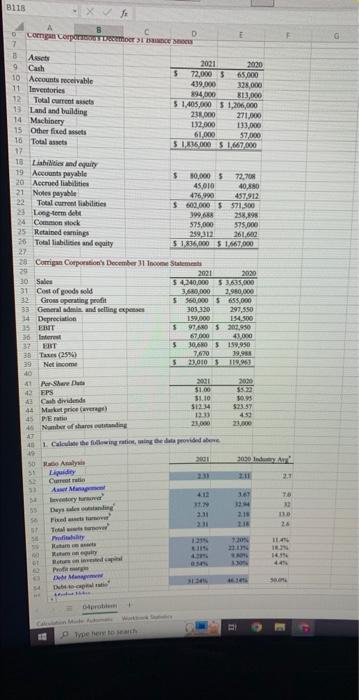

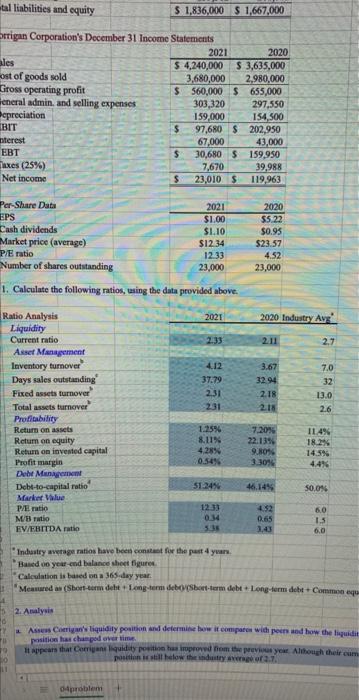

Please answer the question on the first picture f. Calculate Corrigan's ROE as well as the industry average ROE, using the DuPont equation. Note, you

Please answer the question on the first picture

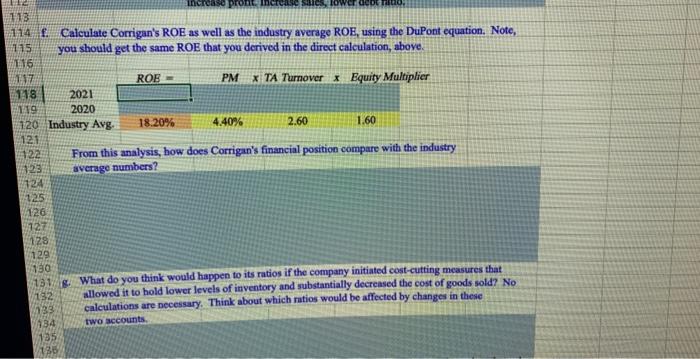

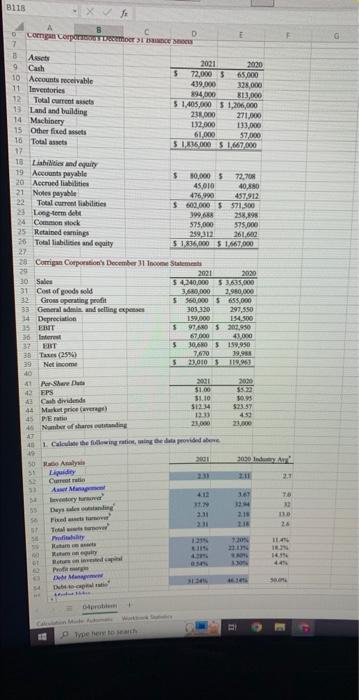

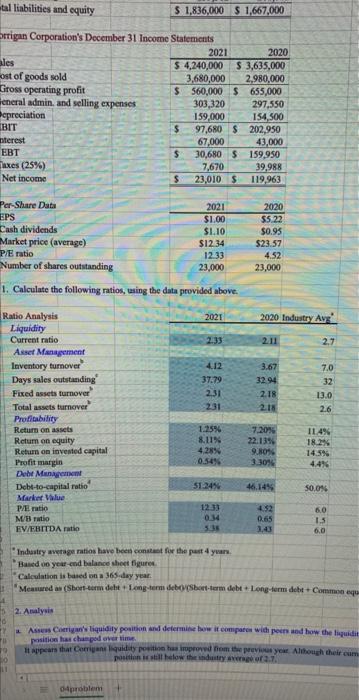

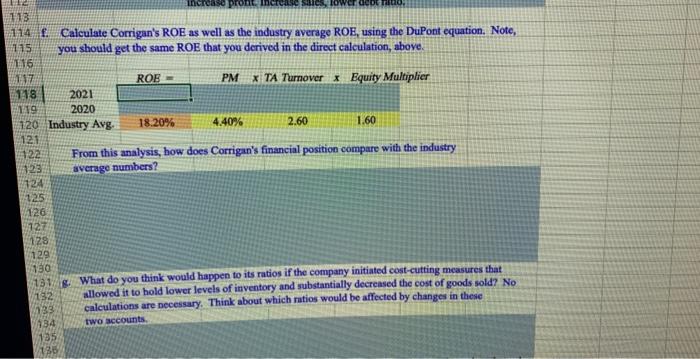

f. Calculate Corrigan's ROE as well as the industry average ROE, using the DuPont equation. Note, you should get the same ROE that you derived in the direct calculation, above. From this analysis, how does Corrigan's financial position compare with the industry average numbers? g. What do you think would happen to its ratios if the company initiated cost-cutting measures that allowed it to hold lower levels of inventory and substantially decreased the cost of goods sold? No calculations are necessary. Think about which ratios would be affected by changes in these two accounts. Currigan Coepores of Docermber 31 Inverae Statsmess 1. Calculate the following ratios, uaing the data provided above. "Industry avetage natios have been conakast for the pust 4 yrars. "Baned on yeat-cnd balance shoet figuree. "Calculation is baned on a 365 day year. "Meanured an (Sboet-eern deht + 1.eng-tern seboYSbiet-term debt + Long-term deth + Consmno equ 2. Analyis rosition has chaspod over time. posithin is stal helow the indiatry iveried ar 2.7. f. Calculate Corrigan's ROE as well as the industry average ROE, using the DuPont equation. Note, you should get the same ROE that you derived in the direct calculation, above. From this analysis, how does Corrigan's financial position compare with the industry average numbers? g. What do you think would happen to its ratios if the company initiated cost-cutting measures that allowed it to hold lower levels of inventory and substantially decreased the cost of goods sold? No calculations are necessary. Think about which ratios would be affected by changes in these two accounts. Currigan Coepores of Docermber 31 Inverae Statsmess 1. Calculate the following ratios, uaing the data provided above. "Industry avetage natios have been conakast for the pust 4 yrars. "Baned on yeat-cnd balance shoet figuree. "Calculation is baned on a 365 day year. "Meanured an (Sboet-eern deht + 1.eng-tern seboYSbiet-term debt + Long-term deth + Consmno equ 2. Analyis rosition has chaspod over time. posithin is stal helow the indiatry iveried ar 2.7

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started