Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please Answer the Question This is an examination in 2 hours. Question 2 (32 marks) You learnt below from the annual report of SA TWO

Please Answer the Question This is an examination in 2 hours.

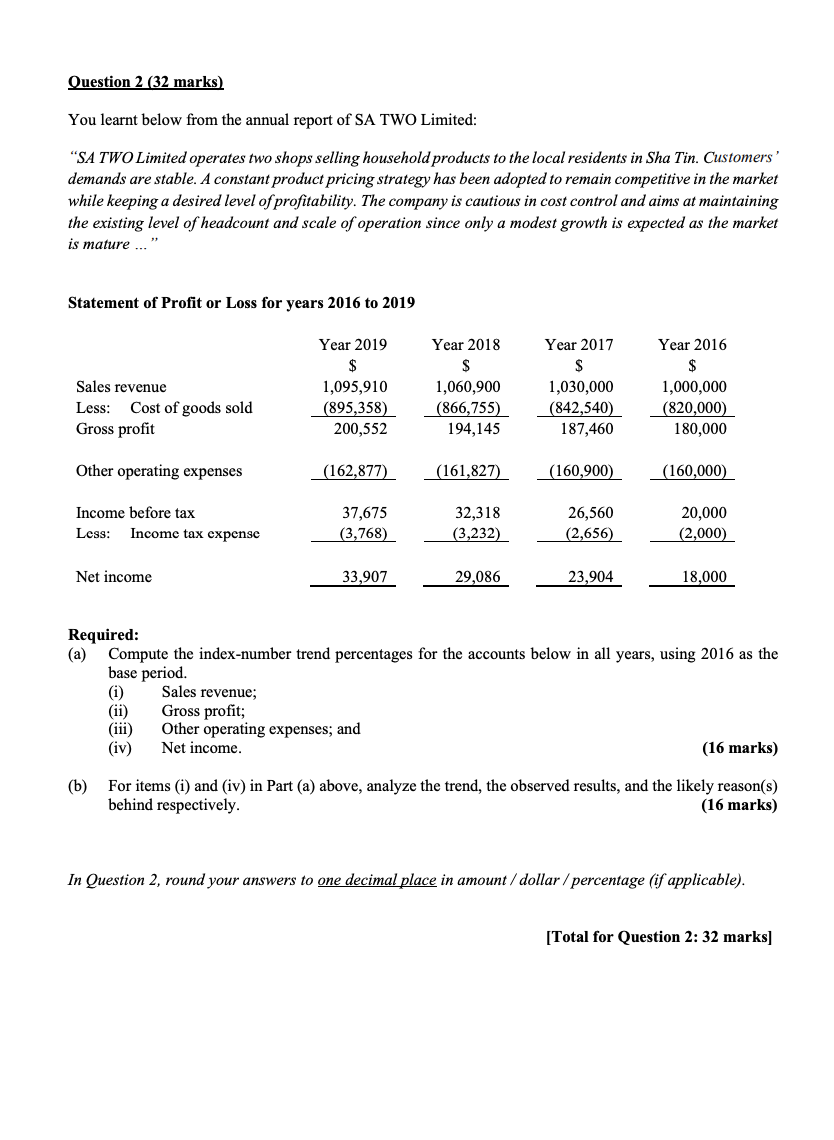

Question 2 (32 marks) You learnt below from the annual report of SA TWO Limited: "SA TWO Limited operates two shops selling household products to the local residents in Sha Tin. Customers' demands are stable. A constant product pricing strategy has been adopted to remain competitive in the market while keeping a desired level of profitability. The company is cautious in cost control and aims at maintaining the existing level of headcount and scale of operation since only a modest growth is expected as the market is mature ... Statement of Profit or Loss for years 2016 to 2019 Year 2019 Sales revenue Less: Cost of goods sold Gross profit 1,095,910 (895,358) 200,552 Year 2018 S 1,060,900 (866,755) 194,145 Year 2017 S 1,030,000 (842,540) 187,460 Year 2016 $ 1,000,000 (820,000) 180,000 Other operating expenses (162,877) (161,827) (160,900) (160,000 Income before tax Less: Income tax expense 37,675 (3,768) 32,318 (3,232) 26,560 (2,656) 20,000 (2,000) Net income 33,907 29,086 23,904 18,000 Required: (a) Compute the index-number trend percentages for the accounts below in all years, using 2016 as the base period. (i) Sales revenue; (ii) Gross profit; Other operating expenses; and (iv) Net income. (16 marks) (b) For items (i) and (iv) in Part (a) above, analyze the trend, the observed results, and the likely reason(s) behind respectively. (16 marks) In Question 2, round your answers to one decimal place in amount /dollar / percentage (if applicable). [Total for Question 2: 32 marks]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started