Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer the question, well explained, step by step with all the details. VERY IMPORTANT! Moneylane Limited acquired its first subsidiary during the year ended

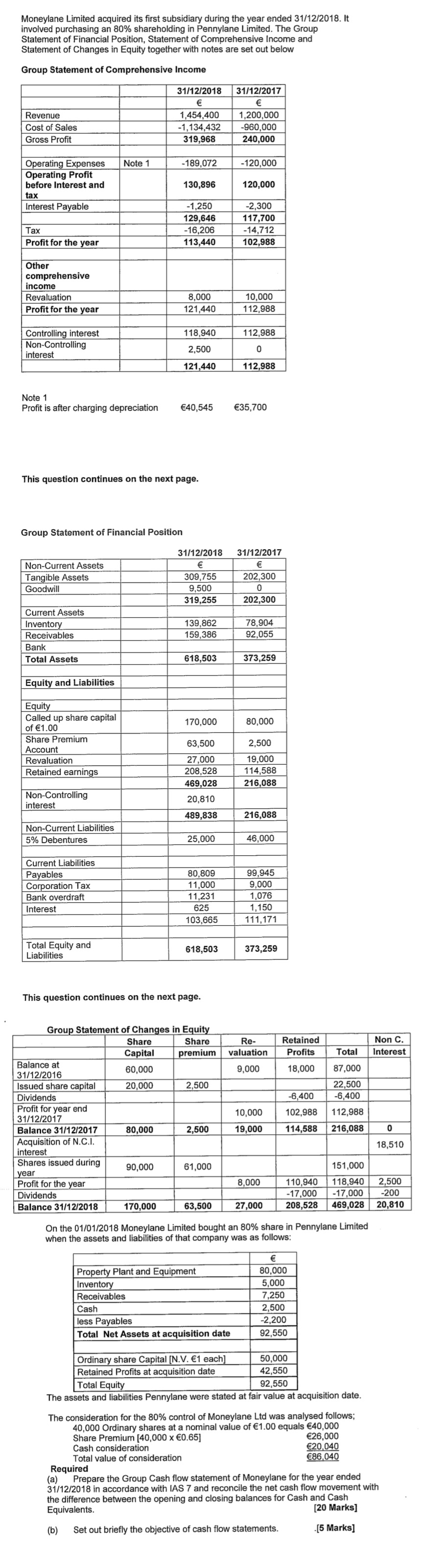

Please answer the question, well explained, step by step with all the details. VERY IMPORTANT!Moneylane Limited acquired its first subsidiary during the year ended 31/12/2018. It involved purchasing an 80% shareholding in Pennylane Limited. The Group Statement of Financial Position, Statement of Comprehensive Income and Statement of Changes in Equity together with notes are set out below Group Statement of Comprehensive Income 31/12/2018 31/12/2017 Revenue Cost of Sales Gross Profit 1,454,400 -1,134,432 319,968 1,200,000 -960.000 240,000 Note 1 - 189,072 -120,000 Operating Expenses Operating Profit before Interest and tax Interest Payable 130,896 120,000 - 1,250 129,646 -16,206 113,440 -2,300 117,700 - 14,712 102,988 | Profit for the year Other comprehensive income Revaluation Profit for the year 8,000 121,440 10,000 112,988 Controlling interest 118,940 112,988 interest 2,500 121,440 112,988 Note 1 Profit is after charging depreciation 40,545 35,700 This question continues on the next page. Group Statement of Financial Position 31/12/2018 31/12/2017 Non-Current Assets Tangible Assets Goodwill 202,300 309,755 9,500 319,255 0 202,300 Current Assets Inventory Receivables Bank Total Assets 139,862 159,386 78,904 92,055 618,503 373,259 Equity and Liabilities 170,000 80,000 Equity Called up share capital of 1.00 Share Premium Account Revaluation Retained earnings 63,500 27,000 208,528 469,028 20,810 2,500 19,000 114,588 216,088 Non-Controlling interest 489,838 216,088 Non-Current Liabilities 5% Debentures 25,000 46,000 Current Liabilities Payables Corporation Tax Bank overdraft Interest 80,809 11,000 11,231 625 103,665 99,945 9,000 1,076 1,150 111,171 Total Equity and Liabilities 618,503 373,259 This question continues on the next page. Re- valuation Retained Profits Non C. Interest Total 9,000 18,000 87,000 22,500 -6,400 -6,400 10,000 102,988 112.988 Group Statement of Changes in Equity Share Share Capital premium Balance at 60,000 Issued share capital 20,000 2,500 Dividends Profit for year end 31/12/2017 Balance 31/12/2017 80,000 2,500 Acquisition of N.C.I. interest Shares issued during 90,000 61,000 year Profit for the year 1 Dividends Balance 31/12/2018 170,000 63,500 19,000 114,588 216,088 18,510 8,000 110,940 -17,000 208,528 151,000 118,940 -17,000 469,028 2,500 - 200 20,810 27,000 On the 01/01/2018 Moneylane Limited bought an 80% share in Pennylane Limited when the assets and liabilities of that company was as follows: Property Plant and Equipment Inventory Receivables Cash less Payables Total Net Assets at acquisition date 80,000 5,000 7,250 2,500 -2,200 92,550 Ordinary share Capital [N.V. 1 each] 50,000 Retained Profits at acquisition date 42,550 Total Equity 92,550 The assets and liabilities Pennylane were stated at fair value at acquisition date. The consideration for the 80% control of Moneylane Ltd was analysed follows; 40,000 Ordinary shares at a nominal value of 1.00 equals 40,000 Share Premium (40,000 x 0.65] 26,000 Cash consideration 20,040 Total value of consideration 86,040 Required (a) Prepare the Group Cash flow statement of Moneylane for the year ended 31/12/2018 in accordance with IAS 7 and reconcile the net cash flow movement with the difference between the opening and closing balances for Cash and Cash Equivalents. [20 Marks] (b) Set out briefly the objective of cash flow statements. - [5 Marks] Moneylane Limited acquired its first subsidiary during the year ended 31/12/2018. It involved purchasing an 80% shareholding in Pennylane Limited. The Group Statement of Financial Position, Statement of Comprehensive Income and Statement of Changes in Equity together with notes are set out below Group Statement of Comprehensive Income 31/12/2018 31/12/2017 Revenue Cost of Sales Gross Profit 1,454,400 -1,134,432 319,968 1,200,000 -960.000 240,000 Note 1 - 189,072 -120,000 Operating Expenses Operating Profit before Interest and tax Interest Payable 130,896 120,000 - 1,250 129,646 -16,206 113,440 -2,300 117,700 - 14,712 102,988 | Profit for the year Other comprehensive income Revaluation Profit for the year 8,000 121,440 10,000 112,988 Controlling interest 118,940 112,988 interest 2,500 121,440 112,988 Note 1 Profit is after charging depreciation 40,545 35,700 This question continues on the next page. Group Statement of Financial Position 31/12/2018 31/12/2017 Non-Current Assets Tangible Assets Goodwill 202,300 309,755 9,500 319,255 0 202,300 Current Assets Inventory Receivables Bank Total Assets 139,862 159,386 78,904 92,055 618,503 373,259 Equity and Liabilities 170,000 80,000 Equity Called up share capital of 1.00 Share Premium Account Revaluation Retained earnings 63,500 27,000 208,528 469,028 20,810 2,500 19,000 114,588 216,088 Non-Controlling interest 489,838 216,088 Non-Current Liabilities 5% Debentures 25,000 46,000 Current Liabilities Payables Corporation Tax Bank overdraft Interest 80,809 11,000 11,231 625 103,665 99,945 9,000 1,076 1,150 111,171 Total Equity and Liabilities 618,503 373,259 This question continues on the next page. Re- valuation Retained Profits Non C. Interest Total 9,000 18,000 87,000 22,500 -6,400 -6,400 10,000 102,988 112.988 Group Statement of Changes in Equity Share Share Capital premium Balance at 60,000 Issued share capital 20,000 2,500 Dividends Profit for year end 31/12/2017 Balance 31/12/2017 80,000 2,500 Acquisition of N.C.I. interest Shares issued during 90,000 61,000 year Profit for the year 1 Dividends Balance 31/12/2018 170,000 63,500 19,000 114,588 216,088 18,510 8,000 110,940 -17,000 208,528 151,000 118,940 -17,000 469,028 2,500 - 200 20,810 27,000 On the 01/01/2018 Moneylane Limited bought an 80% share in Pennylane Limited when the assets and liabilities of that company was as follows: Property Plant and Equipment Inventory Receivables Cash less Payables Total Net Assets at acquisition date 80,000 5,000 7,250 2,500 -2,200 92,550 Ordinary share Capital [N.V. 1 each] 50,000 Retained Profits at acquisition date 42,550 Total Equity 92,550 The assets and liabilities Pennylane were stated at fair value at acquisition date. The consideration for the 80% control of Moneylane Ltd was analysed follows; 40,000 Ordinary shares at a nominal value of 1.00 equals 40,000 Share Premium (40,000 x 0.65] 26,000 Cash consideration 20,040 Total value of consideration 86,040 Required (a) Prepare the Group Cash flow statement of Moneylane for the year ended 31/12/2018 in accordance with IAS 7 and reconcile the net cash flow movement with the difference between the opening and closing balances for Cash and Cash Equivalents. [20 Marks] (b) Set out briefly the objective of cash flow statements. - [5 Marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started