Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer the questions 15.20, 16.1 and 16.2 with your detailed explanations, it's much appreciated! 15.20 D Co's year-end balance on the receivables control account

Please answer the questions 15.20, 16.1 and 16.2 with your detailed explanations, it's much appreciated!

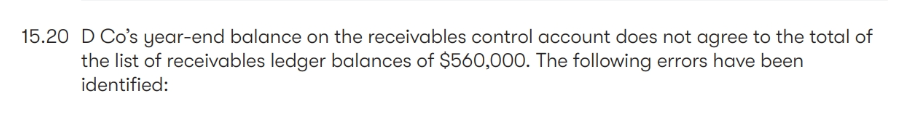

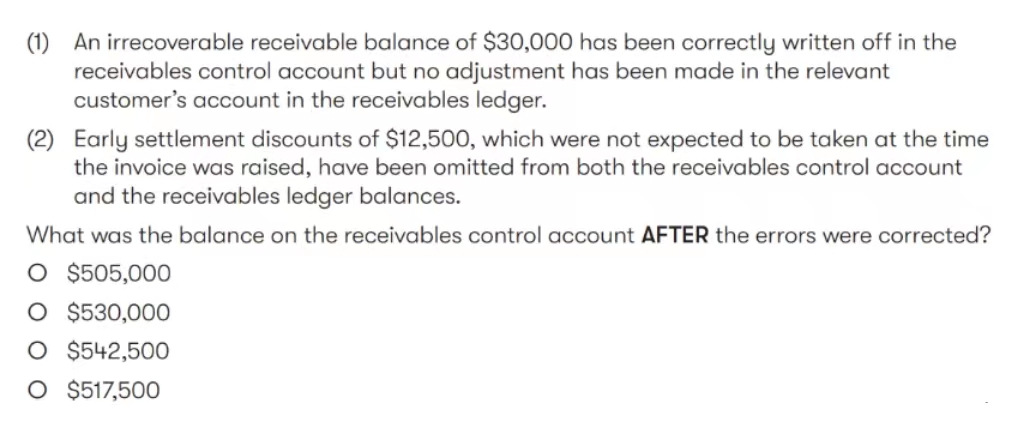

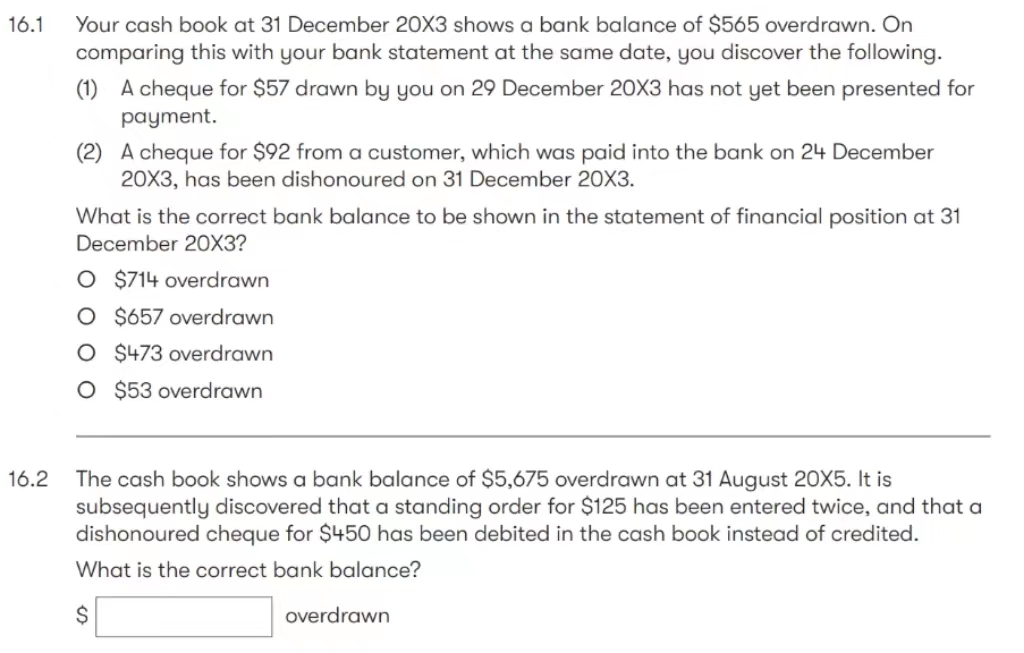

15.20 D Co's year-end balance on the receivables control account does not agree to the total of the list of receivables ledger balances of $560,000. The following errors have been identified: (1) An irrecoverable receivable balance of $30,000 has been correctly written off in the receivables control account but no adjustment has been made in the relevant customer's account in the receivables ledger. (2) Early settlement discounts of $12,500, which were not expected to be taken at the time the invoice was raised, have been omitted from both the receivables control account and the receivables ledger balances. What was the balance on the receivables control account AFTER the errors were corrected? $505,000 $530,000 $542,500 $517,500 Your cash book at 31 December 203 shows a bank balance of $565 overdrawn. On comparing this with your bank statement at the same date, you discover the following. (1) A cheque for $57 drawn by you on 29 December 203 has not yet been presented for payment. (2) A cheque for $92 from a customer, which was paid into the bank on 24 December 203, has been dishonoured on 31 December 203. What is the correct bank balance to be shown in the statement of financial position at 31 December 20X3? \$714 overdrawn $657 overdrawn $473 overdrawn $53 overdrawn The cash book shows a bank balance of $5,675 overdrawn at 31 August 205. It is subsequently discovered that a standing order for $125 has been entered twice, and that a dishonoured cheque for $450 has been debited in the cash book instead of credited. What is the correct bank balance? $ overdrawn

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started