Answered step by step

Verified Expert Solution

Question

1 Approved Answer

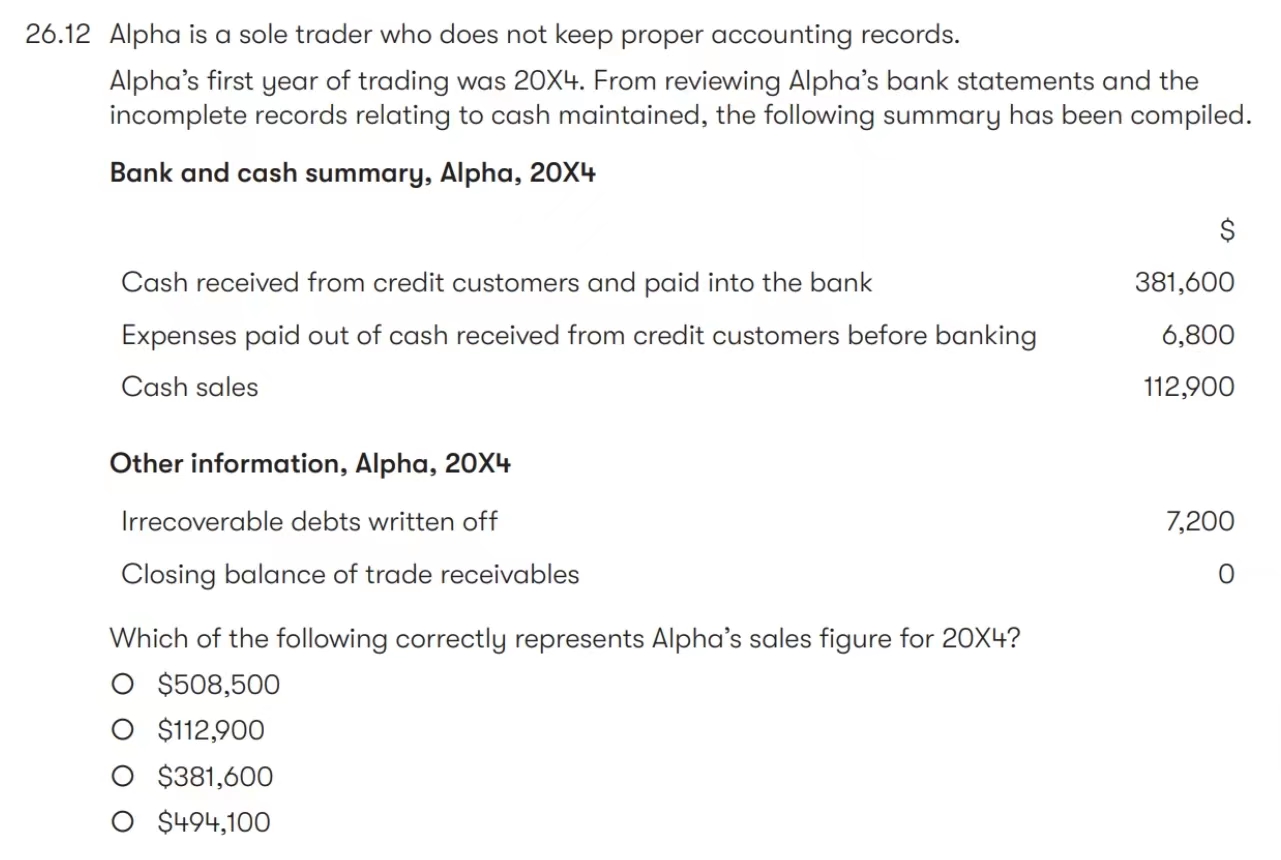

Please answer the questions 26.12, 26.13 and 26.14 with your detailed explanations, it's much appreciated! b.: $494,100 A sole trader who does not keep full

Please answer the questions 26.12, 26.13 and 26.14 with your detailed explanations, it's much appreciated!

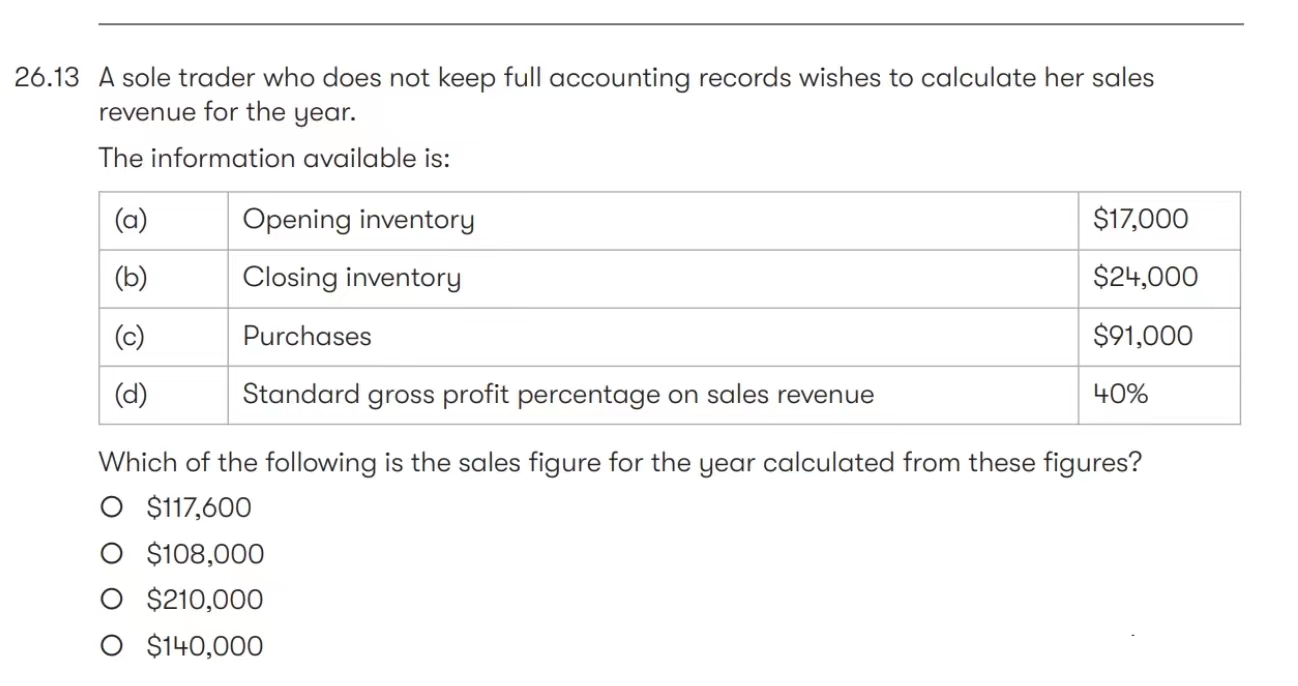

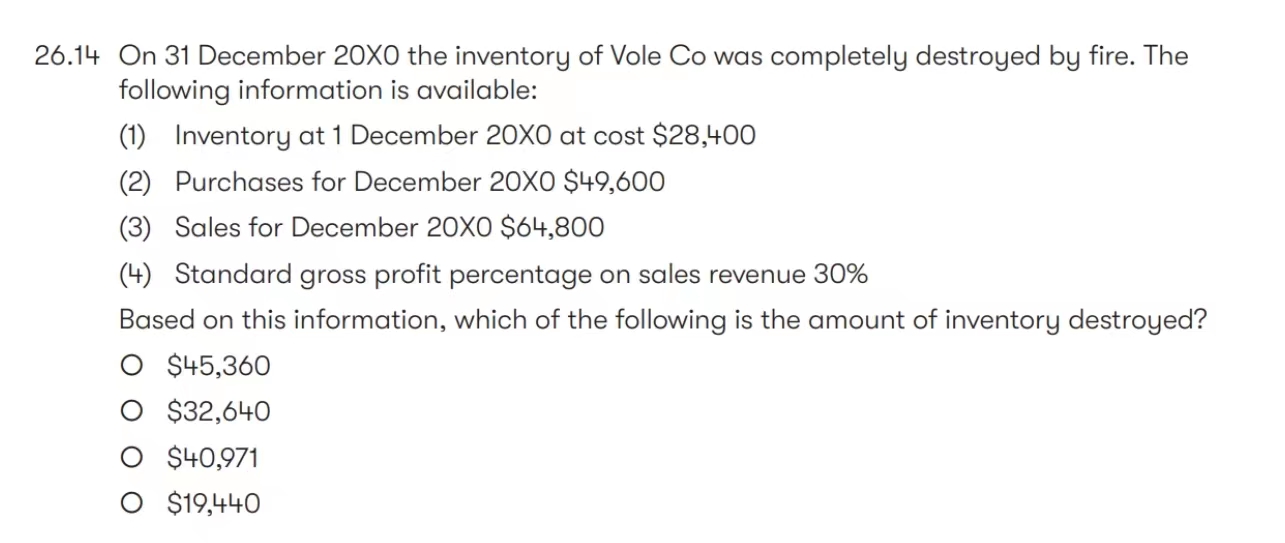

b.: $494,100 A sole trader who does not keep full accounting records wishes to calculate her sales revenue for the year. The information available is: Which of the following is the sales figure for the year calculated from these figures? $117,600 $108,000 $210,000 $140,000 6.14 On 31 December 20X0 the inventory of Vole Co was completely destroyed by fire. The following information is available: (1) Inventory at 1 December 200 at cost $28,400 (2) Purchases for December 20X0 \$49,600 (3) Sales for December 200$64,800 (4) Standard gross profit percentage on sales revenue 30% Based on this information, which of the following is the amount of inventory destroyed? $45,360$32,640$40,971$19,440

b.: $494,100 A sole trader who does not keep full accounting records wishes to calculate her sales revenue for the year. The information available is: Which of the following is the sales figure for the year calculated from these figures? $117,600 $108,000 $210,000 $140,000 6.14 On 31 December 20X0 the inventory of Vole Co was completely destroyed by fire. The following information is available: (1) Inventory at 1 December 200 at cost $28,400 (2) Purchases for December 20X0 \$49,600 (3) Sales for December 200$64,800 (4) Standard gross profit percentage on sales revenue 30% Based on this information, which of the following is the amount of inventory destroyed? $45,360$32,640$40,971$19,440 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started