Answered step by step

Verified Expert Solution

Question

1 Approved Answer

EXPATRIATE COMPENSATION AT ROBERT BOSCH GMBH: COPING WITH MODERN MOBILITY CHALLENGES By Thar Sahakiants, Marion Festing, Manfred Froehlecke I would rather lose money than

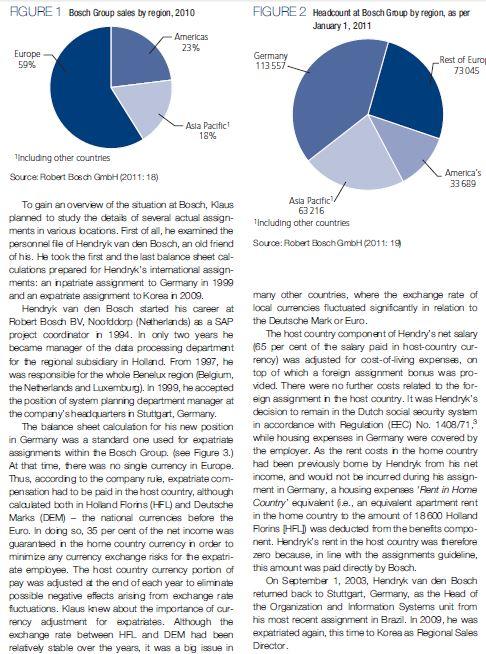

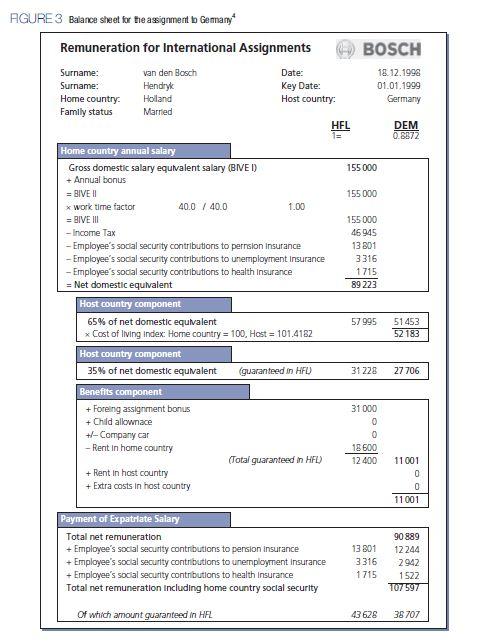

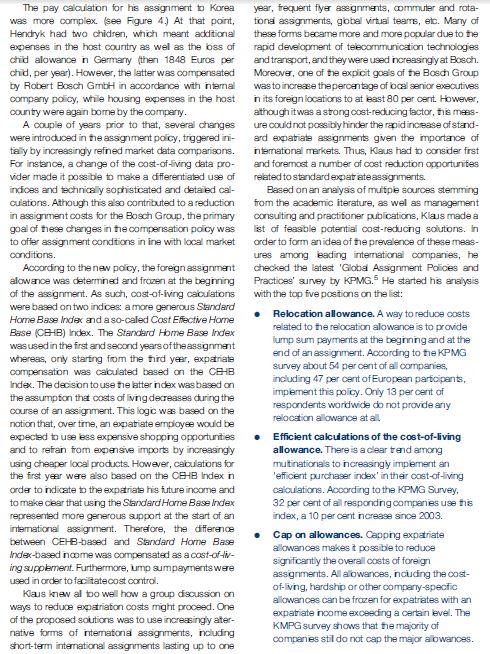

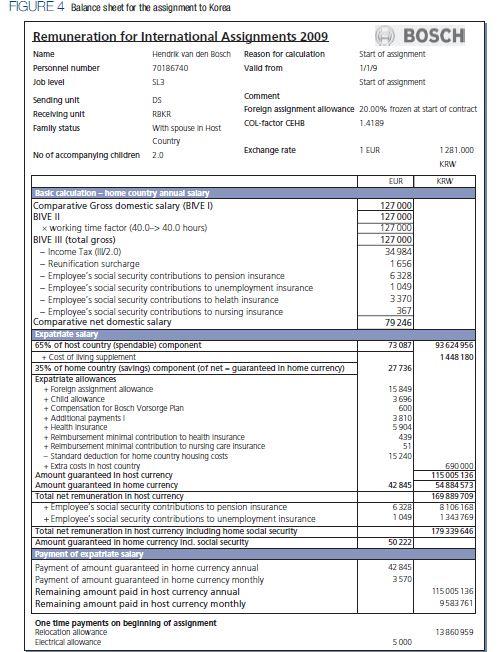

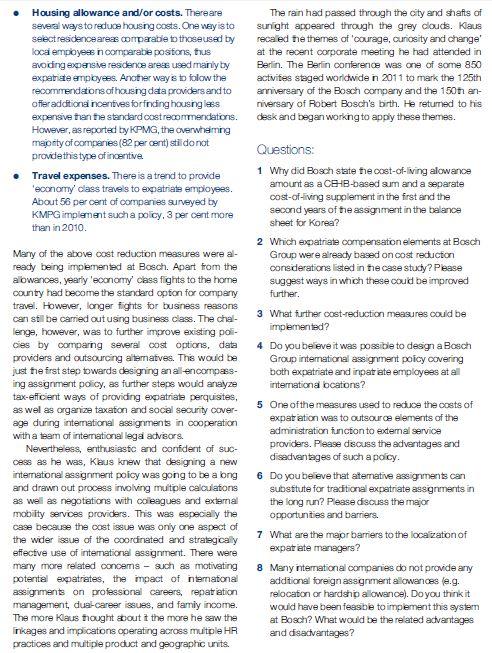

EXPATRIATE COMPENSATION AT ROBERT BOSCH GMBH: COPING WITH MODERN MOBILITY CHALLENGES By Thar Sahakiants, Marion Festing, Manfred Froehlecke I would rather lose money than trust." Robert Bosch It was raining in Stuttgart. The new task which Klaus Meier, an employee of Robert Bosch GmbH's German headquarters' central International Assignments department, received last week from his direct super- visor Michael Stein was simultaneously interesting and extremely challenging: a new international assignment policy had to be designed for the whole Bosch Group. The importance of a new international assign- ment policy is hard to overestimate. First it may be useful to take a look at some statistics for 2010 from the latest annual report of the Bosch Group? The report, citing 2010 as 'a year of historic recovery after recession on a historic scale', highlighted that Bosch Group sales had skyrocketed by about 24 per cent to 47.3 billion euros. About 41 per cent of the company's total sales were made outside Europe. (see Figure 1.) Out of 283 597 worldwide employees, 169 950 - or about 60 per cent of the total headcount - were located outside Germany, the home country of the corporation. Moreover, 34.18 per cent of these per- sonnel were located outside Europe. (see Figure 2.) Statistics on the importance of international opera- tons for Robert Bosch were indeed impressive, but the figures on international mobility within the Bosch Group were even more so. In 2010, there were approximately 2200 executives on international proj- ects requiring relocation to a foreign country and last- ing over two years, while the number of inpatriates from Asia, the Americas and Europe on assignments in Germany over the same two-year period reached 400 employees. Each new location and new market meant addi- tonal flows of expatriate and inpatriate employees within the Bosch group. Klaus opened pages 12-13 of the report, which described the highlights of 2010 with respect to new markets, particularly noting: January 18 New presence in Southeast Asia: Bosch Communication Ceriter opens branch in the Philippine capital Manila; May 13. Bosch steps up its activities in Southeast Asia: new headquarters opened in Singapore; July 5. Indian software subsidiary expands its operations: Robert Bosch Engineering and Business Solutions opens location in Vietnam; September 13. Market entry in China. Bosch delivers 40 000 start-stop systems to the automaker Changan; October 11. Bosch builds new plant in India: Packaging Technology invests four million euros in a facility near Goa; SB LiMotive opens a new production plant: in Ulsan, Korea, ithium-ion battery cells for hybrid and electric vehicles will be manufactured: November 16. New proving ground in Japan: in the north of Hokkaido, an extended proving ground has been inaugurated-twice as big as the predecessor. (Robert Bosch GmbH, 2011:12-13) Although a whole range of issues related to interna- tional mobility needed to be addressed in the new international assignment policy, Klaus wanted to start with the financial aspects of the operation. As an inter- national mobility professional himself, he knew only too well about the high costs of expatriation. These costs included not only expensive expatriate compen- sation packages, but also huge administration expenses and the costs of expatriate failure, e.g. the premature termination of an assignment. These total costs had the potential to make long-term assign- ments prohibitively expensive. AGURE 1 Bosch Group sales by region, 2010 Americas 23% Europe- 59% Tincluding other countries Source: Robert Bosch GmbH (2011:18) Asia Pacific 18% To gain an overview of the situation at Bosch, Klaus planned to study the details of several actual assign- ments in various locations. First of all, he examined the personnel file of Hendryk van den Bosch, an old friend of his. He took the first and the last balance sheet cal- culations prepared for Hendryk's international assign- ments: an inpatriate assignment to Germany in 1999 and an expatriate assignment to Korea in 2009. Hendryk van den Bosch started his career at Robert Bosch BV, Noofddorp (Netherlands) as a SAP project coordinator in 1994. In only two years he became manager of the data processing department for the regional subsidiary in Holland. From 1997, he was responsible for the whole Benelux region (Belgium, the Netherlands and Luxemburg). In 1999, he accepted the position of system planning department manager at the company's headquarters in Stuttgart, Germany. The balance sheet calculation for his new position in Germany was a standard one used for expatriate assignments within the Bosch Group. (see Figure 3.) At that time, there was no single currency in Europe. Thus, according to the company rule, expatriate com- pensation had to be paid in the host country, although calculated both in Holland Florins (HFL) and Deutsche Marks (DEM) - the national currencies before the Euro. In doing so, 35 per cent of the net income was guaranteed in the home country currency in order to minimize any currency exchange risks for the expatri- ate employee. The host country currency portion of pay was adjusted at the end of each year to eliminate possible negative effects arising from exchange rate fluctuations. Klaus knew about the importance of cur- rency adjustment for expatriates. Although the exchange rate between HFL and DEM had been relatively stable over the years, it was a big issue in FIGURE 2 Headcount at Bosch Group by region, as per January 1, 2011 Germany 113 557- Asia Pacific 63216 Including other countries Source: Robert Bosch GmbH (2011:19) Rest of Europ 73045 America's 33 689 many other countries, where the exchange rate of local currencies fluctuated significantly in relation to the Deutsche Mark or Euro. The host country component of Hendry's net salary (65 per cent of the salary paid in host-country our- rency) was adjusted for cost-of-living expenses, on top of which a foreign assignment bonus was pro- vided. There were no further costs related to the for- eign assignment in the host country. It was Hendryk's decision to remain in the Dutch social security system in accordance with Regulation (EEC) No. 1408/71, while housing expenses in Germany were covered by the employer. As the rent costs in the home country had been previously bome by Hendryk from his net income, and would not be incurred during his assign- ment in Germany, a housing expenses 'Rent in Home Country' equivalent (.e., an equivalent apartment rent in the home country to the amount of 18600 Holland Florins [HFL]) was deducted from the benefits compo- nent. Hendryk's rent in the host country was therefore zero because, in line with the assignments guideline, this amount was paid directly by Bosch. On September 1, 2003, Hendryk van den Bosch returned back to Stuttgart, Germany, as the Head of the Organization and Information Systems unit from his most recent assignment in Brazil. In 2009, he was expatriated again, this time to Korea as Regional Sales Director. AGURE 3 Balance sheet for the assignment to Germany Remuneration for International Assignments van den Bosch Hendryk Holland Married Surname: Surname: Home country: Family status Home country annual salary Gross domestic salary equivalent salary (BIVE I) + Annual bonus = BIVE II * work time factor = BIVE III -Income Tax 40.0 / 40.0 - Employee's social security contributions to pernsion Insurance - Employee's social security contributions to unemployment Insurance - Employee's social security contributions to health Insurance = Net domestic equivalent Host country component 35% of net domestic equivalent Date: Key Date: Host country: Host country component 65% of net domestic equivalent x Cost of living index: Home country=100, Host = 101.4182 Benefits component + Foreing assignment bonus + Child allownace +/-Company car - Rent in home country 1.00 + Rent In host country + Extra costs in host country (guaranteed in HFL) (Total guaranteed in HFL) Payment of Expatriate Salary Total net remuneration + Employee's social security contributions to pension insurance + Employee's social security contributions to unemployment Insurance + Employee's social security contributions to health Insurance Total net remuneration including home country social security Of which amount guaranteed in HFL HFL 1= BOSCH 155 000 155 000 18.12.1996 01.01.1999 Germany 155 000 46945 13801 3316 1715 89 223 57 995 31 228 31:000 0 0 18 600 12 400 13801 3316 1715 43 628 DEM 0.8872 51453 52 183 27706 11:001 0 0 11001 90 889 12 244 2942 1522 107 597 38707 The pay calculation for his assignment to Korea was more complex. (see Figure 4.) At that point, Hendryk had two children, which meant additional expenses in the host country as well as the loss of child alowance in Germany (then 1848 Euros per child, per year). However, the latter was compensated by Robert Bosch GmbH in accordance with internal company policy, while housing expenses in the host country were again bome by the company. A couple of years prior to that, several changes were introduced in the assignment policy, triggered ini- tally by increasingly refined market data comparisons. For instance, a change of the cost-of-living data pro- vider made it possible to make a differentiated use of indices and technically sophisticated and detailed cal- culations. Athough this also contributed to a reduction in assignment costs for the Bosch Group, the primary goal of these changes in the compensation policy was to offer assignment conditions in line with local market conditions. According to the new policy, the foreign assignment alowance was determined and frozen at the beginning of the assignment. As such, cost-of-iving calculations were based on two indices: a more generous Standard Home Base Index and a so-called Cost Effective Home Base (CEHB) Index. The Standard Home Base Index was used in the first and second years of the assignment whereas, only starting from the third year, expatriate compensation was calculated based on the CEHB Index. The decision to use the latter index was based on the assumption that costs of living decreases during the course of an assignment. This logic was based on the notion that, over time, an expatriate employee would be expected to use less expensive shopping opportunities and to refrain from expensive imports by increasingly using cheaper local products. However, calculations for the first year were also based on the CEHB Index in order to indicate to the expatriate his future income and to make clear that using the Standard Home Base Index represented more generous support at the start of an international assignment. Therefore, the difference between CEHB-based and Standard Home Base Index-based income was compensated as a cost-of-liv- ing supplement. Furthermore, jump sumpayments were used in order to facilitate cost control. Klaus knew al too well how a group discussion on ways to reduce expatriation costs might proceed. One of the proposed solutions was to use increasingly ater- native forms of international assignments, including short-term international assignments lasting up to one year, frequent flyer assignments, commuter and rota- tional assignments, global virtual teams, etc. Many of these forms became more and more popular due to the rapid development of telecommunication technologies and transport, and they were used increasingly at Bosch. Moreover, one of the explicit goals of the Bosch Group was to increase the percentage of local senior executives in its foreign locations to at least 80 per cent. However, although it was a strong cost-reducing factor, this meas- ure could not possibly hinder the rapid increase of stand- ard expatriate assignments given the importance of international markets. Thus, Klaus had to consider first and foremost a number of cost reduction opportunites related to standard expatriate assignments. Based on an analysis of multiple sources stemming from the academic iterature, as wel as management consulting and practitioner publications, Klaus made a list of feasible potential cost-reducing solutions. In order to form an idea of the prevalence of these meas- ures among leading international companies, he checked the latest 'Global Assignment Policies and Practices' survey by KPMG.5 He started his analysis with the top five positions on the list: Relocation allowance. A way to reduce costs related to the relocation allowance is to provide lump sum payments at the beginning and at the end of an assignment. According to the KPMG survey about 54 per cent of all companies, including 47 per cent of European participants, implement this policy. Only 13 per cent of respondents worldwide do not provide any relocation allowance at all Efficient calculations of the cost-of-living allowance. There is a clear trend among mutinationals to increasingly implement an 'efficient purchaser index' in their cost-of-living calculations. According to the KPMG Survey, 32 per cent of all responding companies use this index, a 10 per cent increase since 2003. Cap on allowances. Capping expatriate allowances makes it possible to reduce significantly the overall costs of foreign assignments. All allowances, including the cost- of-living, hardship or other company-specific allowances can be frozen for expatriates with an expatriate income exceeding a certain level. The KMPG survey shows that the majority of companies still do not cap the major allowances. FIGURE 4 Balance sheet for the assignment to Korea Remuneration for International Assignments 2009 Hendrik van den Bosch Reason for calculation 70186740 Valid from SL3 DS RBKR With spouse in Host Country 2.0 Name Personnel number Job level Sending unit Receiving unit Family status No of accompanying children Basic calculation-home country annual salary Comparative Gross domestic salary (BIVE I) BIVE II Expatriate salary 65% of host country (spendable) component x working time factor (40.0-> 40.0 hours) BIVE III (total gross) - Income Tax (II/2.0) - Reunification surcharge - Employee's social security contributions to pension insurance - Employee's social security contributions to unemployment insurance - Employee's social security contributions to helath insurance - Employee's social security contributions to nursing insurance Comparative net domestic salary + Compensation for Bosch Vorsorge Plan + Additional payments I + Health Insurance Exchange rate + Cost of living supplement 35% of home country (savings) component (of net-guaranteed in home currency) Expatriate allowances + Foreign assignment allowance + Chilld allowance Comment Foreign assignment allowance 20.00% frozen at start of contract COL-factor CEHB 1.4189 + Reimbursement minimal contri o health insurance + Reimbursement minimal contribution to nursing care insurance - Standard deduction for home country housing costs + Extra costs in host country Amount guaranteed In host currency Amount guaranteed in home currency Total net remuneration in host currency + Employee's social security contributions to pension insurance + Employee's social security contributions to unemployment insurance Total net remuneration in host currency Including home social security Amount guaranteed in home currency Ind. social security Payment of expatriate salary One time payments on beginning of assignment Relocation allowance Electrical allowance Payment of amount guaranteed in home currency annual Payment of amount guaranteed in home currency monthly Remaining amount paid in host currency annual Remaining amount paid in host currency monthly BOSCH Start of assignment 1/1/9 Start of assignment 1 EUR EUR 127 000 127 000 127000 127 000 34 984 1656 6328 1049 3370 367 79 246 73 087 27 736 15849 3696 600 3810 5904 439 51 15240 42 845 6328 1049 50 222 42 845 3570 5000 1281.000 KRW KRW 93 624956 1448 180 690000 115005 136 54 884573 169 889 709 8106.168 1343769 179 339 646 115005 136 9583761 13860959 Housing allowance and/or costs. There are several ways to reduce housing costs. One way is to select residence areas comparable to those used by local employees in comparable positions, thus avoiding expensive residence areas used mainly by expatriate employees. Another way is to follow the recommendations of housing data providers and to offer additional incentives for finding housing less expensive than the standard cost recommendations. However, as reported by KPMG, the overwhelming majority of companies (82 per cent) still do not provide this type of incentive. Travel expenses. There is a trend to provide 'economy class travels to expatriate employees. About 56 percent of companies surveyed by KMPG implement such a policy, 3 per cent more than in 2010. Many of the above cost reduction measures were al- ready being implemented at Bosch. Apart from the allowances, yearly 'economy class fights to the home country had become the standard option for company travel. However, longer fights for business reasons can still be carried out using business class. The chal- lenge, however, was to further improve existing poli- cies by comparing several cost options, data providers and outsourcing alternatives. This would be just the first step towards designing an all-encompass- ing assignment policy, as further steps would analyze tax-efficient ways of providing expatriate perquisites, as wel as organize taxation and social security cover- age during international assignments in cooperation with a team of international legal advisors. Nevertheless, enthusiastic and confident of suc- cess as he was, Klaus knew that designing a new international assignment policy was going to be a long and drawn out process involving multiple calculations as well as negotiations with colleagues and external mobility services providers. This was especially the case because the cost issue was only one aspect of the wider issue of the coordinated and strategically effective use of international assignment. There were many more related concems such as motivating potential expatriates, the impact of international assignments on professional careers, repatriation management, dual-career issues, and family income. The more Klaus thought about it the more he saw the inkages and implications operating across multiple HR practices and multiple product and geographic units. The rain had passed through the city and shafts of sunight appeared through the grey clouds. Klaus recalled the themes of 'courage, curiosity and change' at the recent corporate meeting he had attended in Berlin. The Berlin conference was one of some 850 activities staged worldwide in 2011 to mark the 125th anniversary of the Bosch company and the 150th an- niversary of Robert Bosch's birth. He retumed to his desk and began working to apply these themes. Questions: 1 Why did Bosch state the cost-of-living allowance amount as a CEHB-based sum and a separate cost-of-living supplement in the first and the second years of the assignment in the balance sheet for Korea? 2 Which expatriate compensation elements at Bosch Group were already based on cost reduction considerations listed in the case study? Please suggest ways in which these could be improved further. 3 What further cost-reduction measures could be implemented? 4 Do you believe it was possible to design a Bosch Group international assignment policy covering both expatriate and inpatriate employees at all international bocations? 5 One of the measures used to reduce the costs of expatriation was to outsource elements of the administration function to external service providers. Please discuss the advantages and disadvantages of such a policy. 6 Do you believe that aterative assignments can substitute for traditional expatriate assignments in the long run? Please discuss the major opportunities and barriers. 7 What are the major barriers to the localization of expatriate managers? 8 Many international companies do not provide any additional foreign assignment allowances (e.g. relocation or hardship allowance). Do you think it would have been feasible to implement this system at Bosch? What would be the related advantages and disadvantages?

Step by Step Solution

★★★★★

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

1 Why did Bosch state the costofliving allowance amount as a CEHBbased sum and separate costofliving supplement in the first and the second years of the assignment in the balance sheet for Korea Accor...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started