Answered step by step

Verified Expert Solution

Question

1 Approved Answer

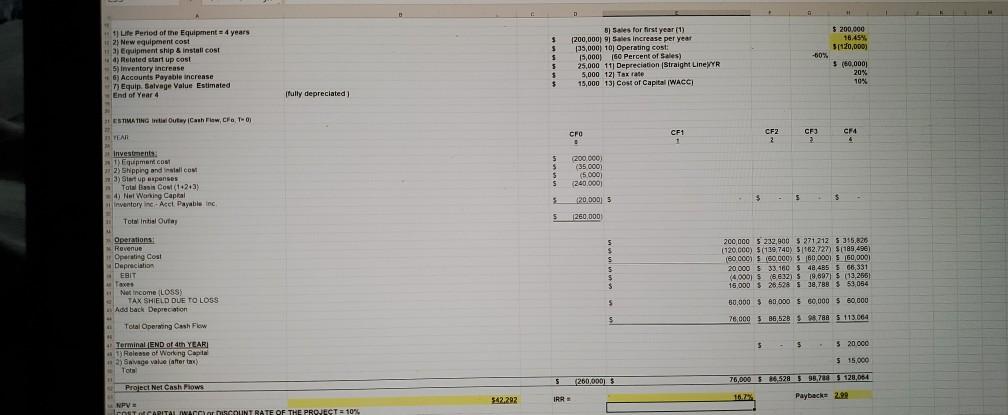

PLEASE ANSWER THE QUESTIONS BELOW FROM THE DATA FROM THE TABLE ABOVE. $ $ 200,000 18454 5[120,000) Life Period of the Equipment 4 years 2)

PLEASE ANSWER THE QUESTIONS BELOW FROM THE DATA FROM THE TABLE ABOVE.

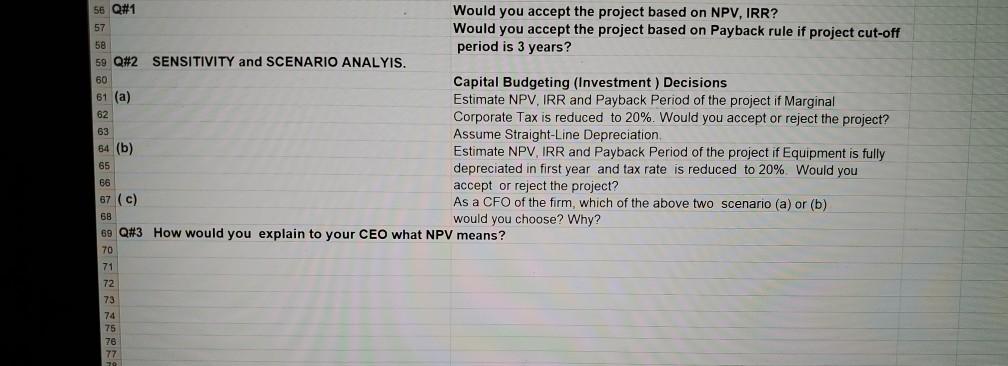

$ $ 200,000 18454 5[120,000) Life Period of the Equipment 4 years 2) New equipment cost a) Equipment ship & Install cost 4) Related start up cost 5) Inventory increase G) Accounts Payable increase 1) Equip Salvage Value Estimated End of Year 4 -60%. 8) Sales for first year (1) 1200,000) 9 es increase per year 35,000) 10 Operating costi 15,000 160 Percent of Sales) 25,000 11 Depreciation (Straight LineWYR 5,000 12j Tax rate 15,000 13 Cost of Capital (WACC) 5 5 5 $ $ 60,0001 20% 10% fully depreciated ESTIMATING in Outay Cash Flow, CraTo TEAN CFO CF1 1 CF2 2 CFU 23 CF4 4 Investments: Equipment COM 2) Shipping and install COM ma) Startup expenses Total Cost (23) 4) Net Working Captal inventory in Acct Payable in 5 200.000 $ (35000) $ (5000) $ 240.000 5 5 120.000 5 $260.000 $$ Total Inbal Outy Operations Revenue Operating cosi Depreciation EBIT Taxes Net income (LOSS) TAX SHIELD DUE TO LOSS Add back Deprecaton $ $ $ $ 200 000 $ 232,000 5 271 212 S 315.826 (120,000) $(139,740) 5162.727) $189.490) (60.000 500.000) $180,0001 5 160 0001 20 000 $ 33.180 $ 48,485 $ 66,331 14.000 $ (632) $ 19,897) $ (13,265) 15.000 $ 20.528 S 38,788 $ 53,064 BU,000 $ 40 000 $ 60,000 $ 60,000 5 $ 76000 506 528 5 987AA $ 113.064 5 $ 5 20 000 Total Operating Cash Flow Terminal END of th YEAR Release of Working Capin 2) Savage value after tax) Tota 5 15.000 76,000 3 86.52899,701 128,064 S (260.00013 Project Net Cash Flows 542.292 IRRE Payback 2.99 NPV IST CAPITAL ACCOUNT RATE OF THE PROJECT = 10C 63 56 Q#1 Would you accept the project based on NPV, IRR? 57 Would you accept the project based on Payback rule if project cut-off 58 period is 3 years? 59 Q#2 SENSITIVITY and SCENARIO ANALYIS. 60 Capital Budgeting (Investment ) Decisions 61 (a) Estimate NPV, IRR and Payback Period of the project if Marginal Corporate Tax is reduced to 20%. Would you accept or reject the project? Assume Straight-Line Depreciation 84 (b) Estimate NPV, IRR and Payback period of the project if Equipment is fully 65 depreciated in first year and tax rate is reduced to 20% Would you 66 accept or reject the project? 67 (c) As a CFO of the firm, which of the above two scenario (a) or (b) 68 would you choose? Why? 69 Q#3 How would you explain to your CEO what NPV means? 70 71 72 73 74 75 76 77

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started