Please answer the template questions as well and show all the answers the way the sheet presents them. Thank you!

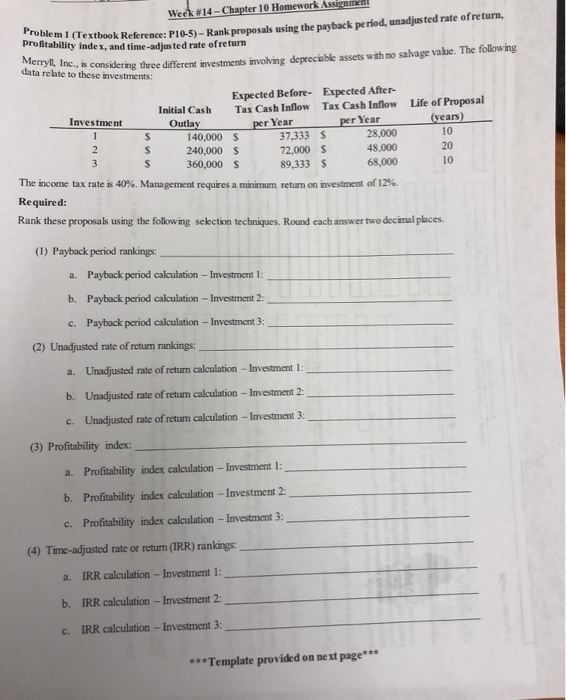

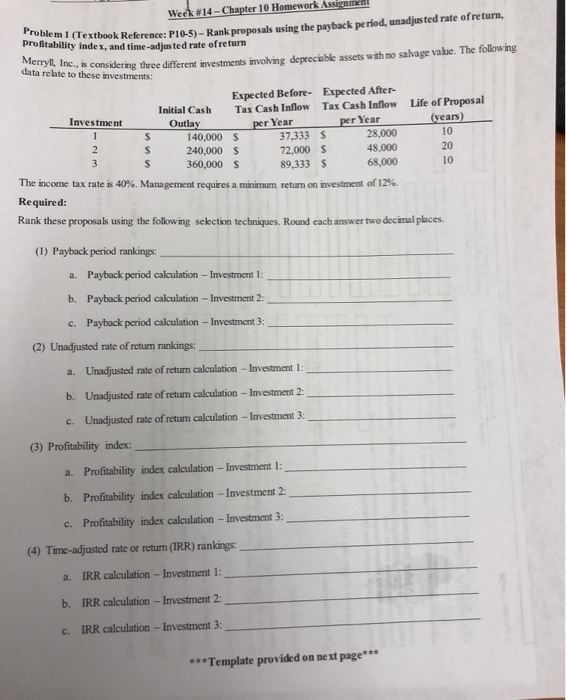

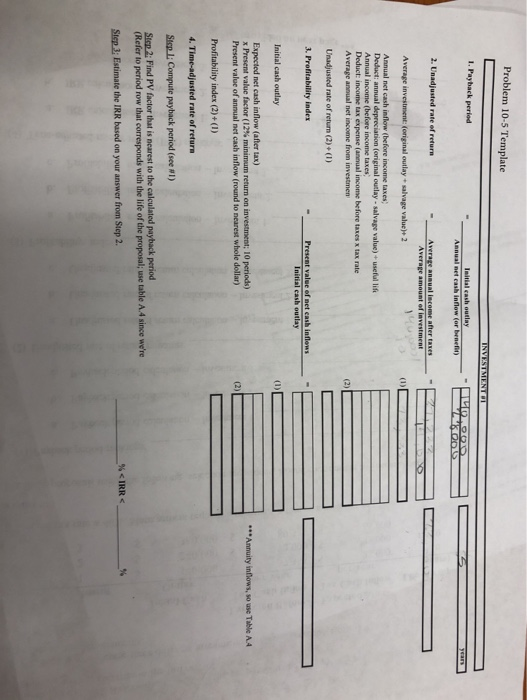

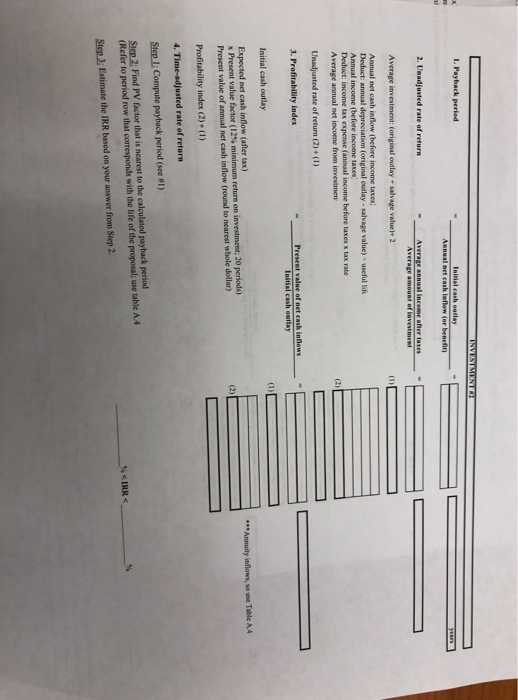

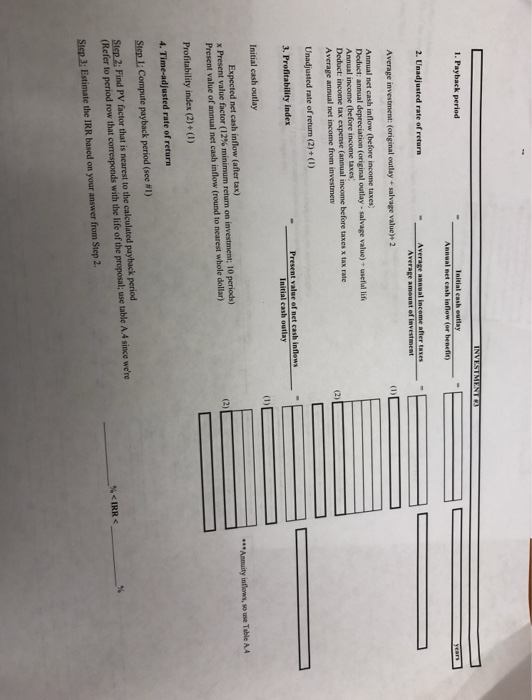

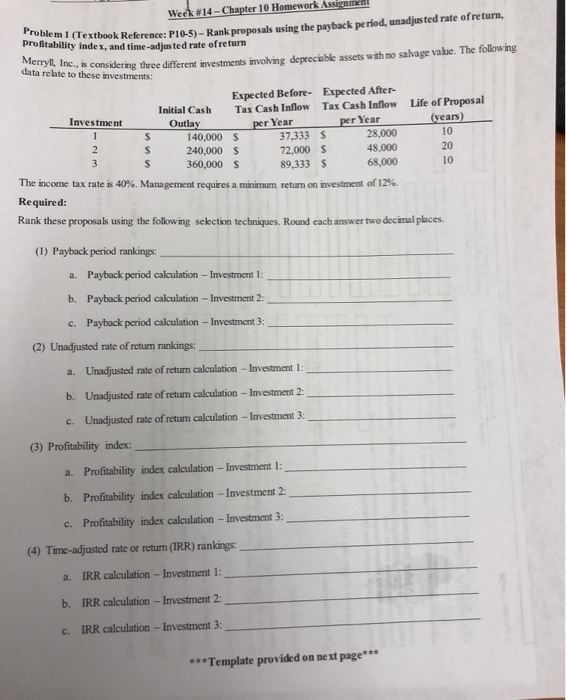

Problem 1 (Textbook Week #14 - Chapter 10 Homework Assignmal (Textbook Reference: P10-5) - Rank proposals usine the payback period, unadjusted rate of return, Profitability index and time-adjusted rate of return . is considering three different investments involving depreciable assets with no salvage value. The following Merryll, Inc., is considering data relate to these investments: Life of Proposal (years) 10 Expected Before. Expected After- Initial Cash Tax Cash Inflow Tax Cash Inflow Investment Outlay per year per Year 140,000 S 37,333 S 28,000 240,000 $ 72.000 $ 48,000 360,000 $ 89,333 $ 68,000 The income tax rate is 40%. Management requires a minimum return on investment of 12%. Required: 20 10 Rank these proposals using the following selection techniques. Round cach answer two decimal places. (1) Payback period rankings: a. Payback period calculation - Investment 1: b. Payback period calculation - Investment 2: c. Payback period calculation - Investment 3: (2) Unadjusted rate of retum rankings: a. Unadjusted rate of return calculation - Investment 1: b. Unadjusted rate of return calculation - Investment 2: c. Unadjusted rate of retum calculation - Investment 3: (3) Profitability index: a. Profitability index calculation - Investment 1: b. Profitability index calculation - Investment 2: c. Profitability index calculation - Investment 3: (4) Time-adjusted rate or return (IRR) rankings: a. IRR calculation - Investment 1: b. IRR calculation - Investment 2: C. IRR calculation - Investment 3: *** Template provided on next page*** Problem 10-5 Template INVESTMENT UL 1. Payback period Initial cash outlay wal net cash inflow (or benefi) 2000 2. Unadjusted rate of return Average annual income after takes Average amount of investment Average investment: (original outlay + salvage value) 2 (1) Annual net cash inllow (before income taxes Deduct: annual depreciation (original outlay - salvage value) + useful life Annual income (before income taxes, Deduct income tax expense (annual income before taxes x tax rate Average annual net income from investmen Unadjusted rate of return (2) + (1) 3. Profitability index Present value of net cash intens Initial cash outlay Initial cash outlay Expected net cash inflow (after tax) x Present value factor (12% minimum return on investment: 10 periods) Present value of annual net cash intlow (round to nearest whole dollar) *** Annuity inflows, so use Table A.4 Profitability index (2)+(1) 4. Time-adjusted rate of return Step 1: Compute payback period (see #1) Step 2: Find PV factor that is nearest to the calculated payback period (Refer to period row that corresponds with the life of the proposaluse table A since we're % IRR Step 3: Estimate the IRR based on your answer from Step 2. 1. Payback period Initial cash outlay Annual net cash inflow (or benefit 2. Unadjusted rate of return Average annual income after takes Average amount of investment Average investment foriginal outlay + salvage value)+ 2 Annual net cash in low before income taxes, Deduct: annual depreciation (original outlay - salvage value) useful life Annual income before income taxes Deduct: income tax expense (annual income before taxes x tax rate Average annual net income from investmen Unadjusted rate of return (2) + (1) 3. Profitability Index Present value of net cash indows Initial cash outlay *** Annuity inflows, souse Table 1.4 Expected net cash inflow (after tax) * Present value factor (12% minimum return on investment 20 periods) Present value of annual net cash inflow (round to nearest whole dollar) Profitability index (2) (1) 4. Time-adjusted rate of return ) Step 1: Compute payback period (see % IRR Step 2: Find PV factor that is nearest to the calculated payback period (Refer to period row that corresponds with the life of the proposaluse table 14 Step 3: Estimate the IRR based on your answer from Step 2 INVESTMENTO 1. Payback period Initial cash outlay Annual net cash inflow for benefit) 2. Unadjusted rate of return Average annual income after taxes Average amount of investment Average investment: (original outlay + salvage value) 2 Annual net cash inflow (before income taxes Deduct: annual depreciation (original outlay - salvage value) useful life Annual income (before income taxes Deduct: income tax expense (annual income before taxes x tax rate Average annual net income from investmen Unadjusted rate of return (2) + (1) 3. Profitability index Present value of net cash inflow Initial cash outlay Initial cash outlay *** Annuity inflows, sowe Table AA Expected net cash inflow (after tax) x Present value factor (12% minimum return on investment; 10 periods) Present value of annual net cash inflow (round to nearest whole dollar) Profitability index (2)+(1) 4. Time-adjusted rate of return ) Step 1: Compute payback period (see Step 2: Find PV factor that is nearest to the calculated payback period (Refer to period row that corresponds with the life of the proposal; use table A4 since we're Step 3: Estimate the IRR based on your answer from Step 2