Answered step by step

Verified Expert Solution

Question

1 Approved Answer

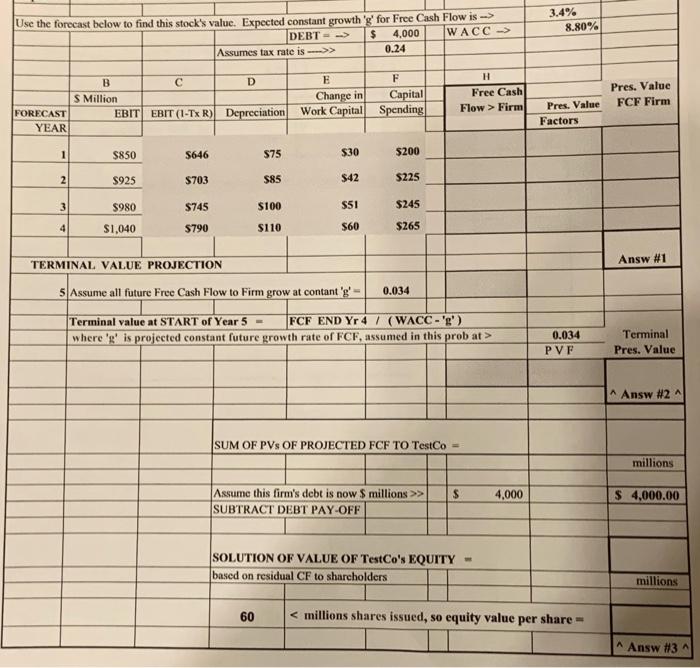

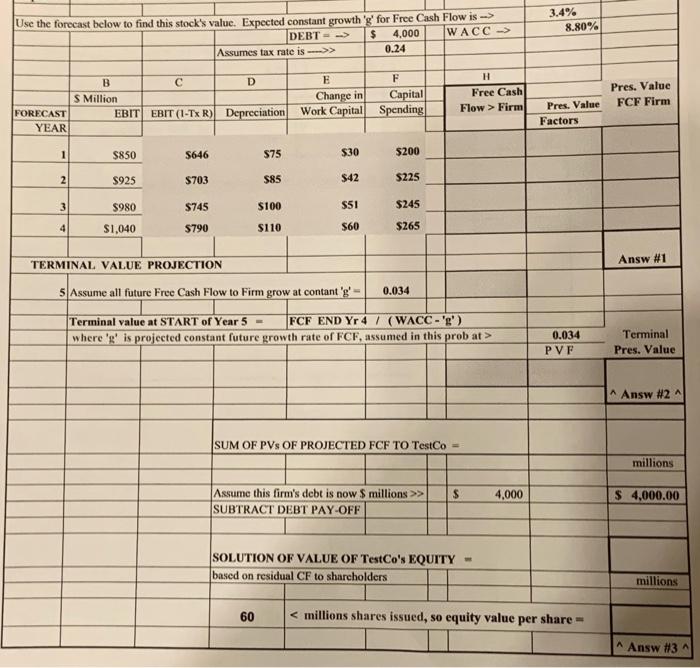

Please answer the three missing values. Will be sure to leave a thumbs up thanks 3.4% 8.80% Use the forecast below to find this stock's

Please answer the three missing values. Will be sure to leave a thumbs up thanks

3.4% 8.80% Use the forecast below to find this stock's value. Expected constant growth 'g' for Free Cash Flow is --> DEBT = - $ 4,000 WACC-> Assumes tax rate is -->> 0.24 D B S Million EBIT EBIT (1-Tx R) E F Change in Capital Work Capital Spending H Free Cash Flow > Firm Pres. Value FCF Firm FORECAST YEAR Depreciation Pres. Value Factors 1 $850 $646 $75 $30 $200 2 S925 $703 585 $42 $225 3 $980 $745 $100 551 $245 4 $1,040 $790 $110 $60 $265 TERMINAL VALUE PROJECTION Answ #1 5 Assume all future Free Cash Flow to Firm grow at contant'g' 0.034 Terminal value at START of Year 5 - FCF END Yr 4 / (WACC -'g') where 'g' is projected constant future growth rate of FCF, assumed in this prob at> 0.034 PVF Terminal Pres. Value Answ #2 SUM OF PVs OF PROJECTED FCF TO TestCo = millions $ 4,000 Assume this firm's debt is now $ millions >> SUBTRACT DEBT PAY-OFF $ 4,000.00 SOLUTION OF VALUE OF TestCo's EQUITY - based on residual CF to shareholders millions 60

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started