Answered step by step

Verified Expert Solution

Question

1 Approved Answer

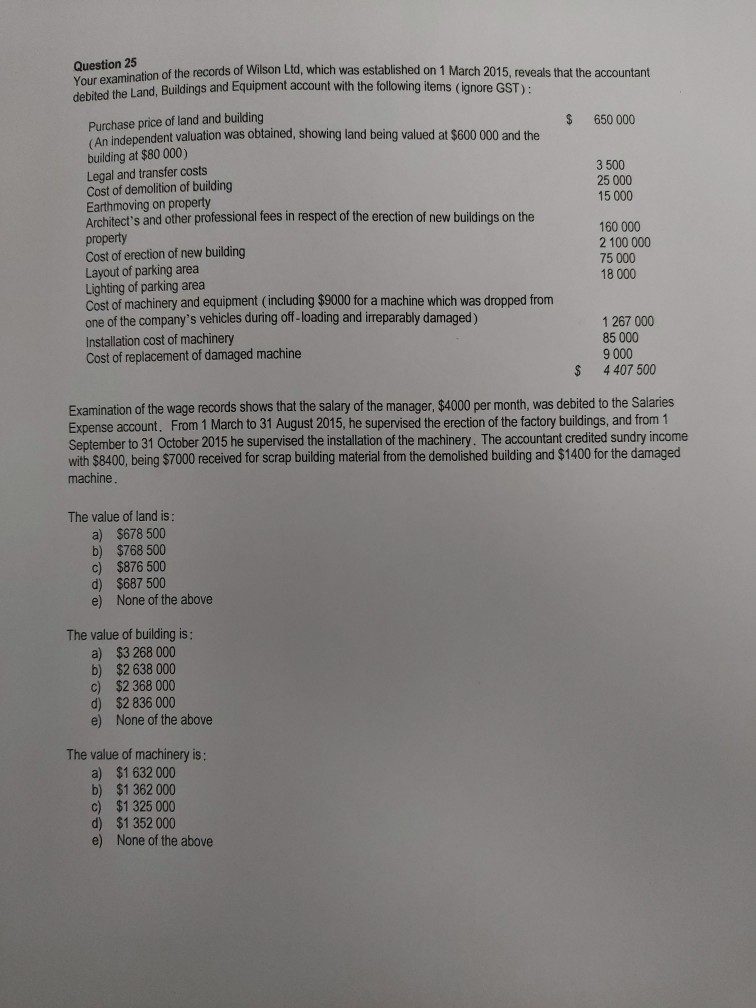

Please answer the value of the land, the value of the building and the value of machinery Question 25 Your examination of the records of

Please answer the value of the land, the value of the building and the value of machinery

Question 25 Your examination of the records of Wilson Ltd, whi of the records of Wilson Ltd, which was established on 1 March 2015, reveals that the accountant the Land, Buildings and Equipment account with the following items (ignore GST): $ 650 000 3 500 25 000 15 000 Purchase price of land and building An independent valuation was obtained, showing land being valued at $600 000 and the building at $80 000) Legal and transfer costs Cost of demolition of building Earthmoving on property Architect's and other professional fees in respect of the erection of new buildings on the property Cost of erection of new building Layout of parking area Lighting of parking area Cost of machinery and equipment (including $9000 for a machine which was dropped from one of the company's vehicles during off-loading and irreparably damaged) Installation cost of machinery Cost of replacement of damaged machine 160 000 2 100 000 75 000 18 000 1 267 000 85 000 9000 4 407 500 $ Examination of the wage records shows that the salary of the manager, $4000 per month, was debited to the Salaries Expense account. From 1 March to 31 August 2015, he supervised the erection of the factory buildings, and from 1 September to 31 October 2015 he supervised the installation of the machinery. The accountant credited sundry income with $8400, being $7000 received for scrap building material from the demolished building and $1400 for the damaged machine. The value of land is: a) $678 500 b) $768 500 c) $876 500 d) $687 500 e) None of the above The value of building is: a) $3 268 000 b) $2638 000 c) $2368 000 d) $2 836 000 e) None of the above The value of machinery is: a) $1 632 000 b) $1 362 000 C) $1 325 000 d) $1 352 000 e) None of the aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started